- South Korea

- /

- Auto Components

- /

- KOSE:A004490

Undiscovered Gems in South Korea to Watch This August 2024

Reviewed by Simply Wall St

The South Korean market has shown promising growth, climbing 1.9% in the last 7 days and 3.8% over the past year, with earnings forecasted to grow by 28% annually. In this favorable environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Ratings | NA | 1.74% | 0.87% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| SELVAS Healthcare | 13.58% | 10.16% | 77.14% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| BIO-FD&CLtd | 2.01% | 8.27% | 22.82% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide, with a market cap of ₩1.16 billion.

Operations: PSK HOLDINGS Inc. generates revenue primarily from its semiconductor manufacturing equipment segment, which contributed ₩117.90 billion.

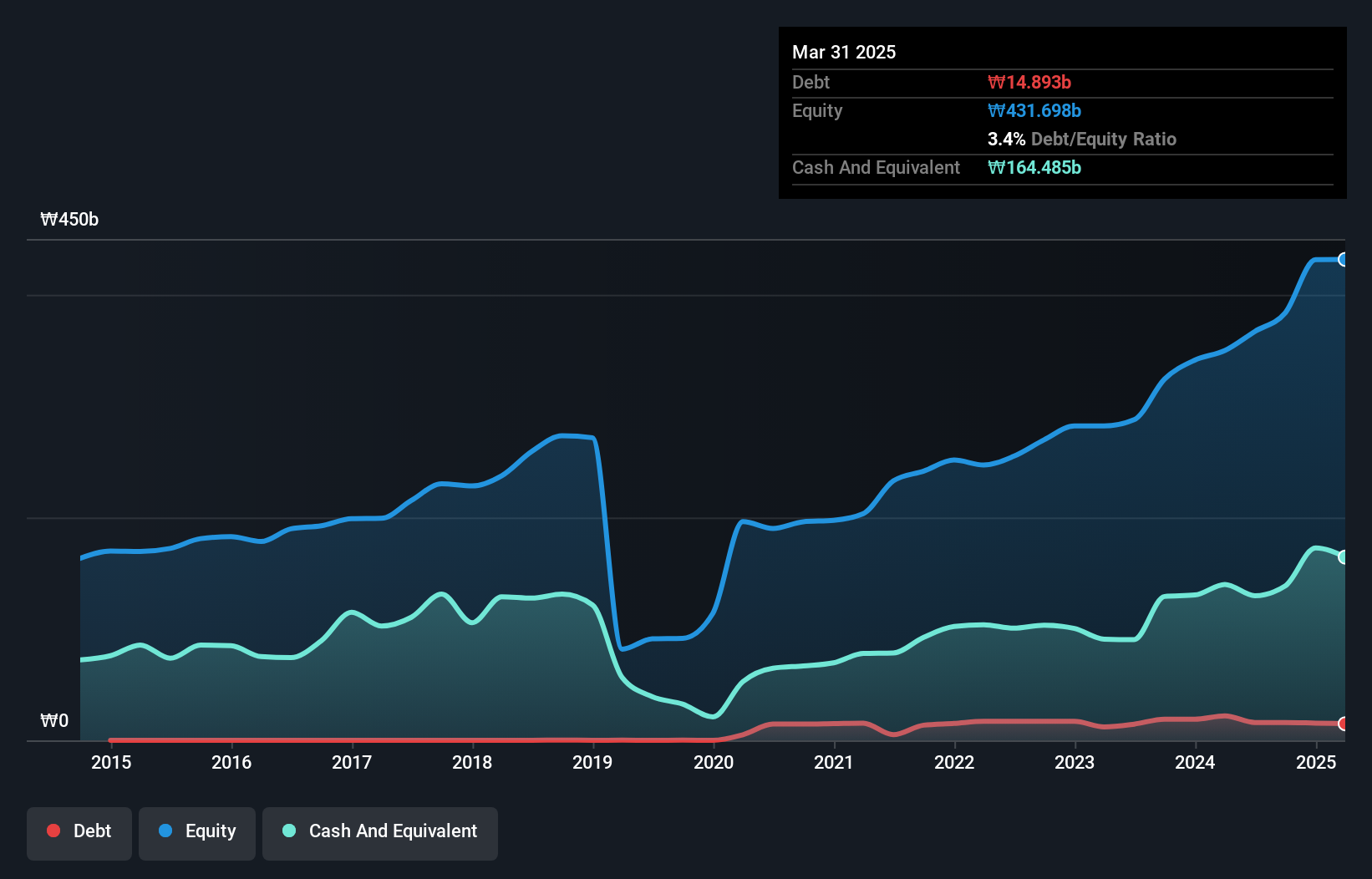

PSK Holdings, a smaller player in South Korea's market, has shown promising growth with earnings up 16.4% over the past year. The company’s debt-to-equity ratio increased from 0.2% to 6.3% in five years, indicating higher leverage but manageable risk due to its greater cash reserves than total debt. A notable one-off gain of ₩18.9B impacted recent financials, highlighting potential volatility yet underscoring strong performance metrics and future growth prospects forecasted at 23.41% annually.

- Delve into the full analysis health report here for a deeper understanding of PSK HOLDINGS.

Explore historical data to track PSK HOLDINGS' performance over time in our Past section.

T&L (KOSDAQ:A340570)

Simply Wall St Value Rating: ★★★★★★

Overview: T&L Co., Ltd. manufactures and sells medical and polymer material products in South Korea, with a market cap of ₩610.24 billion.

Operations: T&L Co., Ltd. generates revenue primarily from its medical products segment, which brought in ₩113.23 billion. The company's market cap stands at ₩610.24 billion.

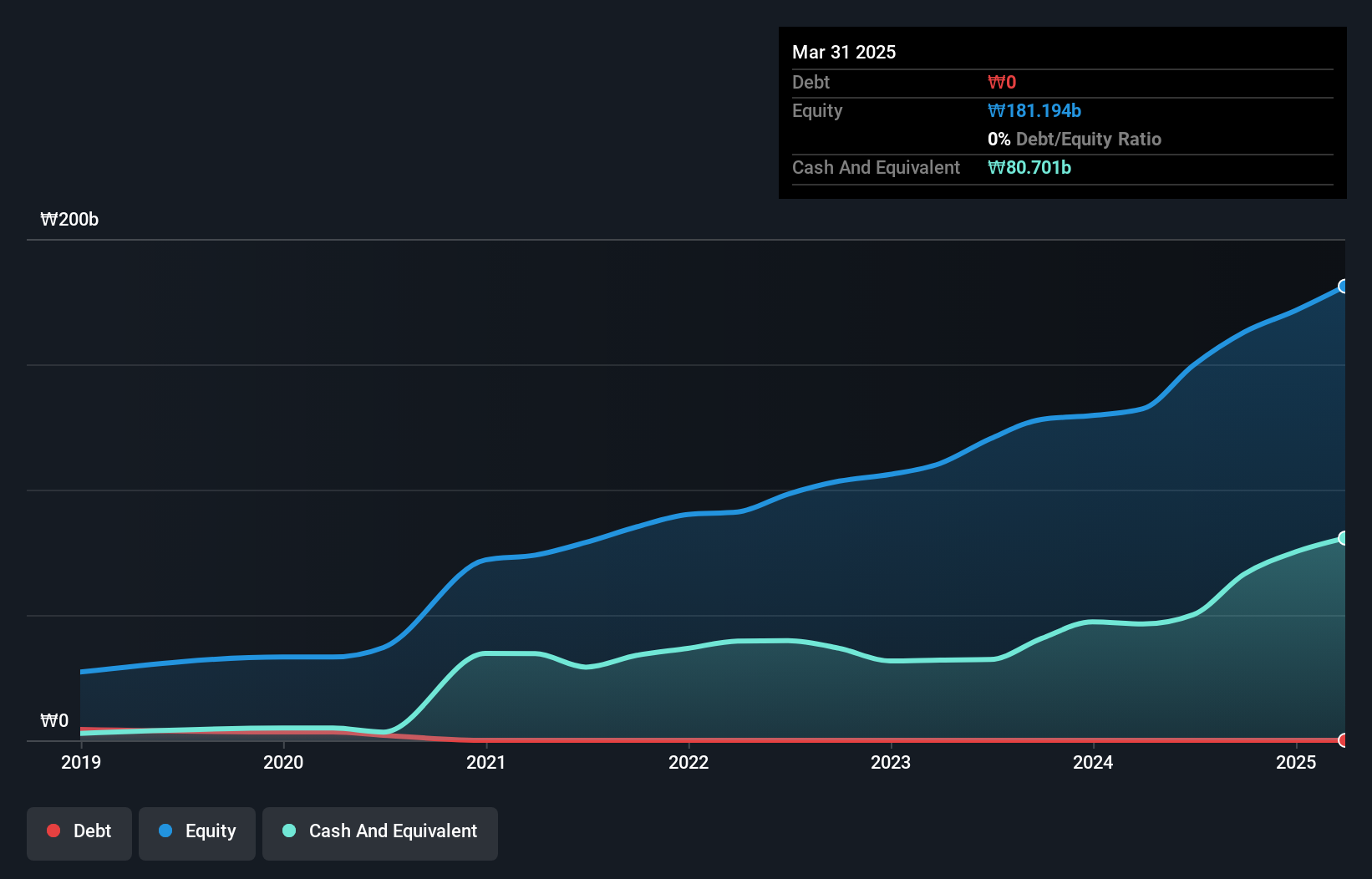

T&L, a promising small-cap in South Korea, has shown impressive financial health. Over the past year, earnings grew by 7.7%, outpacing the Medical Equipment industry’s 3.1%. The company boasts high-quality earnings and is debt-free, a significant improvement from five years ago when its debt to equity ratio was 14.2%. With forecasted annual earnings growth of 34.49%, T&L appears well-positioned for future expansion in its sector.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd., along with its subsidiaries, manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.40 trillion.

Operations: Sebang Global Battery generates revenue primarily from the manufacture and sale of automotive and industrial storage batteries, amounting to ₩1.77 billion. The company's financial performance is influenced by its cost structure and market conditions in both domestic and international markets.

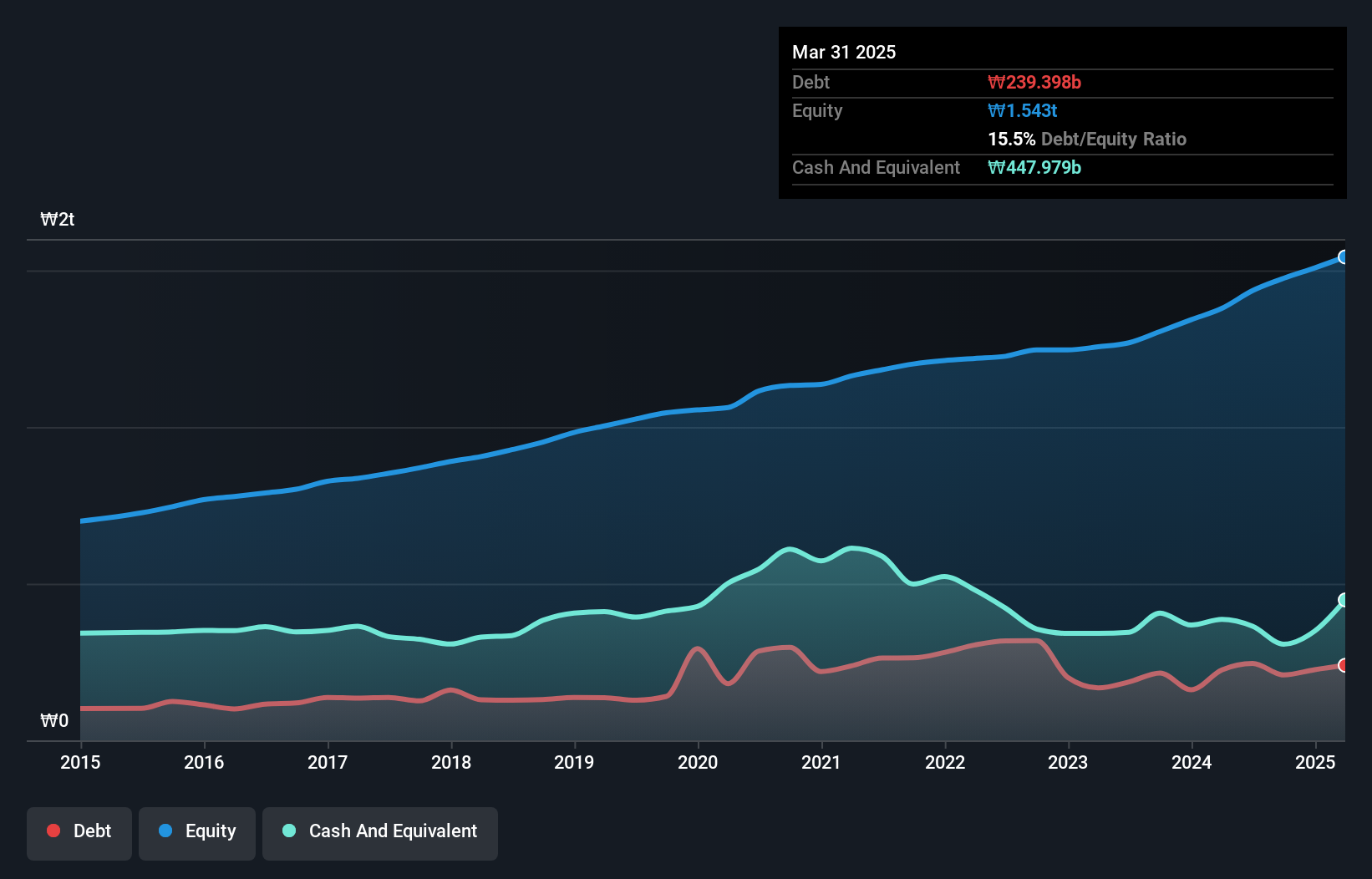

Sebang Global Battery, a smaller player in the battery industry, has shown impressive growth. Earnings surged by 245.4% over the past year, far outpacing the Auto Components industry average of 15.4%. Trading at 22.1% below estimated fair value, it offers a potential bargain for investors. The company is profitable and doesn't face cash runway issues while having more cash than total debt. Notably, its debt to equity ratio increased from 13.6% to 16.3% over five years.

- Click here to discover the nuances of Sebang Global Battery with our detailed analytical health report.

Evaluate Sebang Global Battery's historical performance by accessing our past performance report.

Seize The Opportunity

- Explore the 202 names from our KRX Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004490

Sebang Global Battery

Manufactures and sells lead acid batteries in South Korea and internationally.

Solid track record with excellent balance sheet.