- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A311320

Concerns Surrounding GO Element's (KOSDAQ:311320) Performance

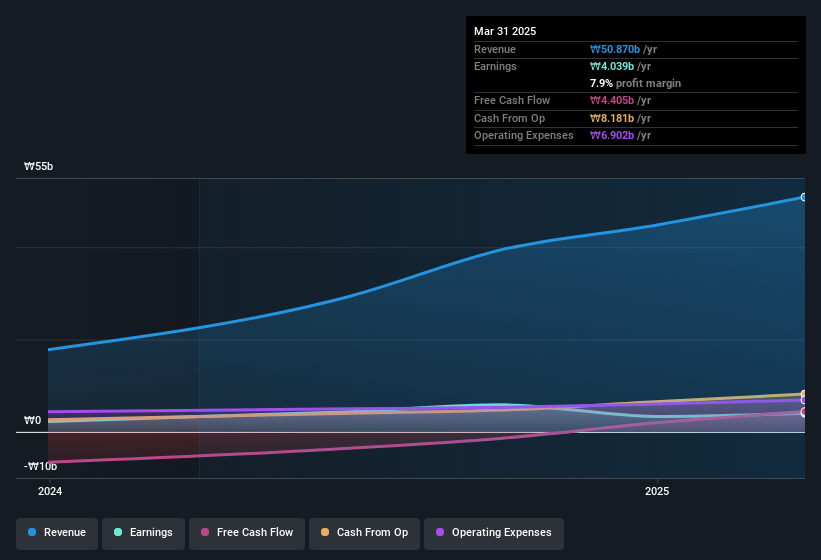

GO Element Co., Ltd.'s (KOSDAQ:311320) robust recent earnings didn't do much to move the stock. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

We've discovered 4 warning signs about GO Element. View them for free.

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, GO Element had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from -₩5.79b last year to ₩10.0 this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Alongside that spike in non-operating revenue, it's also important to note that GO Element'sprofit suffered from unusual items, which reduced profit by ₩2.0b in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. GO Element took a rather significant hit from unusual items in the year to March 2025. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On GO Element's Profit Performance

In its last report GO Element benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. Having said that, it also took a hit from unusual items, which could bode well for next year, assuming the expense was one-off in nature. Having considered these factors, we don't think GO Element's statutory profits give an overly harsh view of the business. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that GO Element has 4 warning signs and it would be unwise to ignore these bad boys.

Our examination of GO Element has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A311320

GO Element

Engages in the development, manufacture, and sales of semiconductor equipment and components.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!