- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035900

Exploring 3 High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

Ahead of Tuesday's holiday for Armed Forces Day, the South Korea stock market had finished lower in two straight sessions, stumbling almost 80 points or 3 percent along the way. The KOSPI now sits just above the 2,590-point plateau and it may extend its losses on Wednesday amid rising geopolitical tensions in the Middle East. In this volatile environment, identifying high growth tech stocks can be crucial for investors looking to navigate market uncertainties and capitalize on innovative sectors poised for expansion.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 50 stocks from our KRX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

JYP Entertainment (KOSDAQ:A035900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JYP Entertainment Corporation operates as an entertainment company in South Korea and internationally with a market cap of ₩1.67 billion.

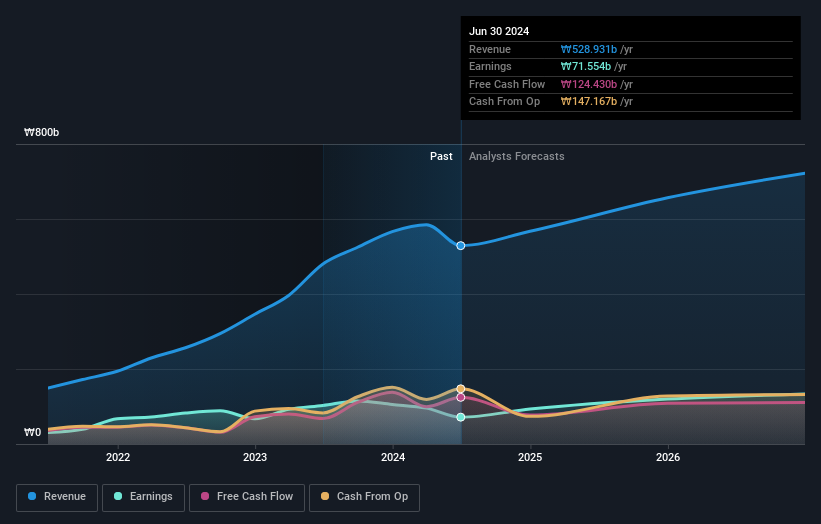

Operations: JYP Entertainment generates revenue primarily through its entertainment segment (₩456.35 billion), followed by distribution and sales (₩60.51 billion), and music publishing (₩12.07 billion). The company's net profit margin stands at 15%.

JYP Entertainment, a South Korean entertainment company, is navigating a complex landscape with mixed financial signals. While its revenue growth at 11.4% annually outpaces the broader Korean market's 10.5%, its earnings forecast of 21.9% yearly growth trails behind the market expectation of 29.7%. Notably, JYP's commitment to innovation is evident in its R&D investments, crucial for maintaining competitiveness in the fast-evolving entertainment sector. Despite challenges like a significant drop in earnings by 30.2% over the past year compared to an industry average increase of 7.3%, the company maintains a robust profit margin of 13.5%, though down from last year’s high of 21.4%. These figures underscore JYP's resilience and potential for recovery amidst industry fluctuations, positioning it as an intriguing entity within South Korea’s high-growth tech landscape.

- Click here to discover the nuances of JYP Entertainment with our detailed analytical health report.

Understand JYP Entertainment's track record by examining our Past report.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. specializes in the production of connectors, hinges, and tempered glass products in South Korea and has a market cap of ₩1.19 billion.

Operations: JNTC Co., Ltd. generates revenue primarily from the manufacturing and sales of mobile parts, amounting to ₩402.99 billion. The company focuses on producing connectors, hinges, and tempered glass products in South Korea.

JNTC, a burgeoning force in South Korea's tech scene, demonstrates robust growth dynamics with its revenue forecast to surge by 18.1% annually, outpacing the broader market's growth of 10.5%. This uptrend is further bolstered by an impressive earnings projection set to expand at a rate of 51.9% per year, significantly ahead of the market expectation of 29.7%. Central to JNTC’s strategy is its hefty investment in R&D, accounting for a substantial portion of its budget, which not only underscores its commitment to innovation but also positions it well amidst fierce industry competition and rapidly evolving technological landscapes. Despite facing challenges like volatile share prices and underwhelming past earnings comparisons due to recent profitability, JNTC’s forward-looking measures and strategic client engagements suggest promising prospects for sustaining its trajectory in high-tech advancements.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

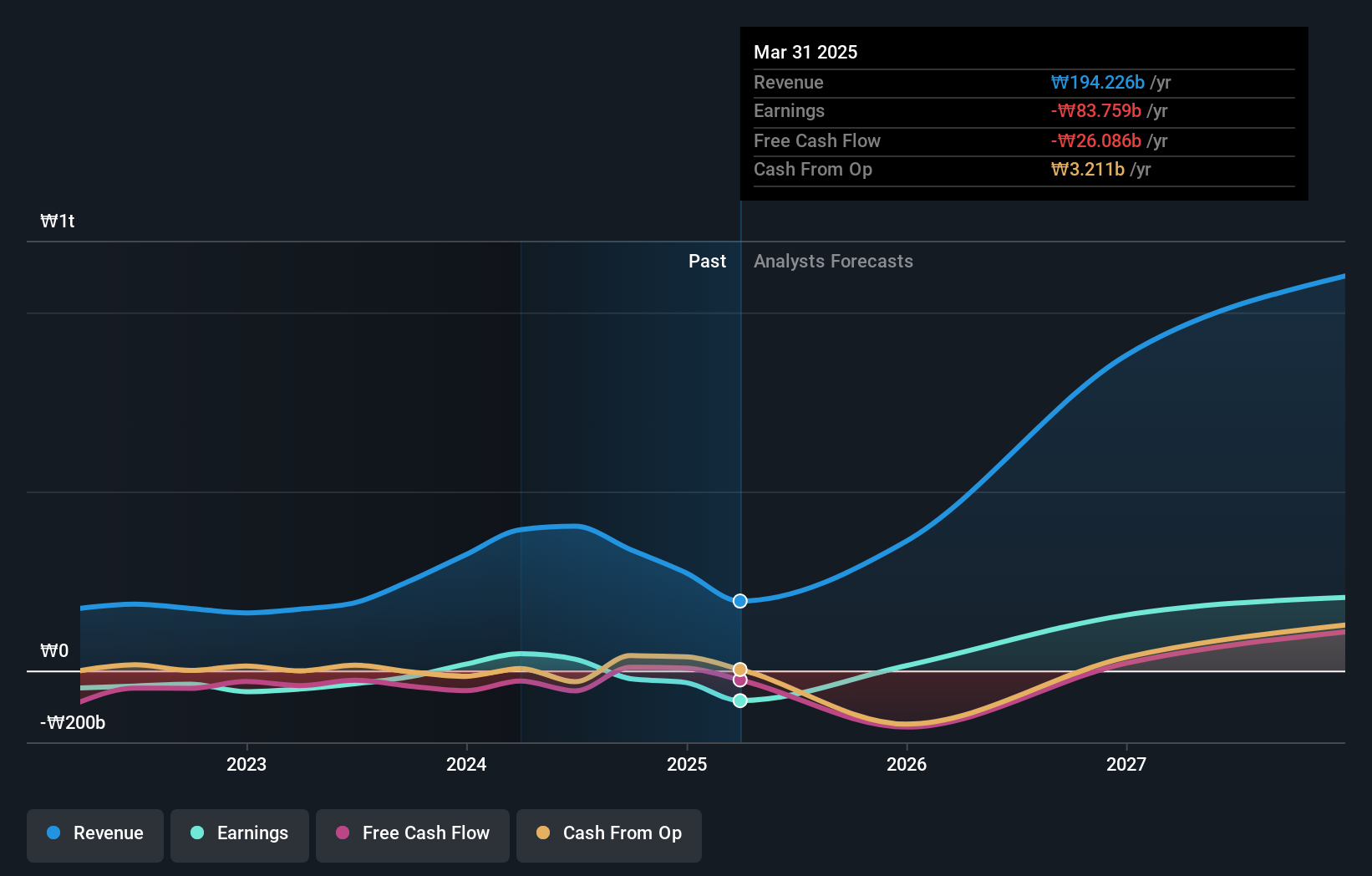

Overview: HYBE Co., Ltd. engages in music production, publishing, artist development, and management businesses with a market cap of ₩7.03 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from music production, publishing, and artist development and management, with significant contributions from its Label (₩1.28 trillion) and Solution (₩1.24 trillion) segments. The company also earns from its Platform segment (₩361.12 billion).

HYBE, amid a dynamic South Korean tech landscape, has demonstrated resilience and strategic foresight with its recent share repurchase initiative aimed at stock price stabilization. The company's R&D investment remains robust, aligning with its 14% annual revenue growth projection and significantly outpacing the market average of 10.5%. Notably, HYBE’s earnings are expected to surge by an impressive 42.2% annually, reflecting a commitment to innovation and market leadership in entertainment technology. This growth is supported by substantial investments in unique content creation and artist management capabilities that cater to global markets, ensuring HYBE remains at the forefront of cultural technology trends.

- Dive into the specifics of HYBE here with our thorough health report.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Taking Advantage

- Delve into our full catalog of 50 KRX High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A035900

JYP Entertainment

Operates as an entertainment company in South Korea and internationally.

Flawless balance sheet with moderate growth potential.