- Luxembourg

- /

- Real Estate

- /

- BDL:ORCL

CPI FIM (BDL:ORCL): Exploring Valuation After a 53% One-Year Return

Reviewed by Simply Wall St

CPI FIM (BDL:ORCL) shares have powered through the past year, delivering a total return of 53%, which outpaces their performance over the past month and quarter. Investors might be curious about what could come next for this real estate player.

See our latest analysis for CPI FIM.

Momentum has cooled in recent weeks, but CPI FIM's 1-year total return of 53% still towers over its longer-term averages. This suggests steady conviction in the story and ongoing growth potential. Share price returns have taken a breather after such a strong run, but over three and five years, total shareholder gains remain compelling.

If you’re open to discovering standout opportunities beyond the real estate sector, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares delivering such robust returns, investors may wonder whether CPI FIM remains undervalued, or if the market has already priced in all of its future growth. Could there still be a compelling opportunity here?

Price-to-Earnings of 12.5x: Is it justified?

With CPI FIM currently trading at a price-to-earnings ratio of 12.5x, well below the peer average, the stock looks undervalued based on this common yardstick. The last close was €0.9.

The price-to-earnings (PE) ratio measures what investors are willing to pay today for a euro of current earnings. For real estate management and development companies, PE is often used as a quick check on valuation, given the connection between recurring profits and long-term asset value.

At 12.5x earnings, CPI FIM is trading at a meaningful discount to both its peer average of 21x and the broader European real estate industry average of 15.2x. The gap suggests that the market may be underestimating the company’s profit potential or assigning a risk premium, despite its recent return to profitability. If market confidence improves, there could be room for the valuation multiple to climb towards those peer levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, a persistent lack of revenue growth or a renewed downturn in net income could quickly challenge the case for CPI FIM’s current valuation.

Find out about the key risks to this CPI FIM narrative.

Another View: Discounted Cash Flow Perspective

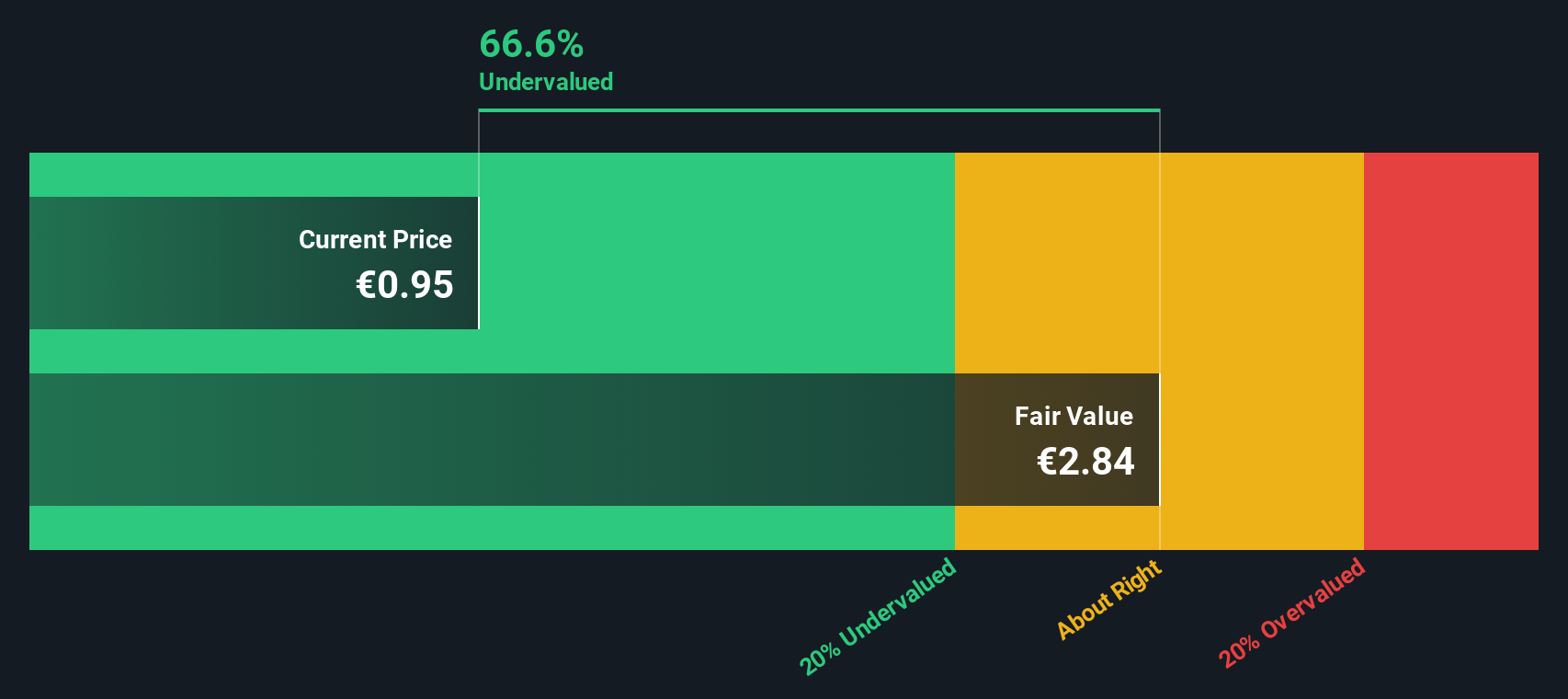

Taking a step back from ratios, our DCF model values CPI FIM at €2.84 per share, which is much higher than its last close of €0.9. This approach weighs projected cash flows instead of current profits and suggests the stock could be deeply undervalued. Does this model reveal something the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CPI FIM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CPI FIM Narrative

If you see things differently, or would rather explore the story from your own perspective, you can quickly craft your own CPI FIM view in just a few minutes, all at your own pace: Do it your way

A great starting point for your CPI FIM research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. With so many trends reshaping markets, the next breakout stock could be one click away. Don’t let these possibilities slip by. Take charge and see what’s out there.

- Tap into rapid innovation by reviewing these 27 AI penny stocks, setting new benchmarks in artificial intelligence for real-world impact and future growth.

- Boost your portfolio’s income stream by checking out these 17 dividend stocks with yields > 3%, offering robust yields and a track record of reliable returns.

- Join the digital revolution with these 80 cryptocurrency and blockchain stocks, transforming financial systems through blockchain and next-generation payment technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BDL:ORCL

CPI FIM

CPI FIM SA, société anonyme (the “Company”) and its subsidiaries (together the “Group” or “CPI FIM”), is an owner of income-generating real estate and land bank primarily in Poland and in the Czech Republic.

Good value with acceptable track record.

Market Insights

Community Narratives