- South Korea

- /

- Entertainment

- /

- KOSE:A352820

Exploring High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

The market in South Korea has climbed 3.8% in the last 7 days and is up 5.8% over the last 12 months, with earnings expected to grow by 29% per annum over the next few years. In this favorable environment, identifying high growth tech stocks that align with these positive trends can be crucial for investors looking to capitalize on potential opportunities.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.73 billion.

Operations: Daejoo Electronic Materials Co., Ltd. primarily generates revenue through the development, production, and sale of electrical and electronic components, amounting to ₩206.32 billion. The company's operations span multiple regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

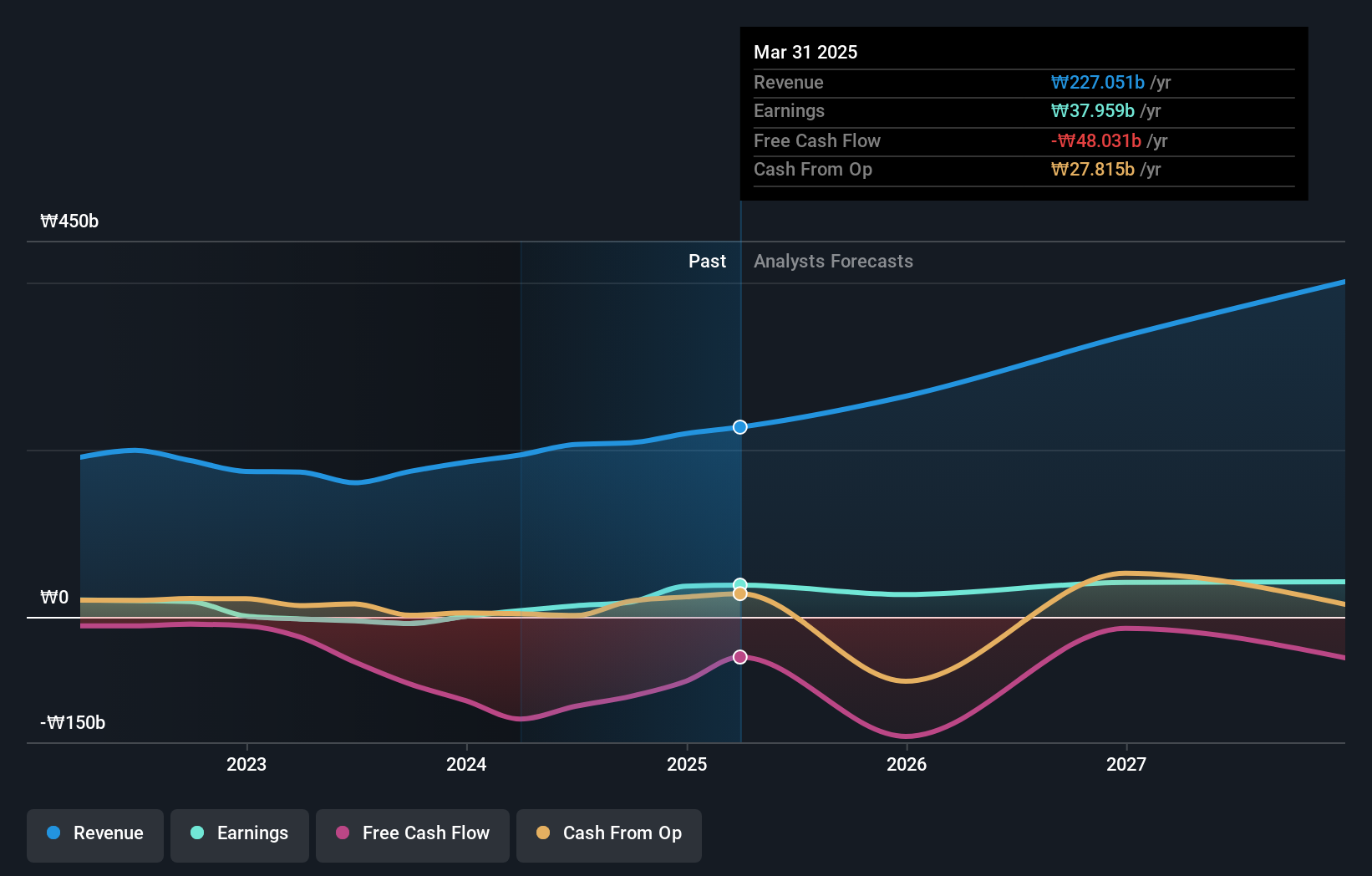

Daejoo Electronic Materials has recently pivoted from a challenging financial position, marked by negative sales figures, to reporting substantial net income growth. In the latest quarter, the company's net income surged to KRW 6,557.14 million from KRW 821.69 million year-over-year, reflecting an impressive turnaround. This resurgence is underpinned by a forecasted annual revenue growth of 42.2% and earnings expected to expand by 48.7% per year, outpacing the broader South Korean market's projections significantly. Despite its volatile share price in recent months and concerns over debt not being well covered by operating cash flow, Daejoo's strategic focus on enhancing its product offerings and operational efficiencies could position it favorably within South Korea’s competitive tech landscape. The company’s commitment to innovation is evident in its R&D initiatives aimed at driving future growth in electronic materials—a sector critical for advancements in technology and manufacturing at large.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. manufactures and sells printed circuit boards (PCBs) worldwide, with a market cap of ₩2.51 billion.

Operations: ISU Petasys generates revenue primarily from the manufacture and sale of printed circuit boards (PCBs), amounting to ₩743.88 billion. The company's market cap stands at ₩2.51 trillion.

ISU Petasys, a South Korean tech firm, is navigating the competitive landscape with a strategic emphasis on R&D investment. In the latest fiscal period, R&D expenses surged to 18.6% of total revenue, underscoring a commitment to innovation despite slower revenue growth projections at 18.6% annually compared to the industry average. This focus is pivotal as earnings are expected to burgeon by an impressive 44.4% per year, outstripping broader market forecasts significantly and positioning ISU Petasys for potential leadership in its sector. The company's dedication to developing cutting-edge technology solutions could catalyze significant advancements in electronics and communication devices, sectors demanding continual innovation. However, it's crucial to note that such heavy investment in research may strain short-term financials but is essential for long-term viability and competitiveness in South Korea’s fast-evolving tech industry. As ISU Petasys continues to enhance its product offerings and operational efficiencies amidst these challenges, its trajectory will be critical to watch for insights into the broader implications for tech development regionally.

- Unlock comprehensive insights into our analysis of ISU Petasys stock in this health report.

Understand ISU Petasys' track record by examining our Past report.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management businesses with a market cap of ₩7.08 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from music production, publishing, and artist management, with notable contributions from its Label and Solution segments (₩1.28 trillion and ₩1.24 trillion respectively). The company also benefits from its Platform segment, adding ₩361.12 billion to its overall revenue.

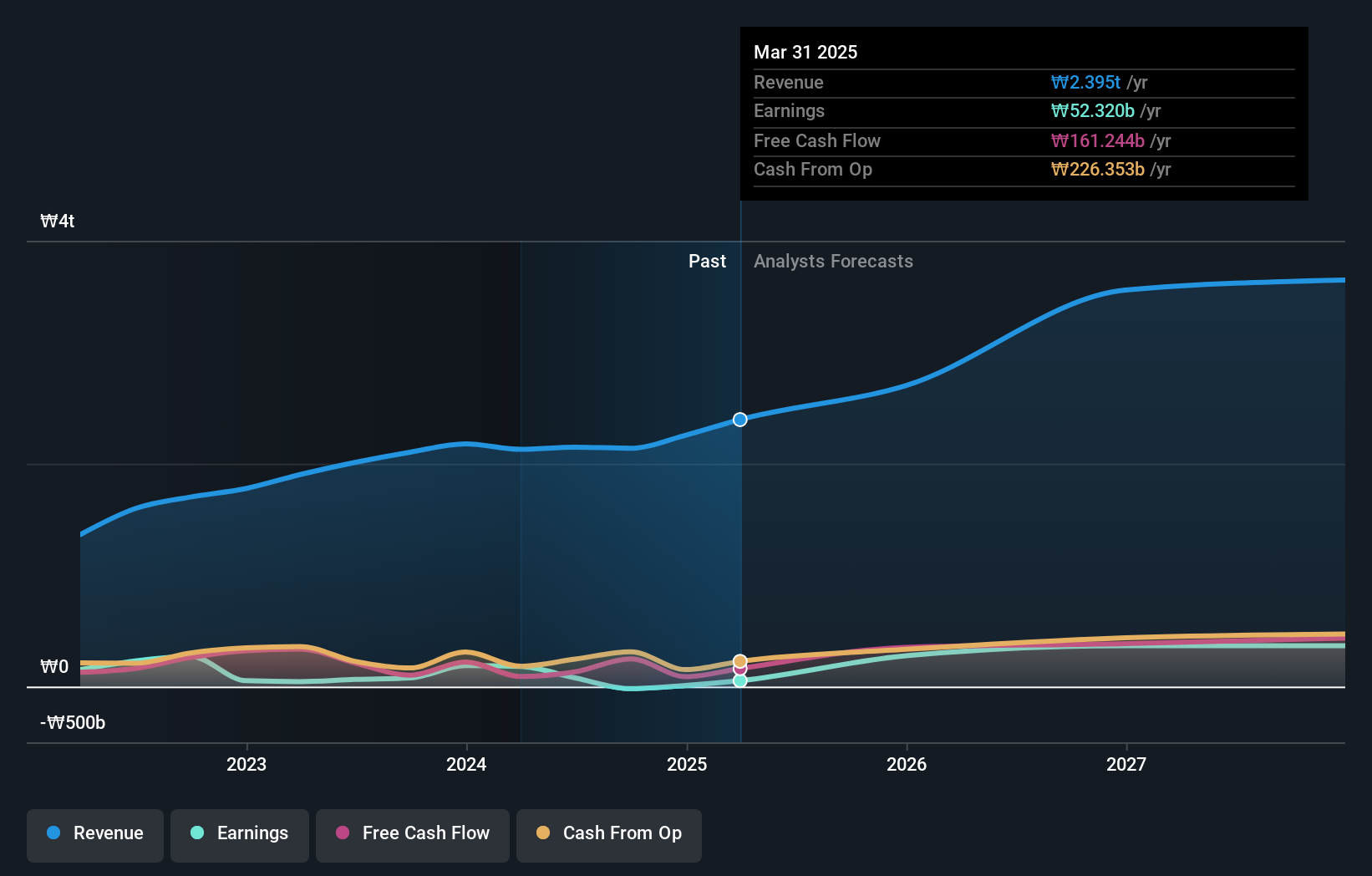

HYBE, a South Korean entertainment company, has demonstrated robust financial agility with its recent share buyback initiative, repurchasing 150,000 shares for KRW 26.09 billion to stabilize stock prices. This move underscores a strategic approach to shareholder value amid fluctuating market conditions. Despite facing challenges like a significant one-off loss of ₩189.4 billion impacting last year's financials, HYBE's earnings are projected to grow at an impressive annual rate of 42.2%. Additionally, the firm invests heavily in innovation with R&D expenses constituting 14% of total revenue—highlighting its commitment to sustaining long-term growth through continuous product and service enhancement in the dynamic tech landscape of South Korea.

- Dive into the specifics of HYBE here with our thorough health report.

Evaluate HYBE's historical performance by accessing our past performance report.

Key Takeaways

- Take a closer look at our KRX High Growth Tech and AI Stocks list of 49 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026