- Taiwan

- /

- Tech Hardware

- /

- TWSE:6669

Exploring None's Top 3 High Growth Tech Stocks

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and fluctuating economic indicators, global markets have experienced mixed performances, with the S&P 500 Index showing resilience despite a slight decline. As investors navigate these turbulent waters, identifying high-growth tech stocks that can withstand such volatility requires careful consideration of their innovation potential and adaptability to shifting market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1217 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★★★

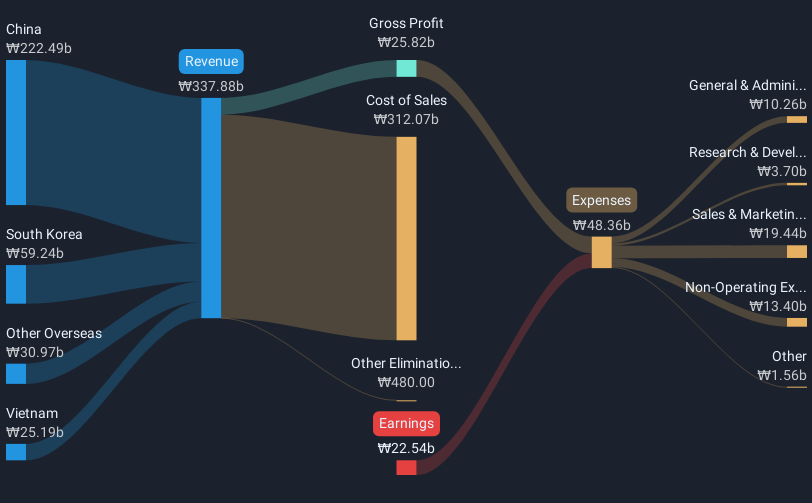

Overview: JNTC Co., Ltd. is a South Korean company specializing in the production of connectors, hinges, and tempered glass products with a market cap of ₩1.22 trillion.

Operations: The company generates revenue primarily from the manufacturing and sales of mobile parts, amounting to approximately ₩337.88 billion.

JNTC, amidst a volatile market, showcases promising growth with an expected annual revenue increase of 29.5%, significantly outpacing the KR market's 9.1%. This tech firm is steering towards profitability with forecasts predicting a robust earnings growth of 104.37% annually over the next three years. Notably, JNTC’s commitment to innovation is evident in its R&D investments, crucial for sustaining its competitive edge in the fast-evolving tech landscape. With a positive free cash flow and strategic movements towards profitability, JNTC appears well-positioned to capitalize on industry trends and meet future demands effectively.

- Click to explore a detailed breakdown of our findings in JNTC's health report.

Assess JNTC's past performance with our detailed historical performance reports.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

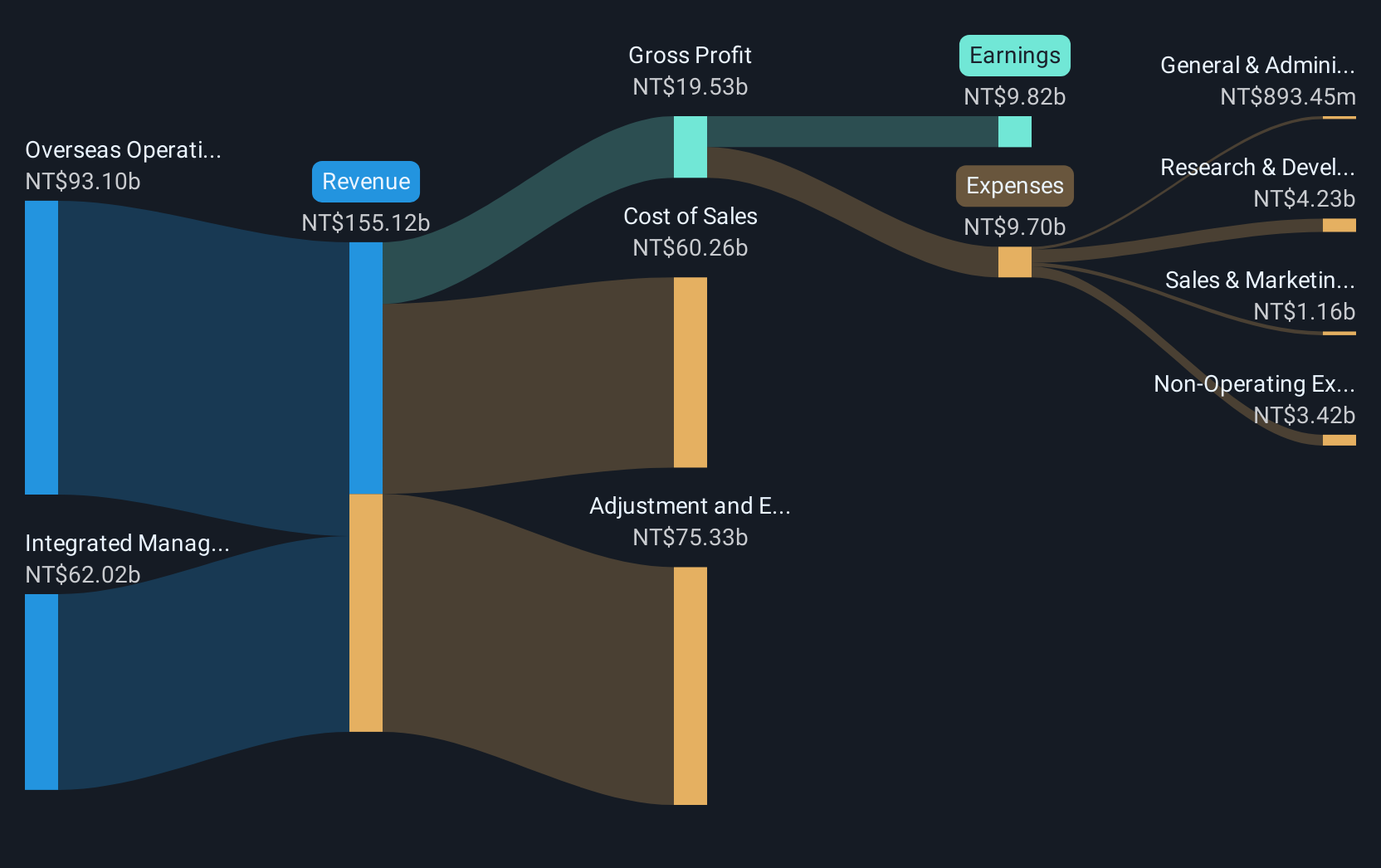

Overview: Asia Vital Components Co., Ltd. is a company that offers thermal solutions on a global scale and has a market capitalization of NT$210.44 billion.

Operations: The company generates revenue primarily from its Overseas Operating Department and Integrated Management Division, with NT$72.11 billion and NT$51.58 billion respectively.

Asia Vital Components has demonstrated robust growth, with a notable 24.6% annual increase in revenue and an impressive 30% surge in earnings, significantly outstripping the TW market's averages of 11.4% and 17.6%, respectively. The company's commitment to innovation is underscored by its R&D spending, which supports its leading position in tech advancements crucial for maintaining competitive advantage in a dynamic industry landscape. Moreover, recent financial results reveal strong performance with third-quarter sales reaching TWD 19.06 billion, up from TWD 15.77 billion year-over-year, alongside net income climbing to TWD 2.32 billion from TWD 1.43 billion, reflecting effective operational execution and market adaptation.

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wiwynn Corporation specializes in the manufacturing and sale of servers and storage products for cloud infrastructure and hyperscale data centers across the United States, Europe, Asia, and other international markets with a market capitalization of approximately NT$406.99 billion.

Operations: The company generates revenue primarily from the computer hardware segment, amounting to NT$303.48 billion.

Wiwynn's recent performance underscores its robust position in the tech sector, with third-quarter sales soaring to TWD 97.82 billion from TWD 52.82 billion year-over-year, and net income more than doubling to TWD 6.33 billion. This surge reflects a significant annual revenue growth of 29.6% and earnings growth of 54.2%, outpacing the industry averages substantially. The company's aggressive investment in R&D is evident from its strong earnings report, positioning it well for sustained innovation and market expansion amidst volatile tech landscapes.

Make It Happen

- Click this link to deep-dive into the 1217 companies within our High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiwynn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6669

Wiwynn

Manufactures and sells servers and storage products in cloud infrastructure and hyperscale data center in the United States, Europe, Asia, and internationally.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives