- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A203450

Should You Buy Union Community Co., Ltd. (KOSDAQ:203450) For Its Upcoming Dividend?

Union Community Co., Ltd. (KOSDAQ:203450) stock is about to trade ex-dividend in three days. This means that investors who purchase shares on or after the 29th of December will not receive the dividend, which will be paid on the 10th of April.

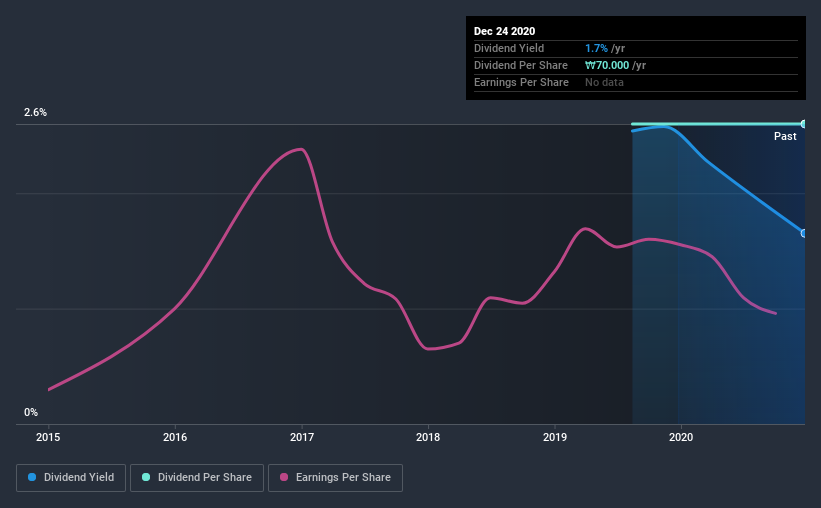

Union Community's next dividend payment will be ₩70.00 per share, on the back of last year when the company paid a total of ₩70.00 to shareholders. Looking at the last 12 months of distributions, Union Community has a trailing yield of approximately 1.7% on its current stock price of ₩4235. If you buy this business for its dividend, you should have an idea of whether Union Community's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Union Community

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. That's why it's good to see Union Community paying out a modest 38% of its earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Thankfully its dividend payments took up just 43% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that Union Community's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Union Community paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Union Community has grown its earnings rapidly, up 26% a year for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. Companies with growing earnings and low payout ratios are often the best long-term dividend stocks, as the company can both grow its earnings and increase the percentage of earnings that it pays out, essentially multiplying the dividend.

Given that Union Community has only been paying a dividend for a year, there's not much of a past history to draw insight from.

To Sum It Up

Is Union Community an attractive dividend stock, or better left on the shelf? Union Community has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. Union Community looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Our analysis shows 4 warning signs for Union Community and you should be aware of these before buying any shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Union Community, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A203450

UNION biometrics

Provides various biometric solutions in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026