- South Korea

- /

- Marine and Shipping

- /

- KOSE:A011200

HMMLtd's (KRX:011200) Earnings Are Weaker Than They Seem

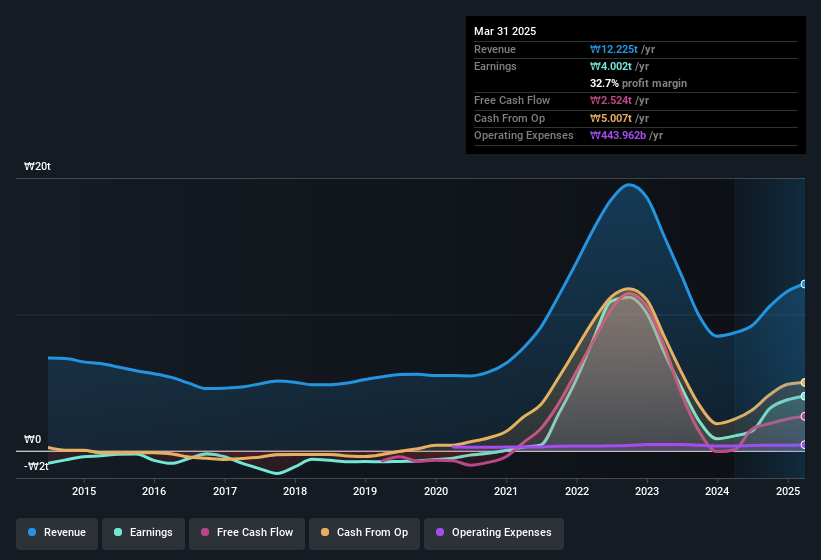

HMM Co.,Ltd's (KRX:011200) stock was strong after they recently reported robust earnings. However, we think that shareholders may be missing some concerning details in the numbers.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, HMMLtd increased the number of shares on issue by 49% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of HMMLtd's EPS by clicking here.

A Look At The Impact Of HMMLtd's Dilution On Its Earnings Per Share (EPS)

Unfortunately, HMMLtd's profit is down 51% per year over three years. The good news is that profit was up 267% in the last twelve months. On the other hand, earnings per share are only up 167% over the same period. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if HMMLtd can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On HMMLtd's Profit Performance

As we discussed above, HMMLtd's dilution over the last year has a major impact on its per-share earnings. For this reason, we think that HMMLtd's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, HMMLtd has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

This note has only looked at a single factor that sheds light on the nature of HMMLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if HMMLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011200

HMMLtd

An integrated logistics company, provides shipping and logistics services in Japan and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.