- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

Exploring ALTEOGEN And Two Other High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it has shown a promising rise of 4.1% over the past year with earnings forecasted to grow by 29% annually. In such an environment, identifying high growth tech stocks like ALTEOGEN can be crucial for investors seeking to capitalize on robust earnings potential and long-term growth prospects.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.40 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. Its business model focuses on innovative biotechnological solutions, including long-acting biobetters and proprietary antibody-drug conjugates.

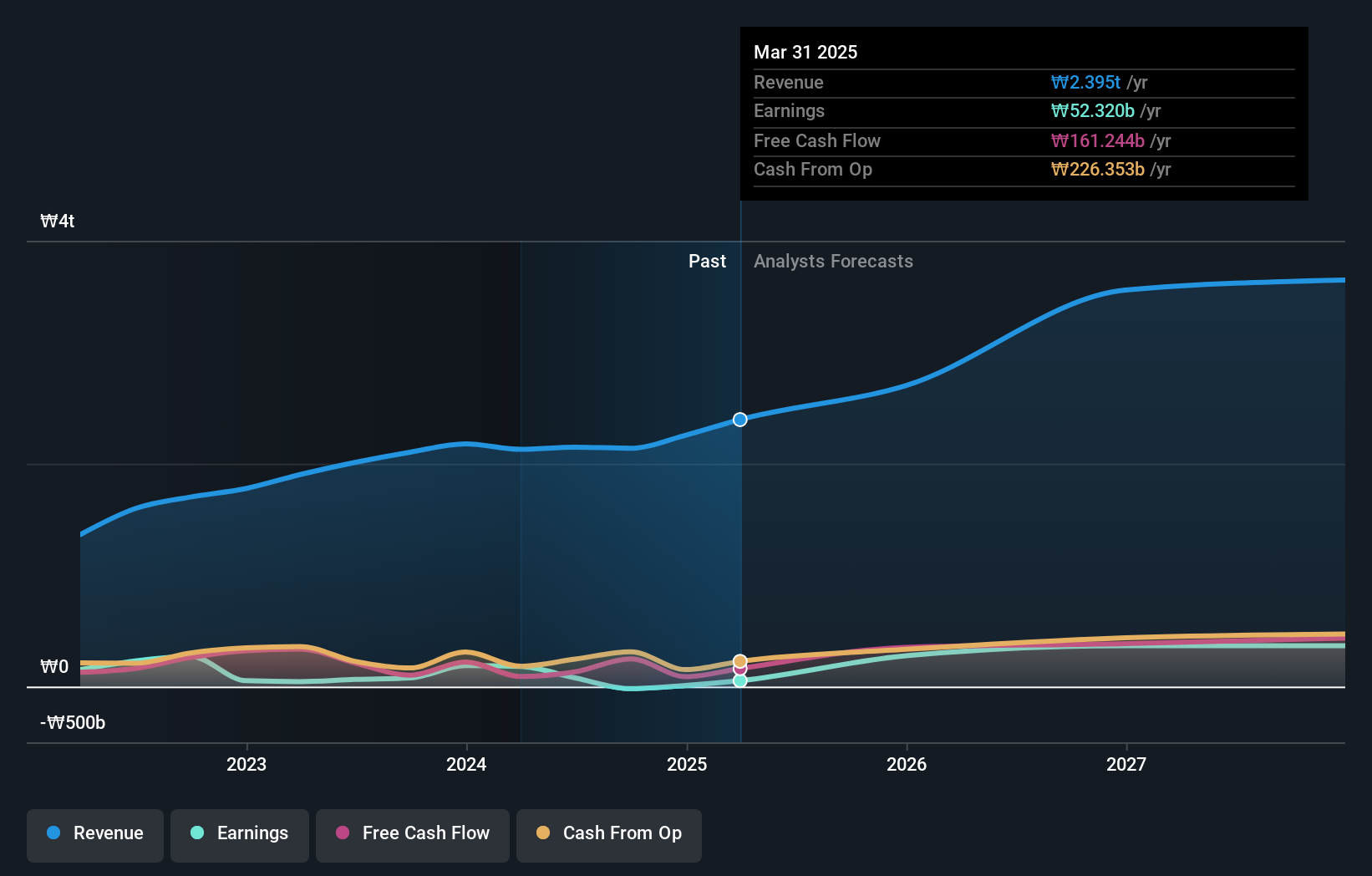

ALTEOGEN, a South Korean biotech firm, is navigating through its growth phase with significant R&D investments and ambitious revenue forecasts. Despite being currently unprofitable, the company's revenue is expected to surge by 64.2% annually, outpacing the local market's growth of 10.3%. This aggressive expansion is backed by a projected annual earnings increase of 99.46%, setting the stage for profitability within three years. ALTEOGEN’s commitment to innovation is evident in its substantial R&D spending aimed at pioneering developments in biotechnology—a sector driven by constant advancements and high entry barriers which could potentially yield substantial future returns despite current volatility and shareholder dilution concerns over the past year.

- Dive into the specifics of ALTEOGEN here with our thorough health report.

Gain insights into ALTEOGEN's historical performance by reviewing our past performance report.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩2.88 trillion.

Operations: ISU Petasys focuses on the manufacturing and sale of printed circuit boards (PCBs), generating revenue of ₩743.88 billion. The company operates on a global scale, leveraging its expertise in PCB production to serve various markets worldwide.

With an anticipated revenue growth of 18.6% per year, ISU Petasys is positioning itself as a competitive player in South Korea's tech sector, albeit growing below the high-growth benchmark of 20%. The company's commitment to innovation is underscored by its R&D investments, which are crucial for staying relevant against industry giants. Notably, ISU Petasys has managed to outpace the broader Korean market’s average with an expected earnings surge of 44.4% annually. This robust profit growth projection suggests potential for significant advancements and market share expansion in the coming years. Despite these promising figures, challenges such as a highly volatile share price and lower profit margins compared to last year (7.5% down from 12.6%) highlight areas that might require strategic adjustments to sustain long-term growth.

- Unlock comprehensive insights into our analysis of ISU Petasys stock in this health report.

Examine ISU Petasys' past performance report to understand how it has performed in the past.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market capitalization of ₩8 trillion.

Operations: The company generates revenue primarily from three segments: Label, Platform, and Solution. The Label segment contributes the highest revenue at ₩1.28 trillion, followed by the Solution segment at ₩1.24 trillion, while the Platform segment adds ₩361.12 billion.

HYBE's strategic focus on R&D investment, which amounted to 13.9% of its revenue, underscores its commitment to innovation within South Korea's dynamic tech landscape. This substantial allocation towards research is pivotal in fostering advancements that keep the company competitive against global entertainment giants. Additionally, HYBE recently concluded a share buyback program, repurchasing 150,000 shares for KRW 26.09 billion, signaling confidence in its financial health and future prospects. Despite facing challenges like a significant one-off loss of ₩189.4 billion affecting earnings last year and an earnings growth forecast at 42% annually—slightly below the high-growth threshold—HYBE continues to outperform many peers with robust revenue projections set to exceed the market average by 3.6%.

Taking Advantage

- Unlock our comprehensive list of 47 KRX High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.