- South Korea

- /

- Marine and Shipping

- /

- KOSDAQ:A124560

What To Know Before Buying Taewoong Logistics Co.,Ltd. (KOSDAQ:124560) For Its Dividend

Dividend paying stocks like Taewoong Logistics Co.,Ltd. (KOSDAQ:124560) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

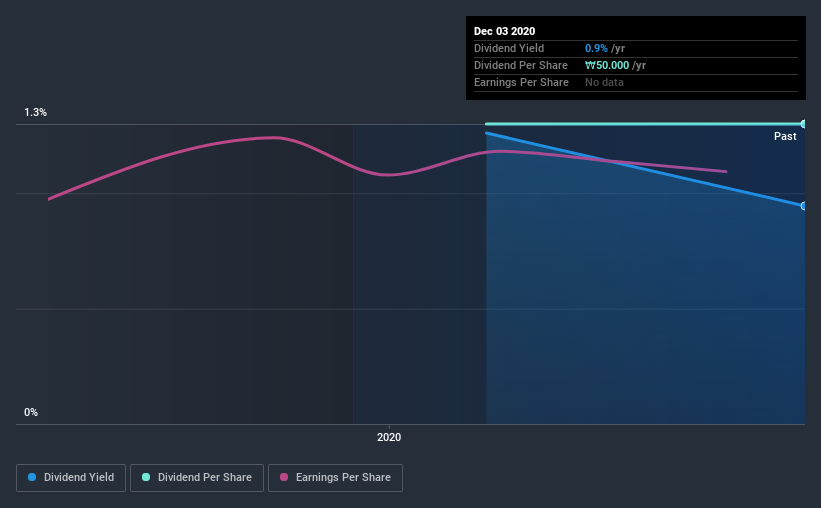

Some readers mightn't know much about Taewoong LogisticsLtd's 0.9% dividend, as it has only been paying distributions for a year or so. Remember though, due to the recent spike in its share price, Taewoong LogisticsLtd's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. There are a few simple ways to reduce the risks of buying Taewoong LogisticsLtd for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Taewoong LogisticsLtd!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Taewoong LogisticsLtd paid out 7.4% of its profit as dividends. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Taewoong LogisticsLtd's cash payout ratio last year was 12%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

While the above analysis focuses on dividends relative to a company's earnings, we do note Taewoong LogisticsLtd's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Taewoong LogisticsLtd's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was ₩50.0 per share.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Taewoong LogisticsLtd has grown its earnings per share at 2.4% per annum over the past five years. As we saw above, earnings per share growth has not been strong. However, the payout ratio is low, and some companies can deliver adequate dividend performance simply by increasing the payout ratio.

We'd also point out that Taewoong LogisticsLtd issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that Taewoong LogisticsLtd has low and conservative payout ratios. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. Overall we think Taewoong LogisticsLtd is an interesting dividend stock, although it could be better.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 4 warning signs for Taewoong LogisticsLtd that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade Taewoong LogisticsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taewoong Logistics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A124560

Taewoong Logistics

A logistics company, provides various transport services by sea, air, bulk project, and inland transportation in South Korea and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026