- South Korea

- /

- Gas Utilities

- /

- KOSE:A003480

Here's Why Hanjin Heavy Industries & Construction Holdings (KRX:003480) Has A Meaningful Debt Burden

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Hanjin Heavy Industries & Construction Holdings Co., Ltd. (KRX:003480) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Hanjin Heavy Industries & Construction Holdings

What Is Hanjin Heavy Industries & Construction Holdings's Net Debt?

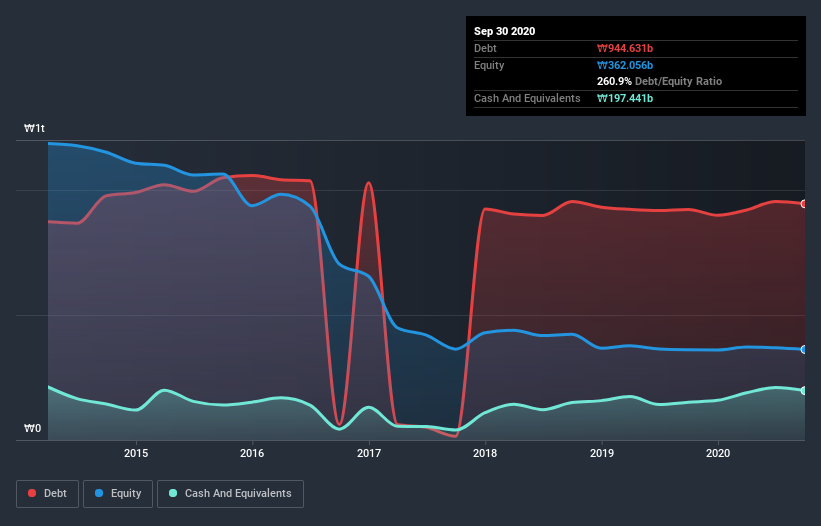

As you can see below, Hanjin Heavy Industries & Construction Holdings had ₩944.6b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of ₩197.4b, its net debt is less, at about ₩747.2b.

How Strong Is Hanjin Heavy Industries & Construction Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hanjin Heavy Industries & Construction Holdings had liabilities of ₩423.3b due within 12 months and liabilities of ₩961.9b due beyond that. Offsetting these obligations, it had cash of ₩197.4b as well as receivables valued at ₩51.4b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩1.14t.

This deficit casts a shadow over the ₩104.1b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Hanjin Heavy Industries & Construction Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 1.1 times and a disturbingly high net debt to EBITDA ratio of 6.4 hit our confidence in Hanjin Heavy Industries & Construction Holdings like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. The silver lining is that Hanjin Heavy Industries & Construction Holdings grew its EBIT by 103% last year, which nourishing like the idealism of youth. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But it is Hanjin Heavy Industries & Construction Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Hanjin Heavy Industries & Construction Holdings produced sturdy free cash flow equating to 79% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

While Hanjin Heavy Industries & Construction Holdings's level of total liabilities has us nervous. For example, its EBIT growth rate and conversion of EBIT to free cash flow give us some confidence in its ability to manage its debt. It's also worth noting that Hanjin Heavy Industries & Construction Holdings is in the Gas Utilities industry, which is often considered to be quite defensive. Taking the abovementioned factors together we do think Hanjin Heavy Industries & Construction Holdings's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Hanjin Heavy Industries & Construction Holdings (of which 1 doesn't sit too well with us!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Hanjin Heavy Industries & Construction Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanjin Heavy Industries & Construction Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A003480

Hanjin Heavy Industries & Construction Holdings

Through its subsidiaries, engages in the shipbuilding, construction, engineering, energy, and leisure businesses in South Korea.

Good value with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026