- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A204270

High Growth Tech Companies To Watch In December 2024

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a divergence in major stock indexes, with growth stocks outperforming value stocks significantly, while small-cap indices like the Russell 2000 have seen declines. Amid this backdrop of mixed economic indicators and geopolitical developments, identifying high-growth tech companies becomes crucial as they often thrive in environments where innovation and adaptability are key drivers of success.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★★★

Overview: JNTC Co., Ltd. operates in South Korea, offering products such as connectors, hinges, and tempered glass, with a market capitalization of approximately ₩983.86 billion.

Operations: The company generates revenue primarily through the manufacturing and sales of mobile parts, amounting to ₩337.88 million. Its product offerings include connectors, hinges, and tempered glass.

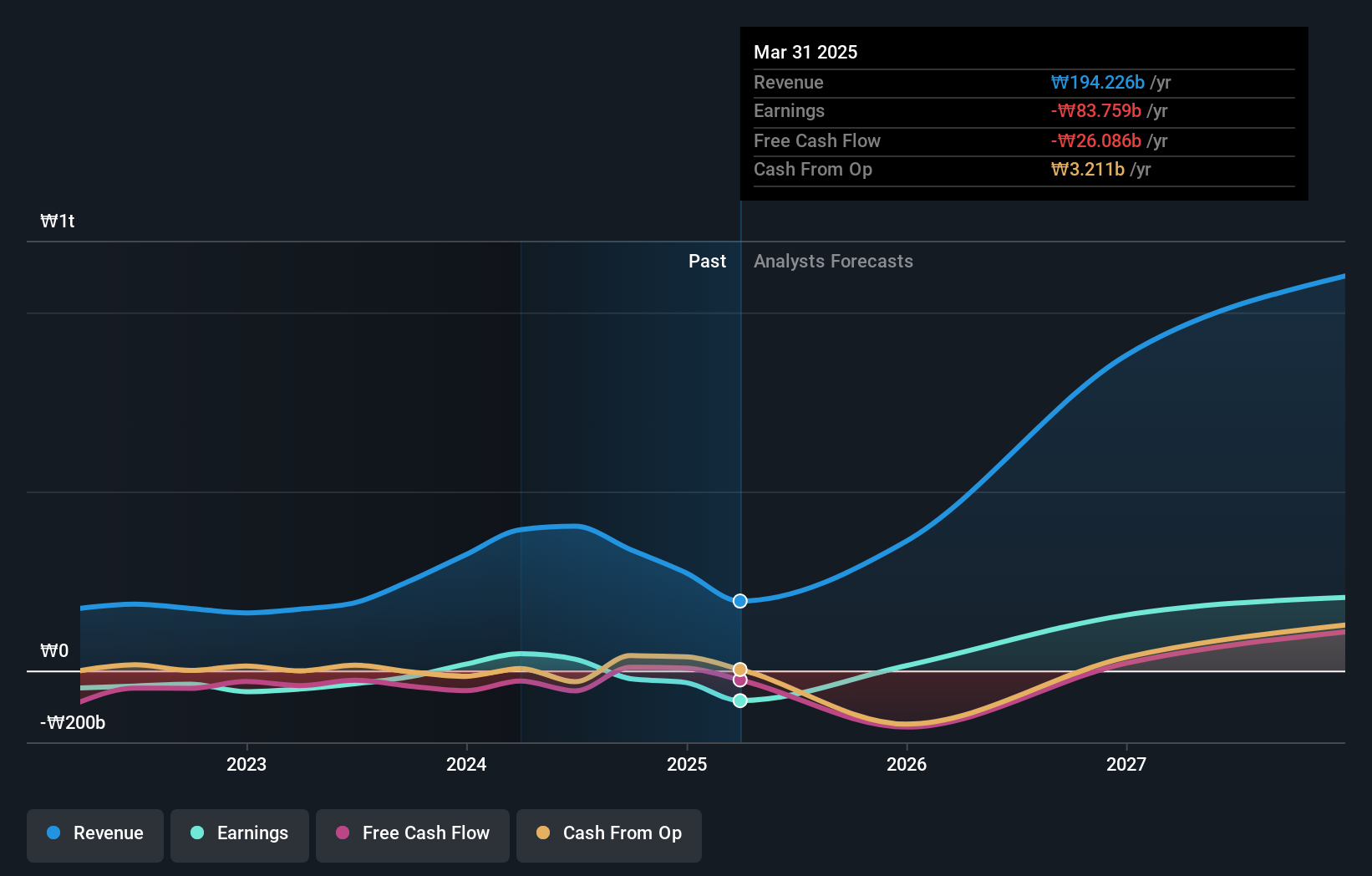

JNTC's trajectory in the tech sector is underscored by its aggressive investment in R&D, dedicating substantial resources to innovation. With R&D expenses climbing to 29.5% of revenue, this strategy supports its forecasted revenue growth at an impressive rate of 29.5% annually, outpacing the KR market's average of 8.9%. Furthermore, earnings are set to surge by an estimated 104.4% per year, highlighting a robust turnaround from current unprofitability to projected profitability within three years. This financial revitalization is bolstered by a positive free cash flow status and an anticipated high Return on Equity (20.2%) in the near future, positioning JNTC as a dynamic contender despite recent market volatility and ongoing challenges in achieving profitability.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. specializes in designing and manufacturing passive optical components for both domestic and international markets, with a market capitalization of CN¥11.63 billion.

Operations: With a focus on optoelectronic devices, Advanced Fiber Resources (Zhuhai) generates revenue primarily from these products, totaling CN¥924.78 million. The company's operations span both domestic and international markets in the optical components sector.

Advanced Fiber Resources (Zhuhai) is demonstrating robust growth, with a notable 23.7% annual revenue increase, outstripping the Chinese market average of 13.7%. This growth trajectory is complemented by an impressive forecast of 42.1% annual earnings growth, positioning it well above the market's 25.9%. The company's commitment to innovation is evident in its R&D investments which have significantly contributed to these financial outcomes. Recent strategic moves include a private placement aimed at funding expansion and enhancements to their technological capabilities, signaling a proactive approach in scaling operations and refining their competitive edge in the tech sector.

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nan Ya Printed Circuit Board Corporation is a company that manufactures and sells printed circuit boards (PCBs) across Taiwan, the United States, Mainland China, Korea, and other international markets with a market capitalization of NT$72.37 billion.

Operations: The company's primary revenue streams are from the domestic market, contributing NT$23.30 billion, and Asia, with NT$14.60 billion. The American market adds a smaller portion at NT$30.17 million to the overall revenue structure.

Nan Ya Printed Circuit Board Corporation, amidst a challenging year with a significant drop in net income from TWD 1,075.64 million to TWD 58.89 million for Q3 and sales declining from TWD 32,941.68 million to TWD 24,413.05 million over nine months, still projects remarkable future growth. The company's R&D commitment is robust, aligning with an anticipated revenue increase of 18.8% per year and an explosive earnings forecast of 97.5% annually—both metrics outpacing the Taiwanese market projections of 12% and 19.3%, respectively. This focus on innovation could pivot its current trajectory towards capturing more advanced tech markets despite recent setbacks.

Turning Ideas Into Actions

- Click here to access our complete index of 1289 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A204270

JNTC

Provides connector, hinge, and tempered glass products in South Korea.

Exceptional growth potential and fair value.

Market Insights

Community Narratives