- South Korea

- /

- Marine and Shipping

- /

- KOSDAQ:A124560

Update: Taewoong LogisticsLtd (KOSDAQ:124560) Stock Gained 21% In The Last Year

Taewoong Logistics Co.,Ltd. (KOSDAQ:124560) shareholders might be concerned after seeing the share price drop 14% in the last week. Looking on the brighter side, the stock is actually up over twelve months. In that time, it is up 21%, which isn't bad, but is below the market return of 46%.

View our latest analysis for Taewoong LogisticsLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Taewoong LogisticsLtd actually saw its earnings per share drop 12%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We are skeptical of the suggestion that the 1.1% dividend yield would entice buyers to the stock. We think that the revenue growth of 10% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

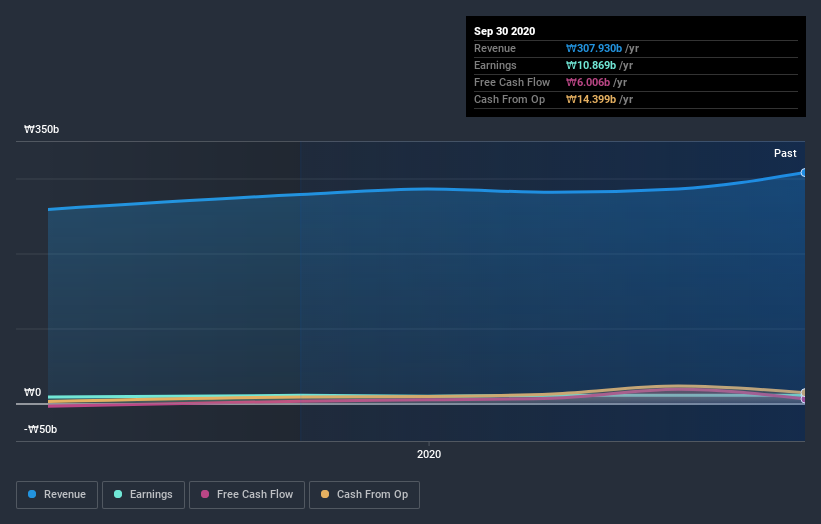

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Taewoong LogisticsLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Taewoong LogisticsLtd shareholders have gained 23% for the year (even including dividends). While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 46%. That's a lot better than the more recent three month gain of 3.0%, implying that share price has plateaued recently, for now. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). It's always interesting to track share price performance over the longer term. But to understand Taewoong LogisticsLtd better, we need to consider many other factors. Take risks, for example - Taewoong LogisticsLtd has 5 warning signs we think you should be aware of.

Of course Taewoong LogisticsLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Taewoong LogisticsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taewoong Logistics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A124560

Taewoong Logistics

A logistics company, provides various transport services by sea, air, bulk project, and inland transportation in South Korea and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives