- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A237750

Introducing PNC Technologies (KOSDAQ:237750), The Stock That Dropped 42% In The Last Year

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the PNC Technologies co., Ltd (KOSDAQ:237750) share price slid 42% over twelve months. That's well bellow the market return of 3.1%. Even if you look out three years, the returns are still disappointing, with the share price down36% in that time. The good news is that the stock is up 3.5% in the last week.

Check out our latest analysis for PNC Technologies

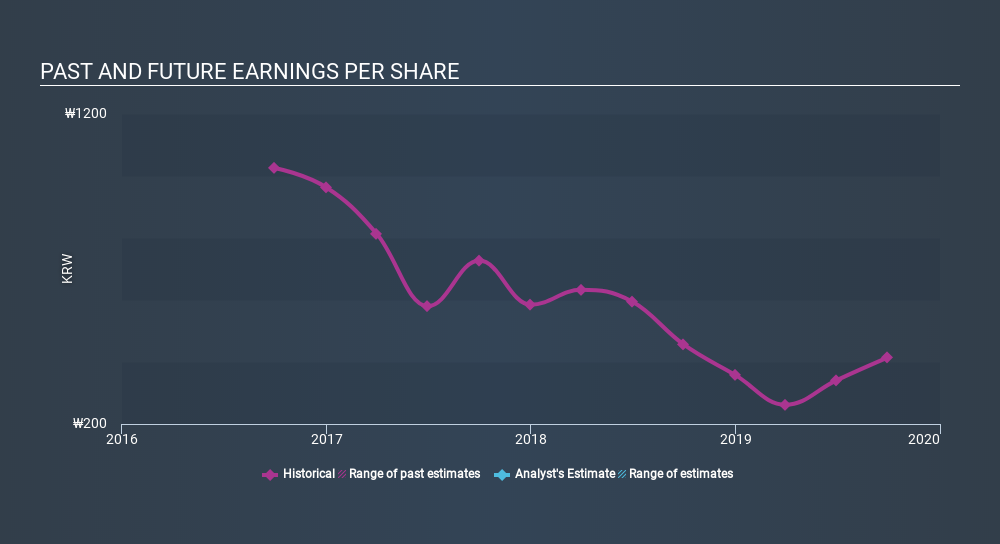

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately PNC Technologies reported an EPS drop of 9.2% for the last year. This reduction in EPS is not as bad as the 42% share price fall. So it seems the market was too confident about the business, a year ago.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on PNC Technologies's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for PNC Technologies shares, which cost holders 42%, while the market was up about 3.1%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 14% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that PNC Technologies is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KOSDAQ:A237750

PNC Technologies

PNC Technologies Co., Ltd operates as a smart grid solution company in Korea and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives