- South Korea

- /

- Communications

- /

- KOSDAQ:A189300

KRX Stocks Possibly Trading Below Fair Value Estimates In August 2024

Reviewed by Simply Wall St

The South Korean market has climbed 4.1% in the last 7 days, with a gain of 8.2%, and over the past 12 months, it is up by 5.2%. As earnings are forecast to grow by 28% annually, identifying stocks that may be trading below their fair value could offer significant opportunities for investors looking to capitalize on this growth trend.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Samwha ElectricLtd (KOSE:A009470) | ₩49600.00 | ₩92540.29 | 46.4% |

| APR (KOSE:A278470) | ₩260500.00 | ₩511392.58 | 49.1% |

| VIOL (KOSDAQ:A335890) | ₩9250.00 | ₩17837.47 | 48.1% |

| Rorze Systems (KOSDAQ:A071280) | ₩13570.00 | ₩25728.91 | 47.3% |

| Medy-Tox (KOSDAQ:A086900) | ₩201000.00 | ₩354219.48 | 43.3% |

| TOVISLtd (KOSDAQ:A051360) | ₩20900.00 | ₩39352.45 | 46.9% |

| Global Tax Free (KOSDAQ:A204620) | ₩3945.00 | ₩7004.83 | 43.7% |

| Jeisys Medical (KOSDAQ:A287410) | ₩12920.00 | ₩23694.51 | 45.5% |

| Wonik Ips (KOSDAQ:A240810) | ₩37350.00 | ₩65046.30 | 42.6% |

| ABCO Electronics (KOSDAQ:A036010) | ₩6350.00 | ₩11530.94 | 44.9% |

Let's uncover some gems from our specialized screener.

Intellian Technologies (KOSDAQ:A189300)

Overview: Intellian Technologies, Inc. provides satellite antennas and terminals in South Korea and internationally, with a market cap of ₩560.86 billion.

Operations: Intellian Technologies generates revenue primarily from telecommunication equipment sales amounting to ₩287.35 billion.

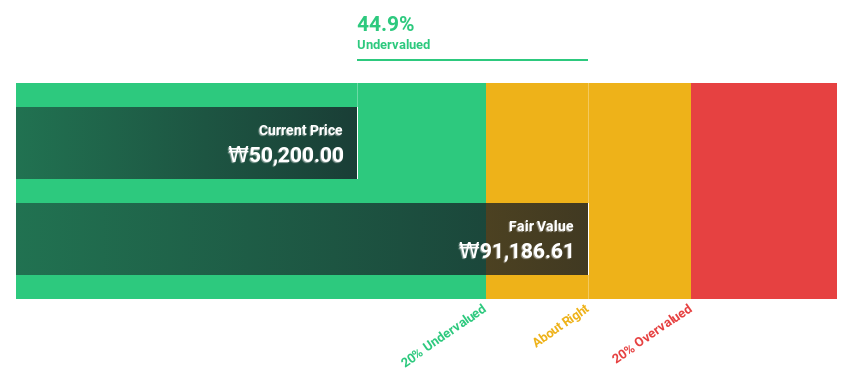

Estimated Discount To Fair Value: 41.4%

Intellian Technologies is trading at ₩53,600, significantly below its estimated fair value of ₩91,420.61. Revenue is projected to grow 30.3% annually, outpacing the KR market's 10.4%. Despite a forecasted low return on equity of 13.6% in three years, earnings are expected to increase by 79.51% per year and become profitable within three years. Recent buybacks totaling KRW 4.99 billion further highlight management's confidence in the stock's potential value.

- Our comprehensive growth report raises the possibility that Intellian Technologies is poised for substantial financial growth.

- Navigate through the intricacies of Intellian Technologies with our comprehensive financial health report here.

HANMI Semiconductor (KOSE:A042700)

Overview: HANMI Semiconductor Co., Ltd. manufactures and sells semiconductor equipment in South Korea and internationally, with a market cap of ₩12.28 trillion.

Operations: The company generates revenue primarily from its semiconductor segment, totaling ₩209.80 billion.

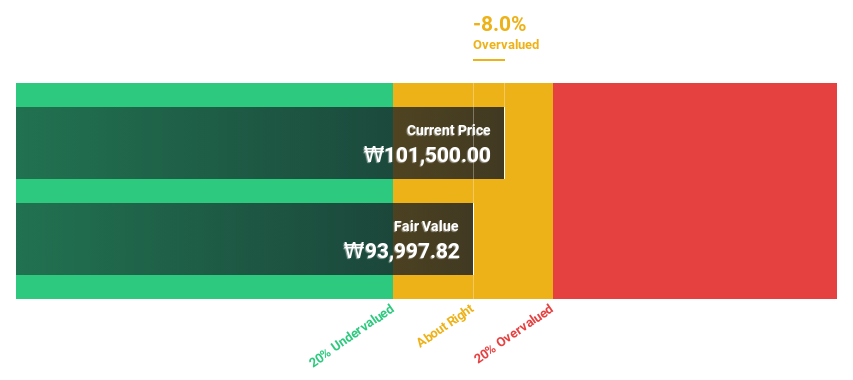

Estimated Discount To Fair Value: 34.7%

HANMI Semiconductor is trading at ₩127,700, well below its estimated fair value of ₩195,485.70. Revenue is forecast to grow 52.6% annually, significantly outpacing the KR market's 10.4%. Earnings are expected to increase by 33.84% per year over the next three years. Recent share buybacks totaling ₩45,354.36 million reflect management's efforts to stabilize stock prices and enhance shareholder value amid high volatility in share price over the past three months.

- Insights from our recent growth report point to a promising forecast for HANMI Semiconductor's business outlook.

- Unlock comprehensive insights into our analysis of HANMI Semiconductor stock in this financial health report.

APR (KOSE:A278470)

Overview: APR Co., Ltd manufactures and sells cosmetic products for men and women, with a market cap of ₩1.99 trillion.

Operations: The company's revenue segments include the manufacture and sale of cosmetic products for both men and women.

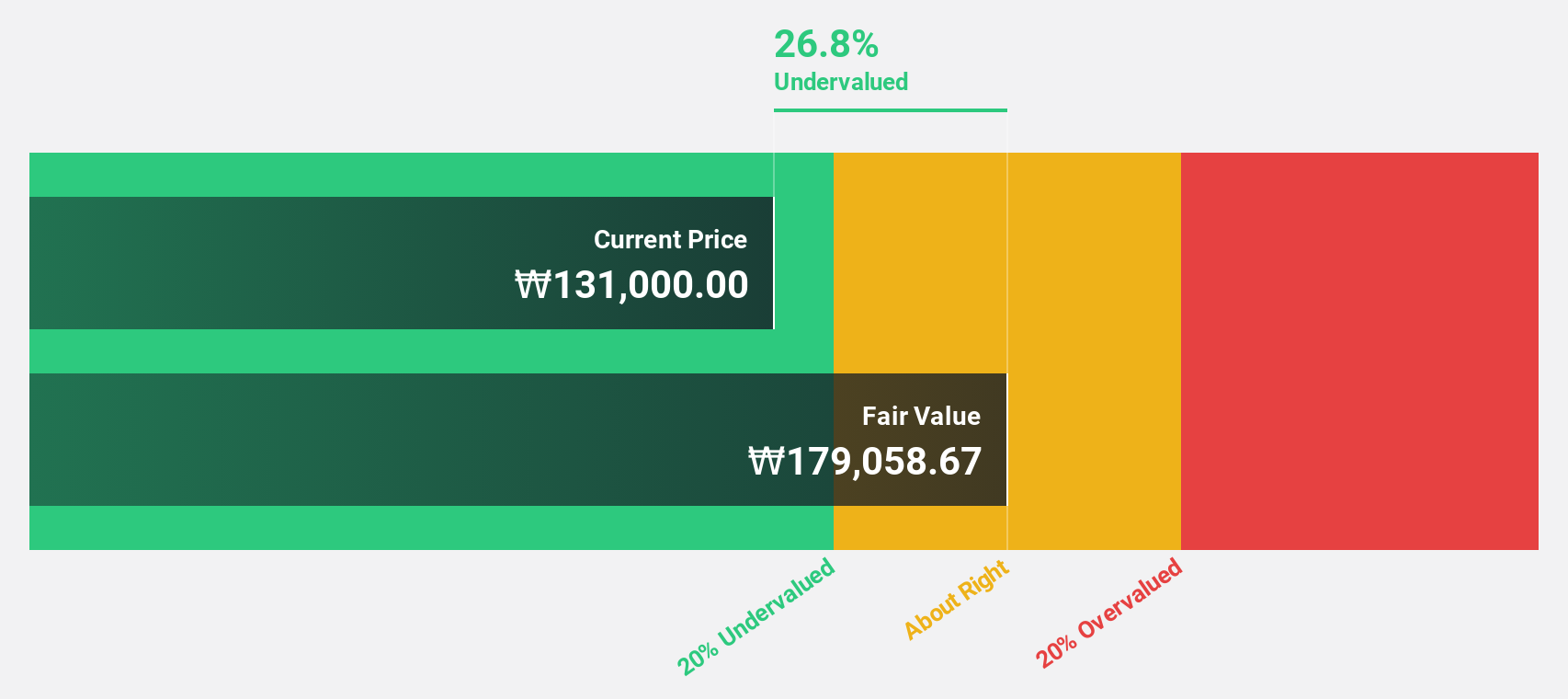

Estimated Discount To Fair Value: 49.1%

APR Co., Ltd. is trading at ₩260,500, significantly below its estimated fair value of ₩511,392.58. Despite high share price volatility over the past three months, earnings grew by 70.2% last year and are forecast to grow 22.62% annually, albeit slower than the KR market's 28.2%. Recent buyback announcements totaling ₩60 billion aim to stabilize stock prices and enhance shareholder value as revenue is expected to grow faster than the market at 20% per year.

- According our earnings growth report, there's an indication that APR might be ready to expand.

- Dive into the specifics of APR here with our thorough financial health report.

Make It Happen

- Unlock our comprehensive list of 38 Undervalued KRX Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A189300

Intellian Technologies

Provides satellite antennas and terminals in South Korea and internationally.

Undervalued with high growth potential.