- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A009470

Is Samwha ElectricLtd (KRX:009470) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Samwha Electric Co.,Ltd. (KRX:009470) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Samwha ElectricLtd

How Much Debt Does Samwha ElectricLtd Carry?

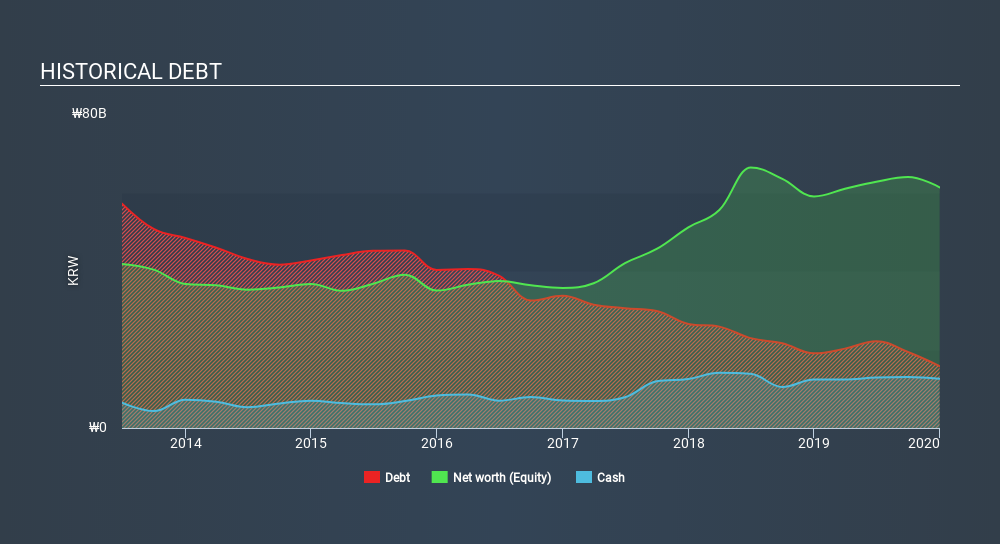

You can click the graphic below for the historical numbers, but it shows that Samwha ElectricLtd had ₩15.8b of debt in December 2019, down from ₩19.0b, one year before. However, because it has a cash reserve of ₩12.6b, its net debt is less, at about ₩3.21b.

How Healthy Is Samwha ElectricLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Samwha ElectricLtd had liabilities of ₩47.3b due within 12 months and liabilities of ₩16.6b due beyond that. Offsetting this, it had ₩12.6b in cash and ₩35.7b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩15.6b.

Since publicly traded Samwha ElectricLtd shares are worth a total of ₩87.3b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt sitting at just 0.32 times EBITDA, Samwha ElectricLtd is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 9.2 times the interest expense over the last year. It is just as well that Samwha ElectricLtd's load is not too heavy, because its EBIT was down 27% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is Samwha ElectricLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Samwha ElectricLtd actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Samwha ElectricLtd's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. When we consider all the elements mentioned above, it seems to us that Samwha ElectricLtd is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Samwha ElectricLtd you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KOSE:A009470

Samwha ElectricLtd

Operates in the electrolytic capacitor industry in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives