- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A441270

Investors Shouldn't Be Too Comfortable With Fine M-TecLTD's (KOSDAQ:441270) Earnings

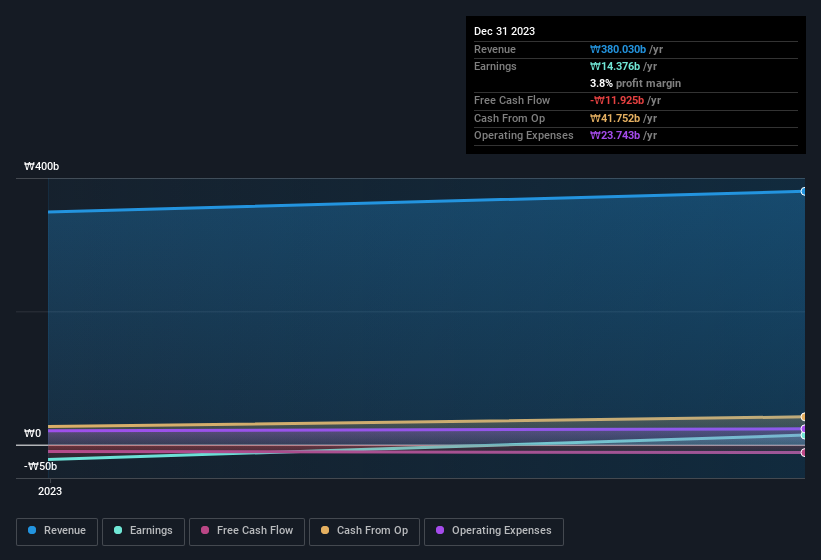

Investors were disappointed with Fine M-Tec CO.,LTD.'s (KOSDAQ:441270) earnings, despite the strong profit numbers. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for Fine M-TecLTD

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Fine M-TecLTD issued 13% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Fine M-TecLTD's historical EPS growth by clicking on this link.

How Is Dilution Impacting Fine M-TecLTD's Earnings Per Share (EPS)?

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Fine M-TecLTD's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

On top of the dilution, we should also consider the ₩3.6b impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Fine M-TecLTD to produce a higher profit next year, all else being equal.

Our Take On Fine M-TecLTD's Profit Performance

Fine M-TecLTD suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Based on these factors, it's hard to tell if Fine M-TecLTD's profits are a reasonable reflection of its underlying profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 3 warning signs with Fine M-TecLTD, and understanding these should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A441270

Fine M-TecLTD

Engages in the manufacture and sale of information technology (IT) parts used for mobile phones and others.

Low risk and overvalued.

Market Insights

Community Narratives