- South Korea

- /

- Tech Hardware

- /

- KOSE:A005930

Is Samsung Electronics Worth a Second Look After 80% Gain in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Samsung Electronics stock? You are not alone. The stock has been on quite a ride lately, and whether you are considering buying, holding, or just tracking your gains, it pays to be informed. In the past week, things have pulled back by -1.2%, but zoom out a little, and the story gets a lot more exciting: up 13.9% over the last 30 days, and an impressive 80.7% year-to-date. The gains over the past twelve months tell a similar story, with a formidable 74.5%, showing that those making a longer-term bet have been handsomely rewarded.

What is driving these moves? Big themes like the ongoing global AI hardware race and increased demand for advanced chips are squarely in focus. Investors are paying close attention to Samsung’s memory chip leadership, especially as new announcements around AI infrastructure and next-gen technologies have put future growth potential under the spotlight. There is also a growing sense that the market is reassessing risk in the broader tech sector, with capital flowing into companies seen as having a structural advantage.

But is Samsung Electronics actually undervalued at current prices? Based on six key valuation checks, the company comes in at a solid 4 out of 6, suggesting it is undervalued by several important metrics, though not across the board. In the next section, we will break down what those checks mean, how they stack up, and why valuation is more nuanced than simply running the numbers. Stay tuned, because we will also share the one thing most approaches miss when sizing up a stock like Samsung.

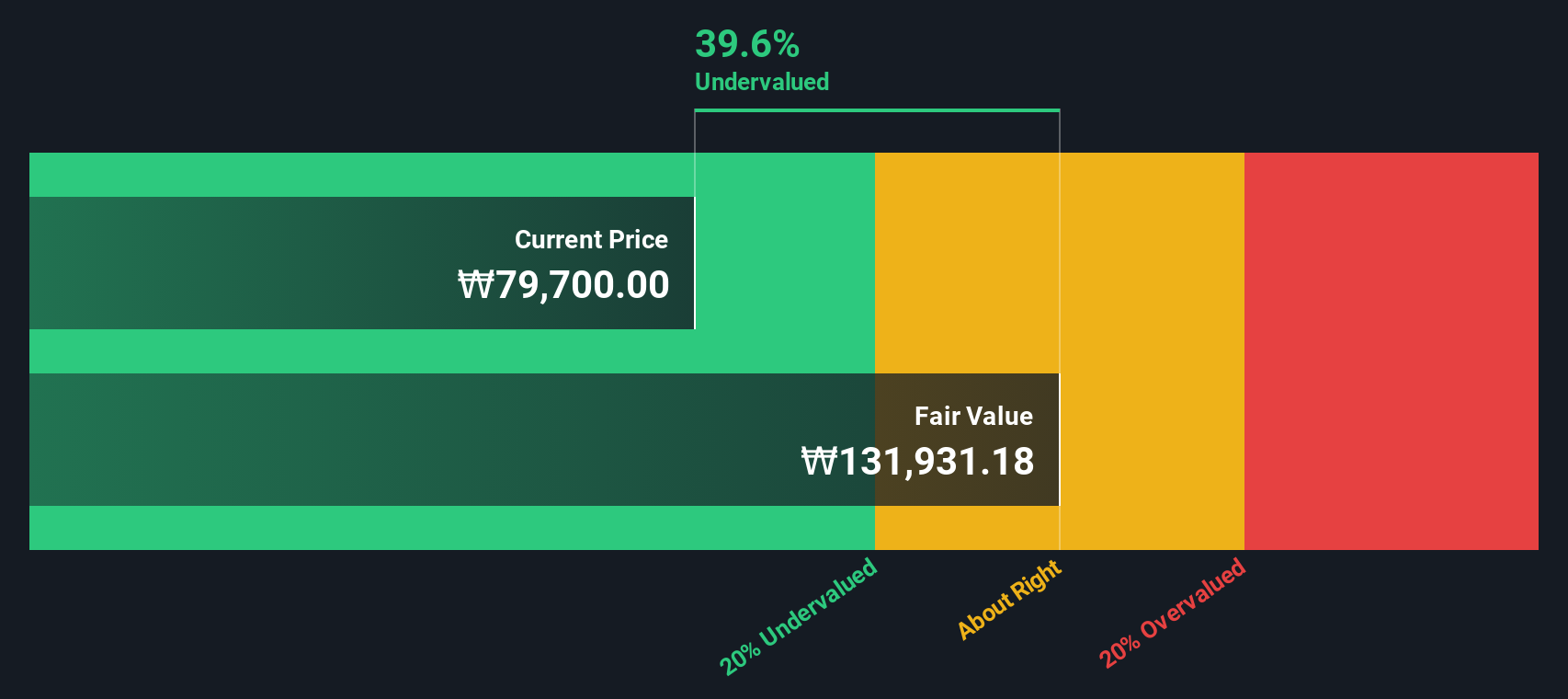

Approach 1: Samsung Electronics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true worth of a business by projecting its future cash flows and discounting them back to their value today. This approach helps investors look past short-term noise and focus on a company's capacity to generate real, long-term cash.

For Samsung Electronics, the DCF analysis starts with a Last Twelve Months Free Cash Flow of ₩16.2 trillion. Analysts expect this figure to rise rapidly, reaching approximately ₩42.2 trillion by 2027. While analyst estimates typically only extend several years into the future, projections for the next decade, relying on both analyst data and calculated assumptions, show cash flows potentially climbing to over ₩71 trillion by 2035.

All values here are presented in Korean Won (₩), consistent with the company's reporting and listing currency. These forecasts feed into the 2 Stage Free Cash Flow to Equity model, which assigns a fair value estimate of ₩147,276 per share. Current market levels suggest the stock trades at a 34.5% discount to this intrinsic value, implying a significant margin of safety for potential investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Samsung Electronics is undervalued by 34.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

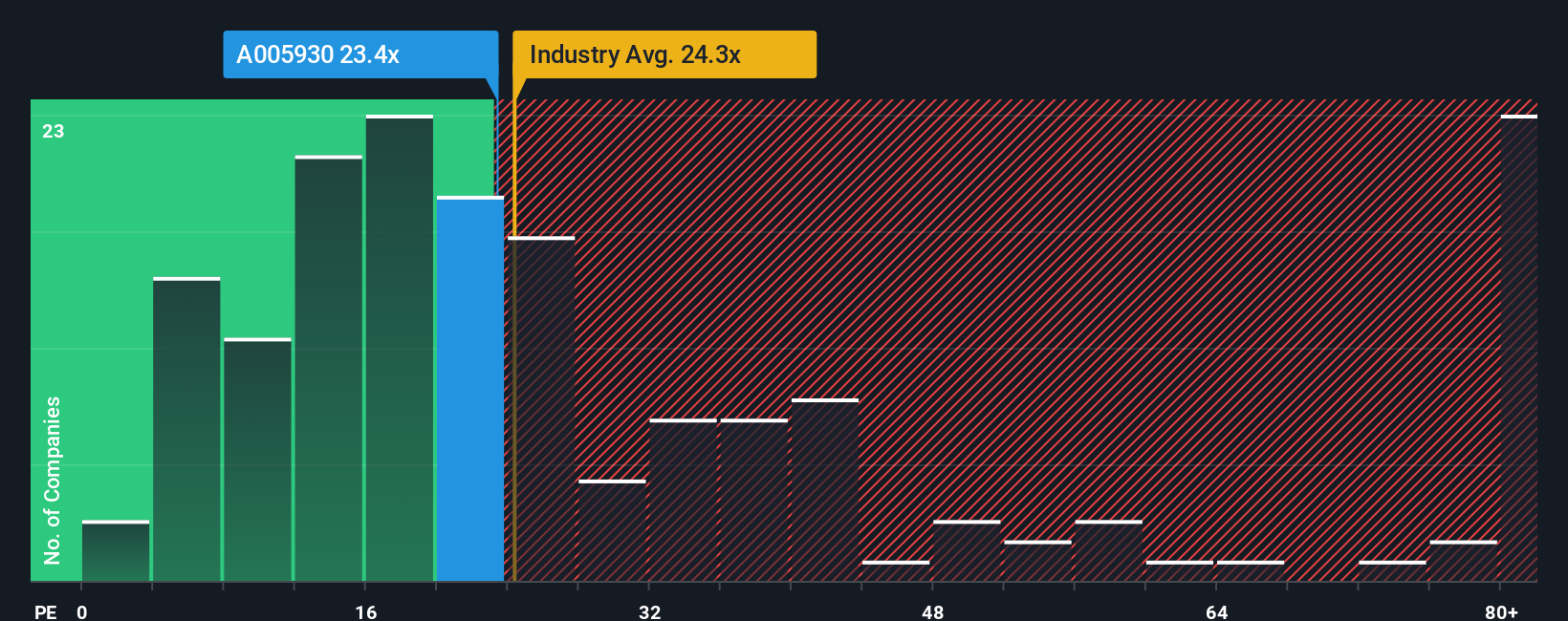

Approach 2: Samsung Electronics Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for mature, profitable companies such as Samsung Electronics. It offers a straightforward way to gauge what investors are currently willing to pay for each unit of the company's earnings, making it highly relevant for firms with steady profits.

A company’s "normal" or "fair" PE ratio depends on factors like expected earnings growth, risk level, and how favorably the market views its prospects. Companies with higher growth expectations or lower risk typically command a higher PE, while uncertainty or slower growth tend to hold the multiple down.

Samsung Electronics currently trades at a PE of 22.4x. This sits just below the technology industry average of 24.0x and slightly above the average of its peer group at 20.0x. While these benchmarks offer some context, they do not account for Samsung’s unique blend of earnings growth, scale, and market positioning.

This is where Simply Wall St's proprietary “Fair Ratio” is useful. The Fair Ratio is designed to reflect a multiple that is justified by a company’s earnings growth, profit margins, size, risk profile, and operating environment. Unlike simple peer or industry comparisons, it gives a more nuanced view that is tailored to Samsung’s specific situation.

For Samsung, the Fair Ratio stands at 31.8x, comfortably above its current multiple. With Samsung trading below its Fair Ratio, this suggests the stock may offer value at current levels, especially considering its growth potential and earnings strength.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

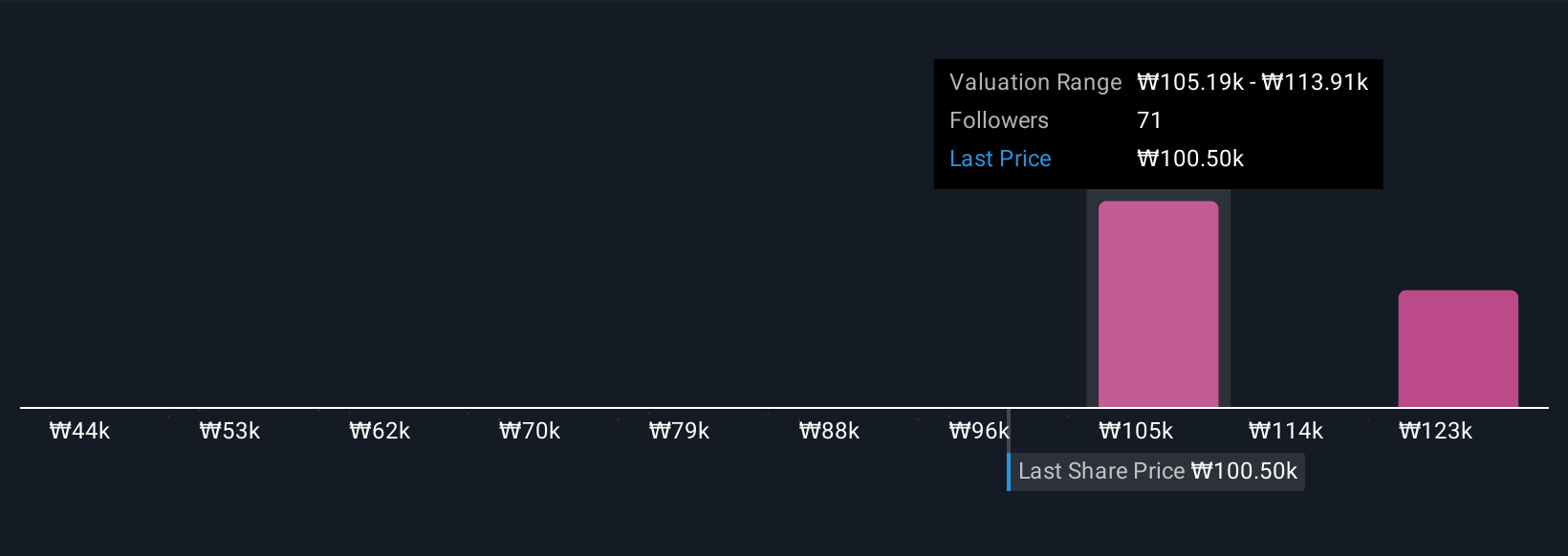

Upgrade Your Decision Making: Choose your Samsung Electronics Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives: these are simple but powerful tools that let you build your own view on Samsung Electronics by connecting your story and outlook for the company to a tailored financial forecast and fair value.

A Narrative is more than just a number. It is your personal perspective, your assumptions about Samsung’s future growth, margins, risks, and opportunities, all woven together into a forecast and a fair value that updates as the company and market move.

Available right within the Simply Wall St Community page (where millions of investors gather to share ideas), Narratives are designed to be easy and accessible. Any investor can compare their fair value to the current share price and see at a glance whether Samsung looks like a buy, hold, or sell based on their own expectations.

The big advantage is that Narratives adjust in real time when news breaks, earnings are released, or fresh data arrives. Your view always keeps pace with what really matters for the stock.

For Samsung Electronics, for instance, some investors are highly optimistic, seeing fair value well above ₩100,000 and banking on AI demand and premium contract wins. More cautious users factor in margin risks and estimate a fair value closer to ₩58,500. Narratives allow you to compare, adjust, and truly own your investment story.

Do you think there's more to the story for Samsung Electronics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005930

Samsung Electronics

Engages in the consumer electronics, information technology and mobile communications, and device solutions businesses worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)