- United Arab Emirates

- /

- Banks

- /

- ADX:NBQ

Top Dividend Stocks Including National Bank of Umm Al-Qaiwain (PSC) And Two Others

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes nearing record highs and positive economic indicators such as low jobless claims and rising home sales, investors are increasingly looking for stable income sources amid ongoing geopolitical uncertainties and fluctuating interest rates. In this environment, dividend stocks like National Bank of Umm Al-Qaiwain (PSC) offer appealing attributes due to their potential for steady income generation, making them an attractive option for those seeking to navigate the current market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market cap of AED4.46 billion.

Operations: National Bank of Umm Al-Qaiwain (PSC) generates revenue primarily from its Treasury and Investments segment, amounting to AED418.58 million, and its Retail and Corporate Banking segment, contributing AED192.74 million.

Dividend Yield: 6.6%

National Bank of Umm Al-Qaiwain (PSC) offers a dividend yield in the top 25% of the AE market, with a payout ratio indicating earnings coverage. However, its dividends have been volatile and unreliable over the past decade. Recent earnings show slight growth in net interest income but a decline in quarterly net income, highlighting potential challenges. Additionally, concerns about high levels of bad loans could impact future dividend stability despite historical growth in payments.

- Click to explore a detailed breakdown of our findings in National Bank of Umm Al-Qaiwain (PSC)'s dividend report.

- Insights from our recent valuation report point to the potential overvaluation of National Bank of Umm Al-Qaiwain (PSC) shares in the market.

SamchullyLtd (KOSE:A004690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samchully Co., Ltd. supplies natural gas in South Korea and the United States, with a market cap of ₩307.14 billion.

Operations: Samchully Co., Ltd. generates revenue through its operations in the natural gas supply sector across South Korea and the United States.

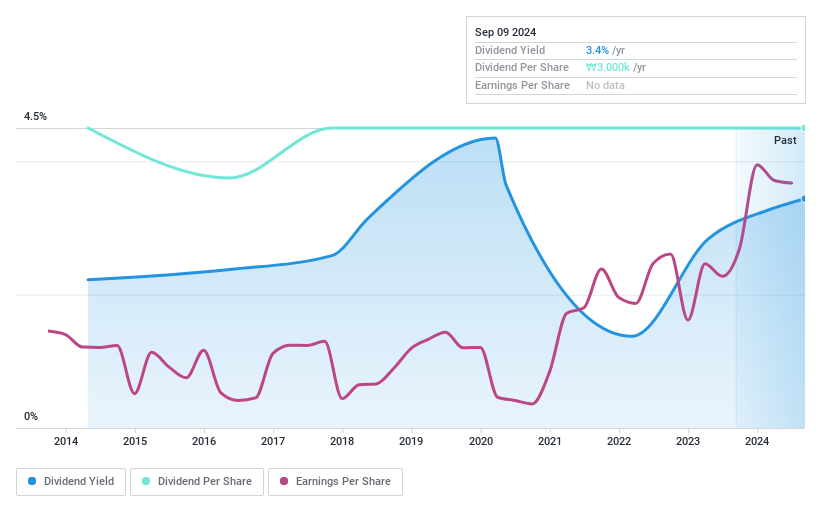

Dividend Yield: 3.3%

Samchully Ltd. maintains a low payout ratio of 9.3% and a cash payout ratio of 5.8%, ensuring dividends are well-covered by both earnings and cash flow, although its yield of 3.32% falls short compared to top-tier dividend payers in the KR market. Despite stable dividends over the past decade, they have not grown, reflecting some inconsistency in reliability due to large one-off items affecting financial results and undervaluation at current trading levels.

- Take a closer look at SamchullyLtd's potential here in our dividend report.

- The analysis detailed in our SamchullyLtd valuation report hints at an deflated share price compared to its estimated value.

Mitani (TSE:8066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitani Corporation operates in the information systems, construction, and energy sectors both in Japan and internationally, with a market cap of ¥161.30 billion.

Operations: Mitani Corporation's revenue is derived from its operations in the information systems, construction, and energy sectors.

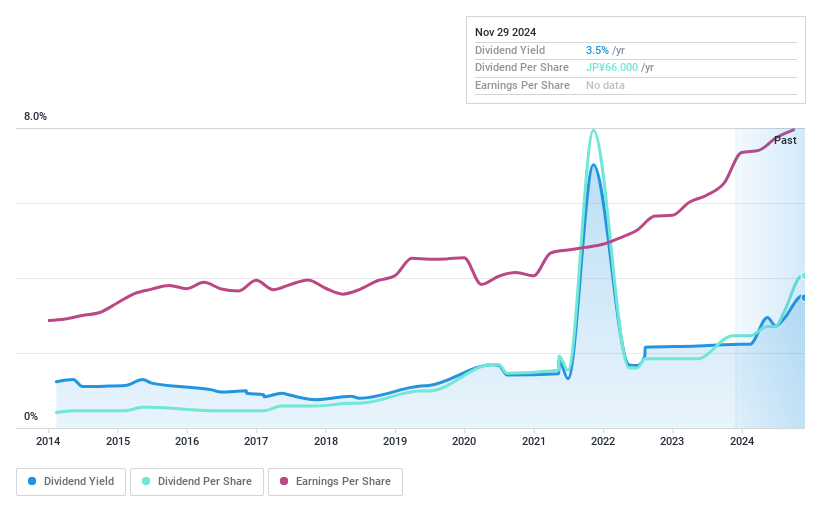

Dividend Yield: 3.5%

Mitani Corporation's dividend yield of 3.48% is slightly below the top JP market payers, yet dividends are well-covered by earnings (13.3% payout ratio) and free cash flow (28.7% cash payout ratio). Despite a history of volatility over the past decade, dividends have increased overall. Recent share buyback plans worth ¥2.4 billion aim to enhance shareholder returns, highlighting a focus on capital policy amidst undervaluation concerns with shares trading 24.1% below fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitani.

- In light of our recent valuation report, it seems possible that Mitani is trading behind its estimated value.

Where To Now?

- Explore the 1978 names from our Top Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Umm Al-Qaiwain (PSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NBQ

National Bank of Umm Al-Qaiwain (PSC)

Engages in the provision of retail and corporate banking services in the United Arab Emirates.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives