- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A203450

Union Community (KOSDAQ:203450) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Union Community Co., Ltd. (KOSDAQ:203450) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Union Community

What Is Union Community's Net Debt?

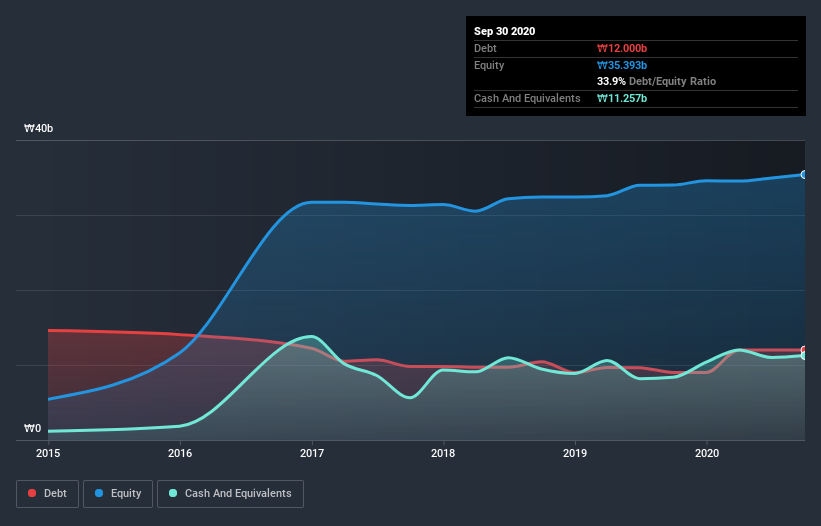

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Union Community had ₩11.6b of debt, an increase on ₩9.00b, over one year. However, because it has a cash reserve of ₩11.3b, its net debt is less, at about ₩299.3m.

A Look At Union Community's Liabilities

We can see from the most recent balance sheet that Union Community had liabilities of ₩17.4b falling due within a year, and liabilities of ₩4.28b due beyond that. Offsetting these obligations, it had cash of ₩11.3b as well as receivables valued at ₩16.2b due within 12 months. So it can boast ₩5.74b more liquid assets than total liabilities.

This surplus suggests that Union Community has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Carrying virtually no net debt, Union Community has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Union Community has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.083 and EBIT of 227 times the interest expense. So relative to past earnings, the debt load seems trivial. In fact Union Community's saving grace is its low debt levels, because its EBIT has tanked 28% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is Union Community's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Union Community recorded free cash flow worth a fulsome 100% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Happily, Union Community's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its EBIT growth rate. When we consider the range of factors above, it looks like Union Community is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 5 warning signs we've spotted with Union Community .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Union Community, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A203450

UNION biometrics

Provides various biometric solutions in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026