Undiscovered Gems with Potential to Watch This September 2024

Reviewed by Simply Wall St

As global markets celebrate the Federal Reserve's first rate cut in over four years, small-cap indexes like the Russell 2000 have shown promising performance, though they remain below their historic peaks. This environment of renewed investor optimism and favorable economic indicators sets a compelling stage for identifying undiscovered gems in the stock market. In such a dynamic landscape, a good stock often combines strong fundamentals with growth potential that has yet to be fully recognized by the broader market. Here are three lesser-known stocks that could present intriguing opportunities this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Al Sagr Cooperative Insurance | NA | 9.35% | 37.73% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

LOLC Finance (COSE:LOFC.N0000)

Simply Wall St Value Rating: ★★★★★☆

Overview: LOLC Finance PLC, a non-banking financial institution with a market cap of LKR205.09 billion, offers a range of financial products and services in Sri Lanka.

Operations: LOLC Finance generates revenue primarily from SME Finance (LKR33.56 billion), Development Finance (LKR16.34 billion), and Alternative Financial Services (LKR3.98 billion).

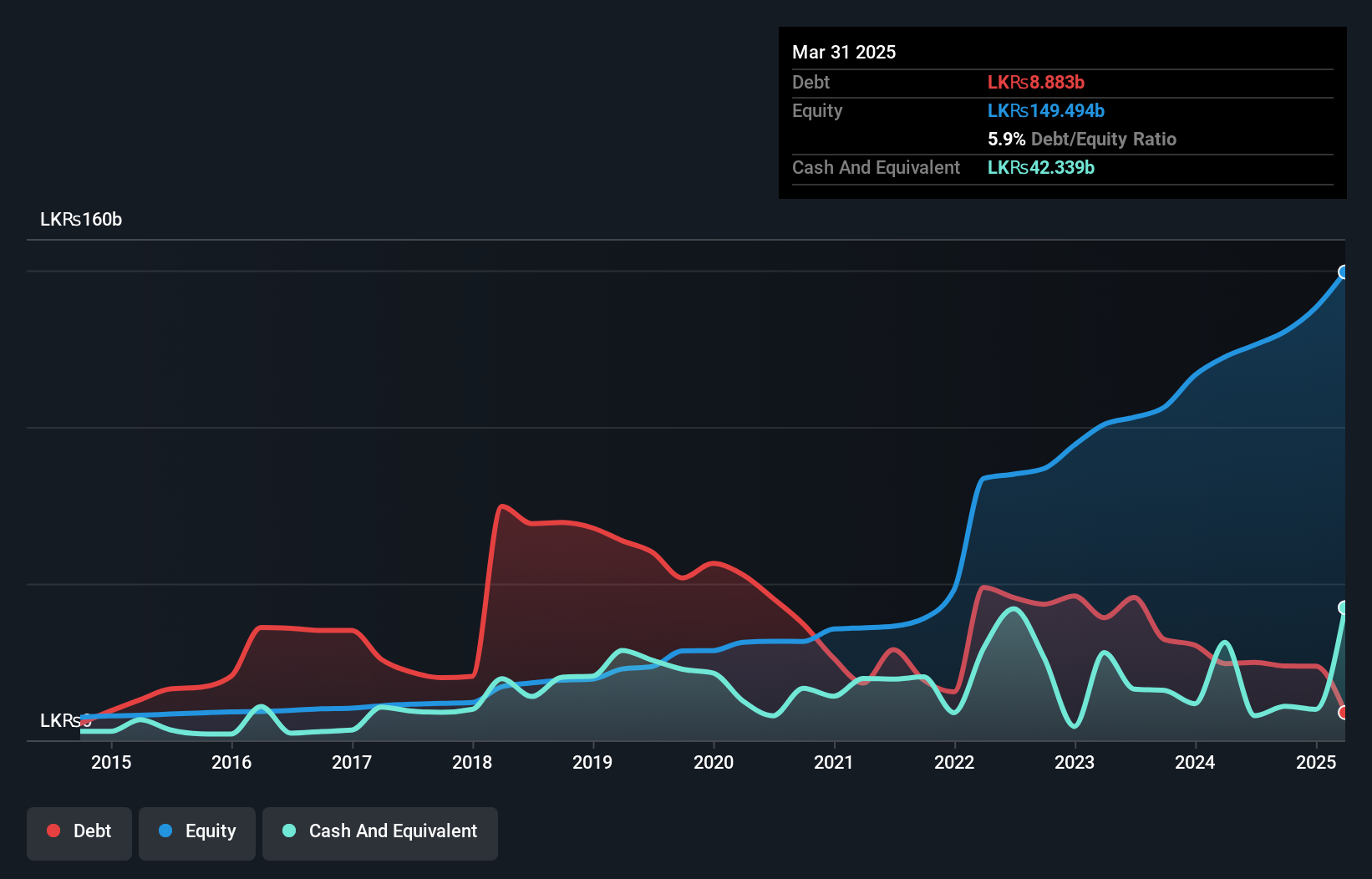

LOLC Finance has seen its debt to equity ratio improve significantly from 255.3% to 19.7% over the past five years, with a net debt to equity ratio at a satisfactory 13.5%. The company reported net income of LKR 3.87 billion for Q1 2024, up from LKR 2.26 billion the previous year, despite a large one-off gain of LKR 4.4 billion impacting recent results. Earnings have grown at an annual rate of 35.3%, although last year's growth (42.3%) lagged behind the industry average (50.9%).

- Take a closer look at LOLC Finance's potential here in our health report.

Gain insights into LOLC Finance's historical performance by reviewing our past performance report.

Zhejiang Zhongxin Environmental Protection Technology Group (SHSE:603091)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Zhongxin Environmental Protection Technology Group Co., Ltd. (market cap: CN¥3.94 billion) specializes in providing environmental protection solutions and technologies.

Operations: The company generates its revenue primarily from environmental protection solutions and technologies.

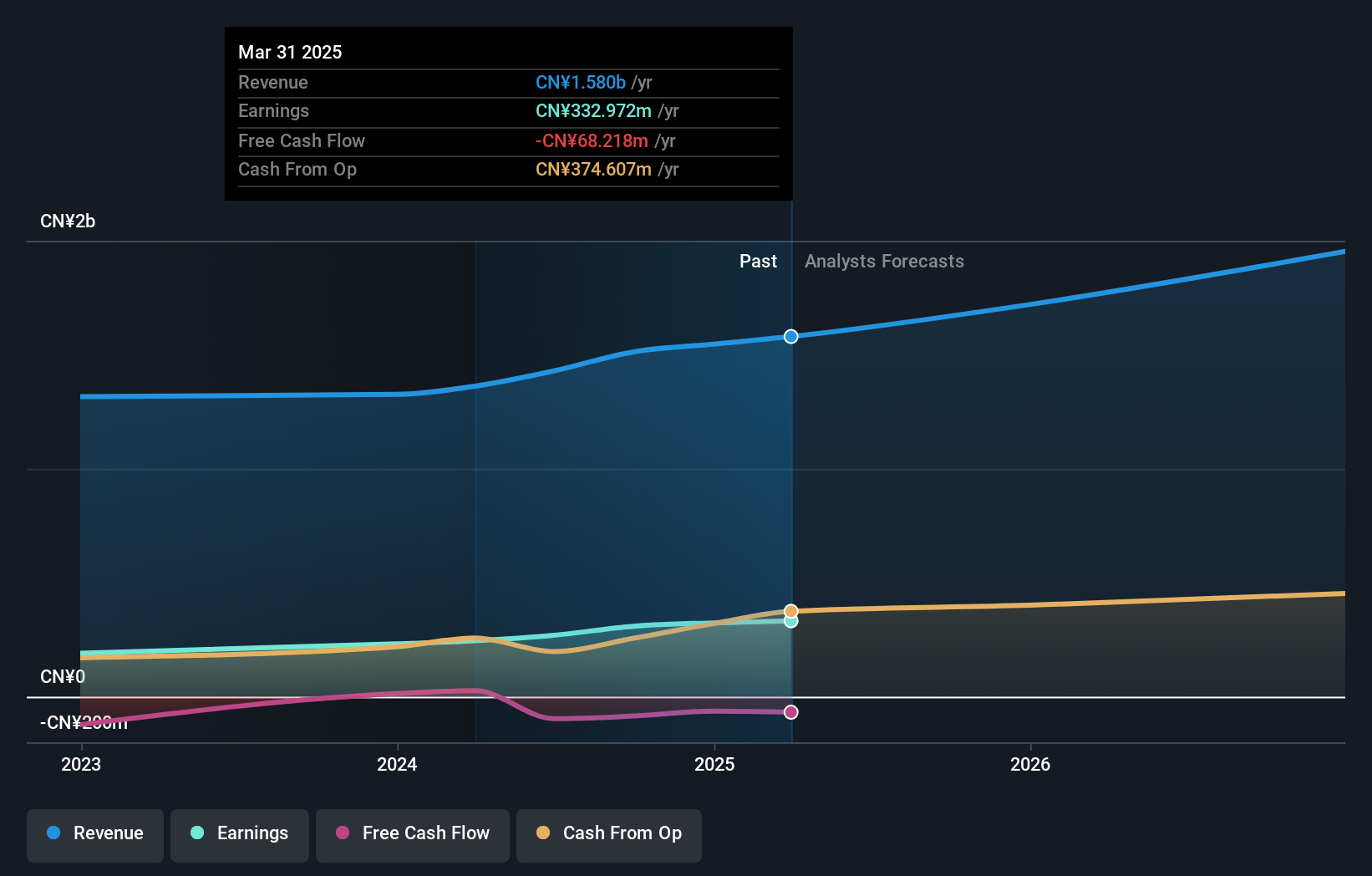

Zhejiang Zhongxin Environmental Protection Technology Group recently completed an IPO raising CNY 677.33 million, offering 16.36 million shares at CNY 26.5 each. The company reported a net debt to equity ratio of 7.3%, deemed satisfactory, and its earnings grew by 21.5% over the past year, outperforming the packaging industry's growth rate of 5.5%. With a price-to-earnings ratio of 16.7x below the CN market average of 27.5x, this small cap seems undervalued and promising for future growth potential in its sector.

Intsig Information (SHSE:688615)

Simply Wall St Value Rating: ★★★★★★

Overview: IntSig Information Co., Ltd. offers optical character recognition solutions to corporate clients and individuals globally, with a market cap of CN¥5.52 billion.

Operations: IntSig Information generates revenue through its optical character recognition solutions for corporate clients and individuals. The company's net profit margin stands at 25.30%.

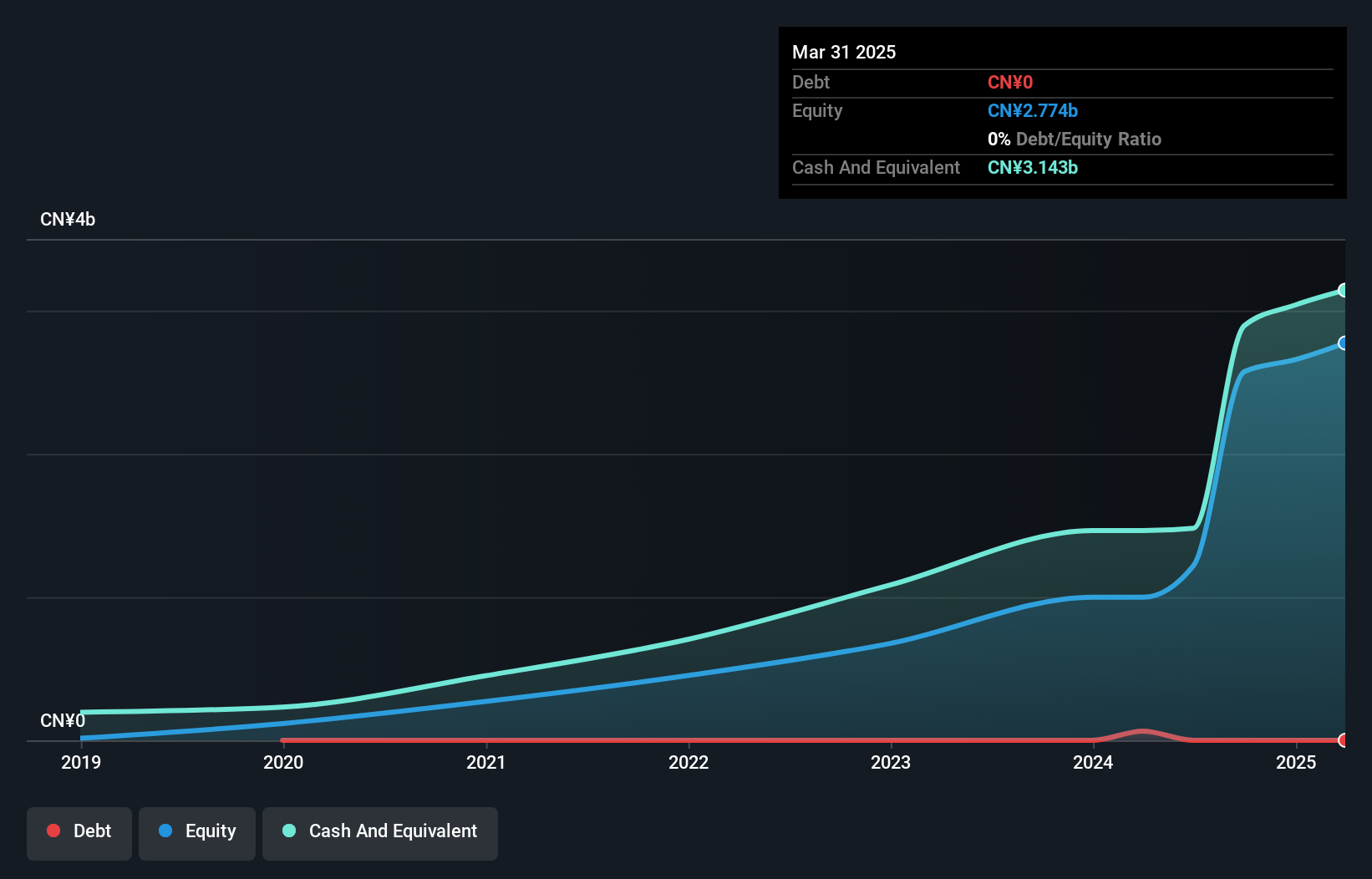

Intsig Information has been debt-free for the past five years, showcasing strong financial health. Recent earnings growth of 17.7% outpaced the Software industry’s -13.6%, indicating robust performance. The company reported half-year sales of CNY 688.18 million and net income of CNY 220.75 million, both up from last year’s figures. With a price-to-earnings ratio of 31.8x below the industry average (61.3x), it appears undervalued relative to peers, despite its highly illiquid shares.

- Click here and access our complete health analysis report to understand the dynamics of Intsig Information.

Explore historical data to track Intsig Information's performance over time in our Past section.

Taking Advantage

- Explore the 4850 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhongxin Environmental Protection Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603091

Zhejiang Zhongxin Environmental Protection Technology Group

Zhejiang Zhongxin Environmental Protection Technology Group Co., Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success