As we enter January 2025, global markets have been marked by volatility, with small-cap stocks underperforming and inflation concerns persisting amid a resilient U.S. labor market and political uncertainties. In this environment, identifying high growth tech stocks requires an understanding of their potential to withstand economic pressures and adapt to evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

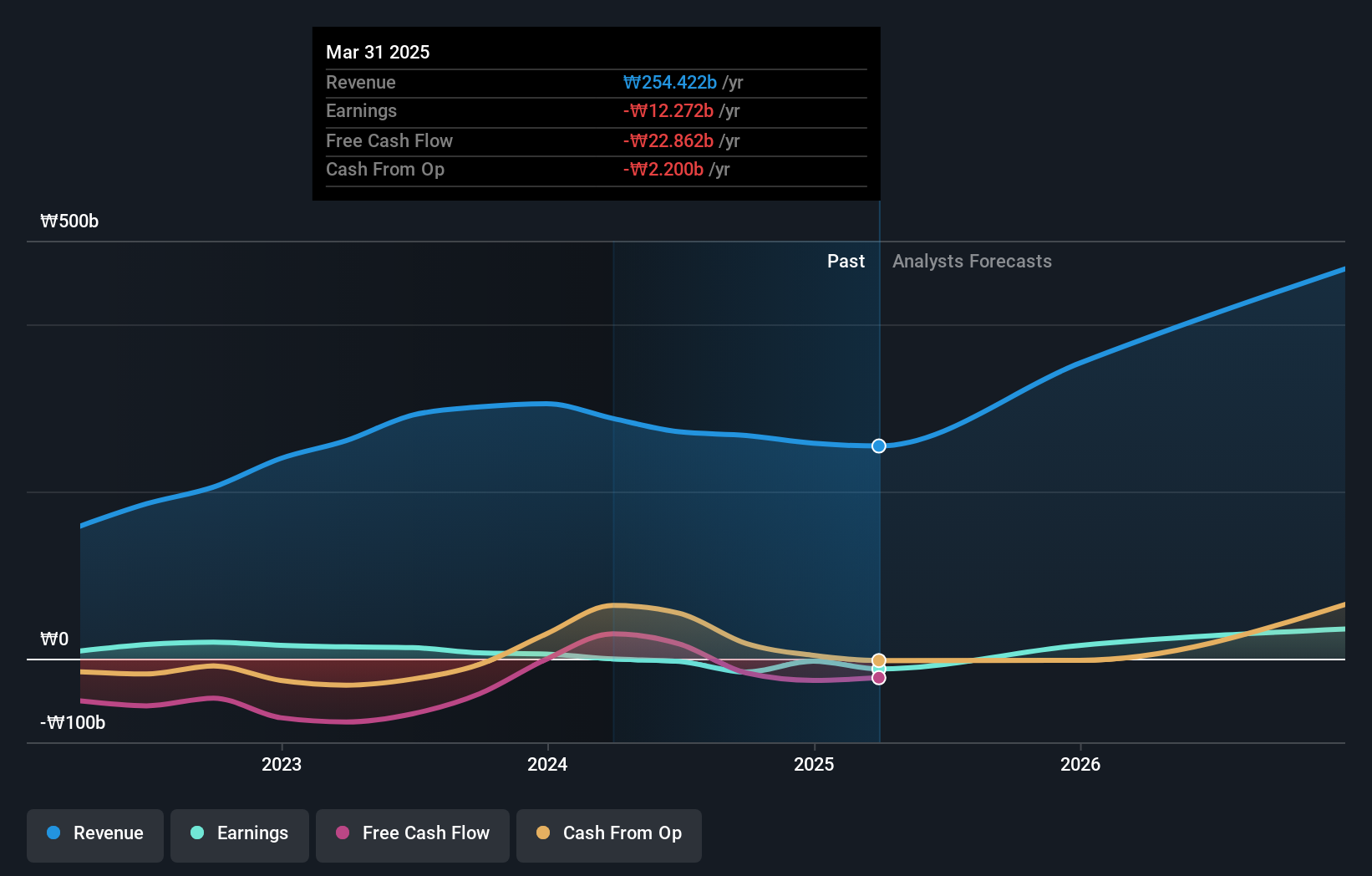

Overview: Intellian Technologies, Inc. is a South Korean company that specializes in providing satellite antennas and terminals both domestically and internationally, with a market cap of ₩404.73 billion.

Operations: The company generates revenue primarily through the sale of telecommunication equipment, amounting to ₩267.04 billion.

Intellian Technologies has demonstrated a robust strategic direction with its recent Telesat contract to supply Gateway Antenna Systems for the Lightspeed LEO constellation, highlighting its capability in high-tech engineering and market adaptability. This deal not only underscores Intellian's innovative approach but also aligns with industry trends towards enhanced satellite communications infrastructure. Furthermore, the company's aggressive move to stabilize its stock price through a KRW 5 billion share repurchase program reflects a proactive stance in shareholder value enhancement. With an anticipated revenue growth of 36.2% per year and earnings poised to surge by 119.1%, Intellian is positioning itself strongly within the tech sector despite current unprofitability and market risks tied to technological and regulatory challenges.

Sun Create Electronics (SHSE:600990)

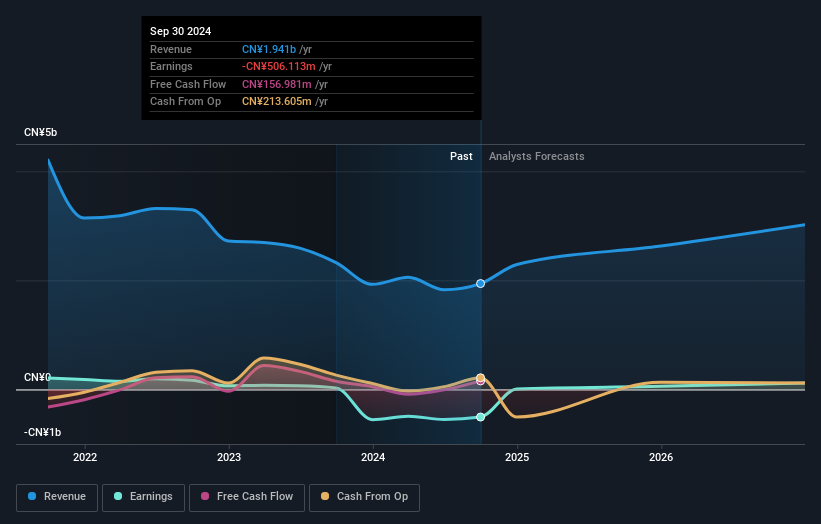

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sun Create Electronics Co., Ltd focuses on the research and development, design, manufacture, and marketing of radar and security systems with a market capitalization of CN¥5.26 billion.

Operations: The company generates revenue primarily from the electronic industry, with reported figures of CN¥1.94 billion. It specializes in radar and security systems, contributing significantly to its financial performance.

Sun Create Electronics, despite a challenging past, is showing signs of a promising turnaround with its recent reduction in net loss to CNY 40.44 million from CNY 87.56 million year-over-year and a slight revenue increase to CNY 1.09 billion. This improvement aligns with an industry trend towards enhanced digital and electronic solutions where Sun Create is actively investing in R&D, crucial for sustaining innovation and competitiveness. The company's engagement in significant corporate activities, including an extraordinary shareholders meeting scheduled for late December, signals strategic shifts possibly aimed at further financial stabilization and growth prospects. With earnings projected to grow by 117.4% annually, Sun Create is positioning itself to capitalize on market opportunities faster than the broader CN market's growth rate of 13.3%. This potential profitability pivot within three years could make it an interesting subject for stakeholders tracking recovery trajectories in tech sectors heavily reliant on evolving technologies and market demands.

- Get an in-depth perspective on Sun Create Electronics' performance by reading our health report here.

Gain insights into Sun Create Electronics' past trends and performance with our Past report.

SoftwareONE Holding (SWX:SWON)

Simply Wall St Growth Rating: ★★★★☆☆

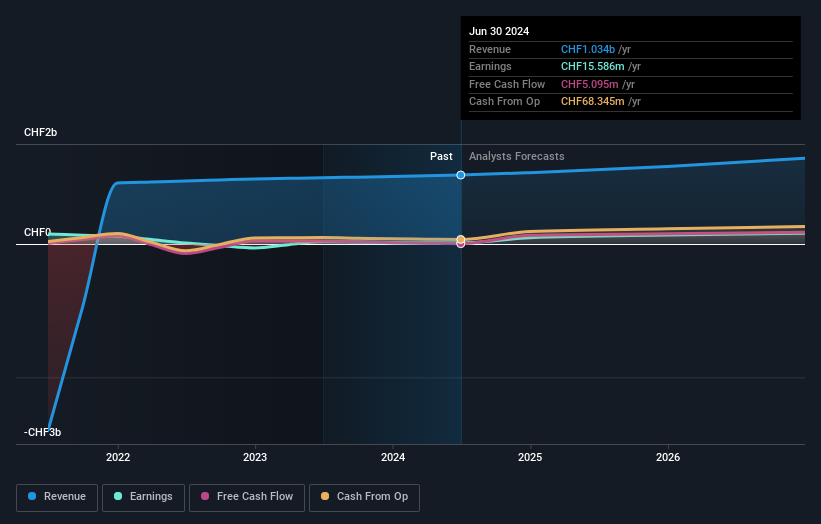

Overview: SoftwareONE Holding AG is a global provider of software and cloud solutions, operating across Switzerland, Europe, the Middle East, Africa, the United States, Canada, Latin America, and the Asia Pacific with a market cap of CHF946.29 million.

Operations: SoftwareONE generates revenue primarily from its regional operations, with significant contributions from EMEA (CHF611.29 million), NORAM (CHF158.45 million), and APAC (CHF148.50 million). The company's diverse geographical presence supports its software and cloud solutions business model across multiple continents.

SoftwareONE Holding's strategic maneuvers, including the anticipated acquisition of Crayon Group, position it as a significant player in the European software reselling market. This move, coupled with an adjusted earnings guidance for 2026 targeting double-digit revenue growth, reflects a robust strategy to enhance market share and financial strength. Particularly noteworthy is SoftwareONE's R&D commitment which remains pivotal; in 2024 alone, R&D expenses accounted for a substantial portion of its revenue, underscoring its dedication to innovation and competitive edge in technology solutions.

- Click here to discover the nuances of SoftwareONE Holding with our detailed analytical health report.

Evaluate SoftwareONE Holding's historical performance by accessing our past performance report.

Where To Now?

- Delve into our full catalog of 1202 High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SWON

SoftwareOne Holding

Provides software and cloud solutions in Switzerland, Germany, Austria, rest of Europe, Mauritius, South Africa, the United States, Canada, Latin America, the Asia Pacific, Dubai, and Qatar.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives