- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

High Growth Tech And 2 Other Dynamic Stocks To Watch

Reviewed by Simply Wall St

Amidst global market fluctuations and policy uncertainties, particularly surrounding the incoming Trump administration's impact on corporate earnings and sector performance, investors remain watchful of key economic indicators such as inflation and interest rate expectations. In this dynamic environment, identifying high growth tech stocks alongside other promising investments requires careful consideration of their potential to adapt and thrive amid shifting regulatory landscapes and economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1296 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

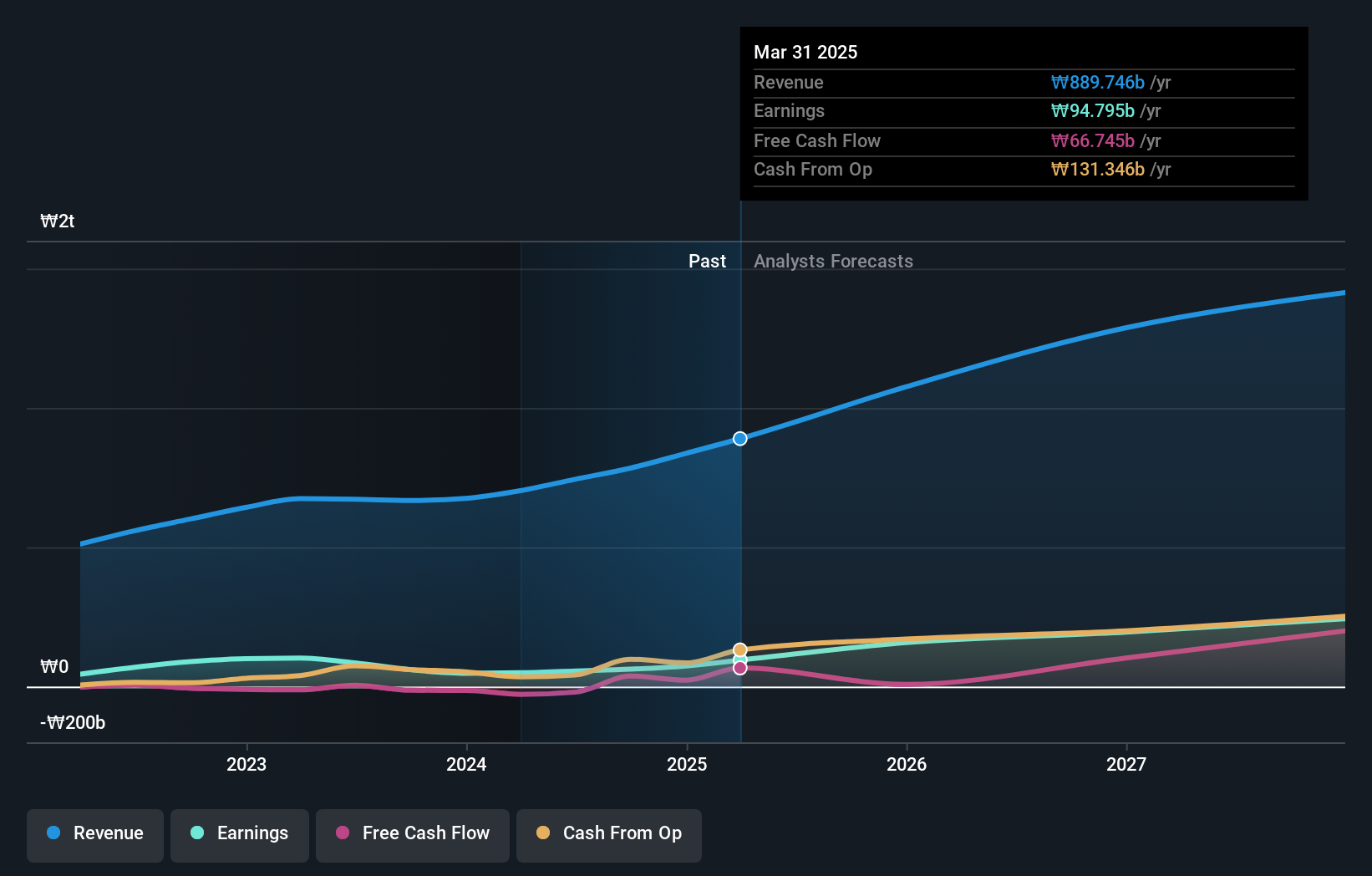

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of approximately ₩1.44 billion.

Operations: The company generates revenue primarily through the manufacture and sale of printed circuit boards, amounting to ₩743.88 billion.

ISU Petasys, despite a volatile share price in recent months, stands out with its robust earnings growth forecast at 44.4% annually, significantly outpacing the broader Korean market's 28%. This growth is bolstered by a strategic focus on R&D, evident from their substantial investment amounting to KRW 549.82 billion in follow-on equity offerings aimed at innovation and expansion. However, challenges persist as their debt coverage by operating cash flow remains weak and profit margins have dipped to 7.5% from last year's 12.6%. With revenue expected to grow at 17.8% per year—faster than the market average of 9.3%—and high-profile presentations like the recent one at the KIS Global Investors Conference, ISU Petasys is navigating through competitive pressures while leveraging its technological advancements for future gains.

- Click here and access our complete health analysis report to understand the dynamics of ISU Petasys.

Explore historical data to track ISU Petasys' performance over time in our Past section.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for communication both in Sweden and internationally, with a market cap of approximately SEK6.54 billion.

Operations: The company generates revenue primarily from its computer hardware segment, totaling approximately SEK1.86 billion.

Dynavox Group, with a notable earnings growth of 34.4% per year, outstrips the Swedish market's average of 15%. This surge is underpinned by its aggressive R&D investments which have fueled innovations leading to a revenue uptick projected at 13.9% annually, surpassing the market's slight decline. Despite carrying a high level of debt, the company’s strategic maneuvers were evident in their recent earnings report showing an increase from SEK 424 million to SEK 483 million in quarterly sales and net income growth from SEK 35 million to SEK 45 million year-over-year. Dynavox's commitment to research and development not only enhances its product offerings but also positions it well for sustained future growth amidst competitive pressures.

- Navigate through the intricacies of Dynavox Group with our comprehensive health report here.

Review our historical performance report to gain insights into Dynavox Group's's past performance.

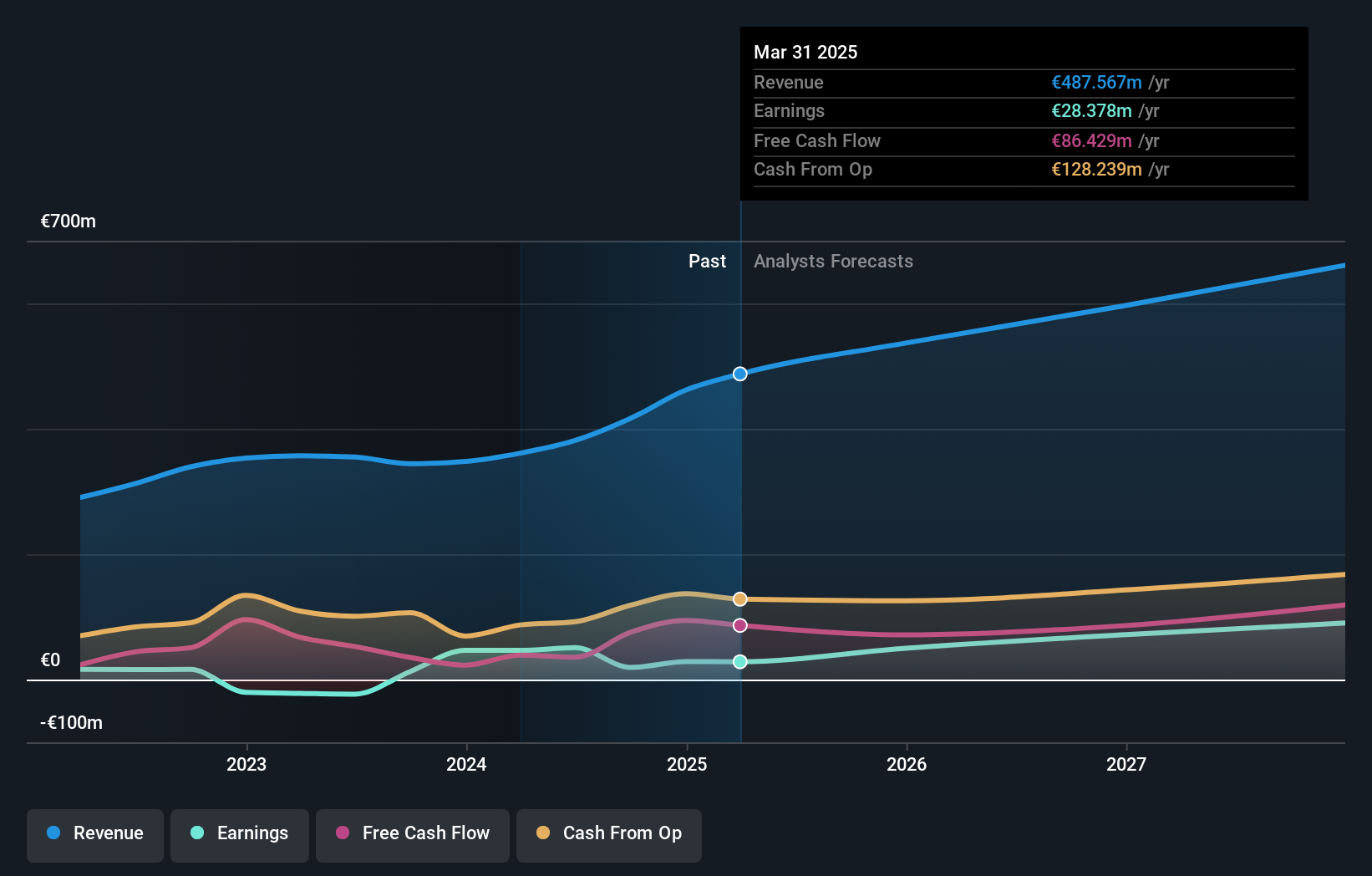

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space across North America and Europe, with a market cap of €728.57 million.

Operations: The company generates revenue primarily from its Supply Side Platforms (SSP) and Demand Side Platforms (DSP), with SSP contributing significantly more at €341.35 million compared to DSP's €57.59 million.

Verve Group has demonstrated robust growth dynamics, evidenced by a 31% organic revenue increase in its latest quarterly report. This performance is underpinned by strategic R&D investments, which are crucial as the company's revenue and earnings forecasts indicate annual increases of 12.6% and 22%, respectively. Notably, the firm's inclusion in the S&P Global BMI Index underscores its market recognition but was shortly followed by an exclusion, reflecting potential volatility in investor sentiment. Despite this, Verve Group’s recent presentations at high-profile investment conferences suggest a strong forward-looking strategy aimed at sustaining growth amid competitive pressures in the tech sector.

- Unlock comprehensive insights into our analysis of Verve Group stock in this health report.

Examine Verve Group's past performance report to understand how it has performed in the past.

Summing It All Up

- Explore the 1296 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for communication in Sweden and internationally.

High growth potential with solid track record.