- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A290550

These 4 Measures Indicate That DK Tech (KOSDAQ:290550) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, DK Tech CO., LTD (KOSDAQ:290550) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

What Is DK Tech's Net Debt?

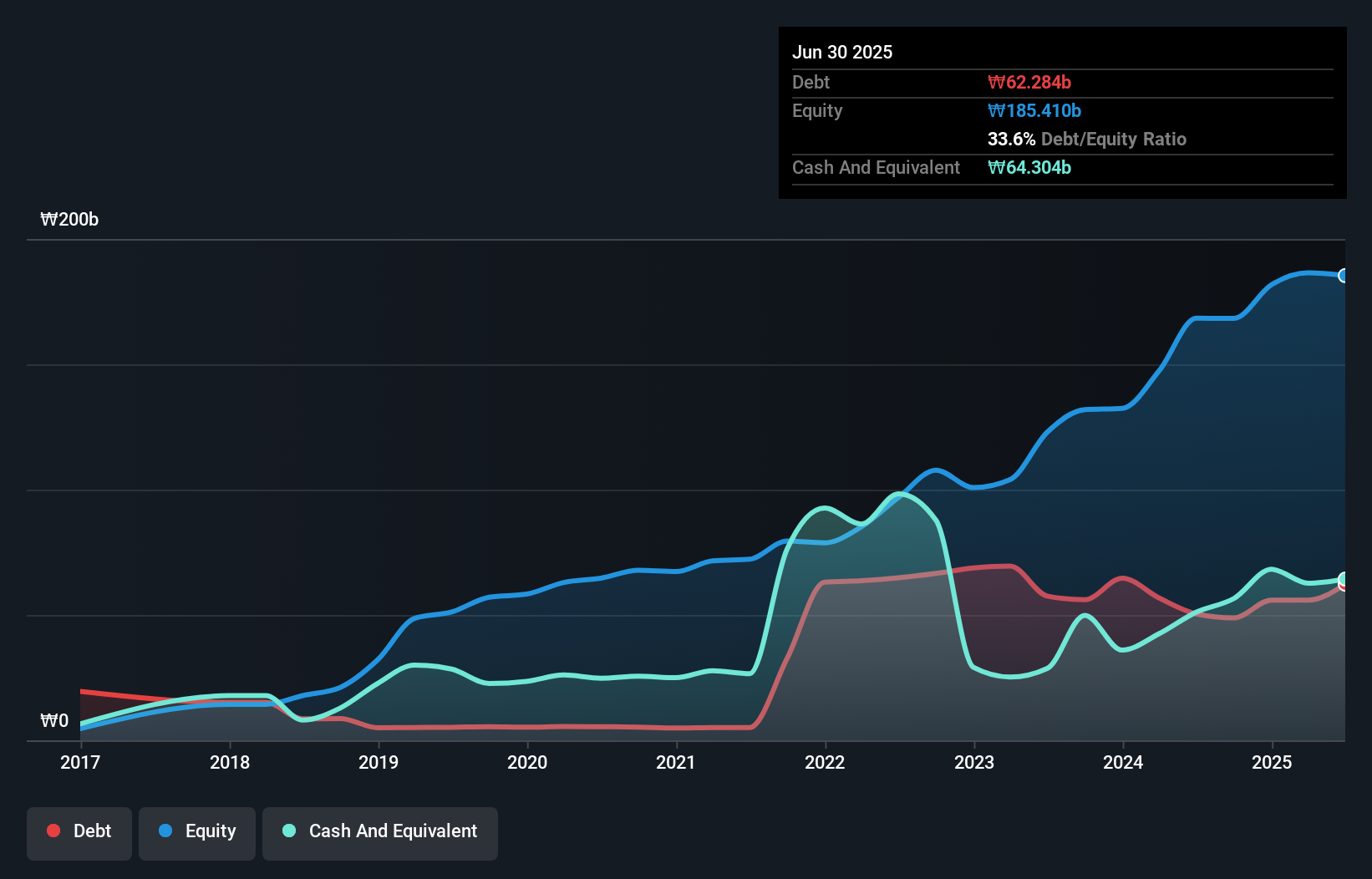

As you can see below, at the end of June 2025, DK Tech had ₩62.3b of debt, up from ₩50.4b a year ago. Click the image for more detail. However, it does have ₩64.3b in cash offsetting this, leading to net cash of ₩2.02b.

How Healthy Is DK Tech's Balance Sheet?

We can see from the most recent balance sheet that DK Tech had liabilities of ₩98.6b falling due within a year, and liabilities of ₩7.84b due beyond that. Offsetting this, it had ₩64.3b in cash and ₩67.3b in receivables that were due within 12 months. So it actually has ₩25.1b more liquid assets than total liabilities.

This short term liquidity is a sign that DK Tech could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that DK Tech has more cash than debt is arguably a good indication that it can manage its debt safely.

View our latest analysis for DK Tech

In fact DK Tech's saving grace is its low debt levels, because its EBIT has tanked 21% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since DK Tech will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. DK Tech may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Considering the last three years, DK Tech actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Summing Up

While it is always sensible to investigate a company's debt, in this case DK Tech has ₩2.02b in net cash and a decent-looking balance sheet. So we are not troubled with DK Tech's debt use. Over time, share prices tend to follow earnings per share, so if you're interested in DK Tech, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A290550

DK Tech

Manufactures and sells electronic components for smart devices in South Korea.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks