Would Shareholders Who Purchased HSBC Bank Malta's (MTSE:HSB) Stock Five Years Be Happy With The Share price Today?

While it may not be enough for some shareholders, we think it is good to see the HSBC Bank Malta p.l.c. (MTSE:HSB) share price up 21% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 51%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for HSBC Bank Malta

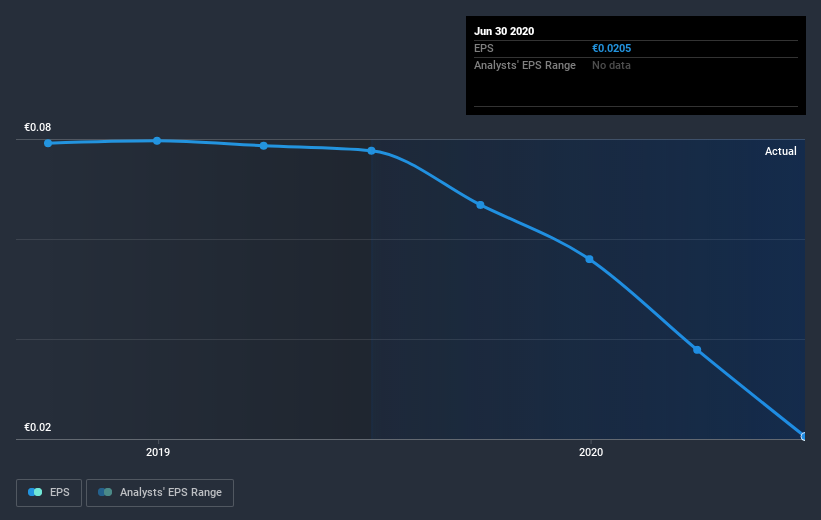

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both HSBC Bank Malta's share price and EPS declined; the latter at a rate of 26% per year. This fall in the EPS is worse than the 13% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on HSBC Bank Malta's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered HSBC Bank Malta's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for HSBC Bank Malta shareholders, and that cash payout explains why its total shareholder loss of 43%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that HSBC Bank Malta shareholders are down 20% for the year. Unfortunately, that's worse than the broader market decline of 13%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with HSBC Bank Malta (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

We will like HSBC Bank Malta better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MT exchanges.

If you decide to trade HSBC Bank Malta, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade HSBC Bank Malta, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HSBC Bank Malta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MTSE:HSB

HSBC Bank Malta

Provides various banking and related financial services in Malta.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives