- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A174880

JangWonTech's (KOSDAQ:174880) Stock Price Has Reduced 61% In The Past Year

Even the best stock pickers will make plenty of bad investments. Unfortunately, shareholders of JangWonTech Co., Ltd. (KOSDAQ:174880) have suffered share price declines over the last year. In that relatively short period, the share price has plunged 61%. Notably, shareholders had a tough run over the longer term, too, with a drop of 38% in the last three years. Shareholders have had an even rougher run lately, with the share price down 57% in the last 90 days.

See our latest analysis for JangWonTech

JangWonTech isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

JangWonTech's revenue didn't grow at all in the last year. In fact, it fell 56%. If you think that's a particularly bad result, you're statistically on the money It's no surprise, then, that investors dumped the stock like it was garbage, sending the share price down 61%. Buying shares in companies that lose money, shrink revenue, and see share price declines is unpopular with investors, but popular with speculators (apparently). This company will really need to improve on the numbers before we get excited about it.

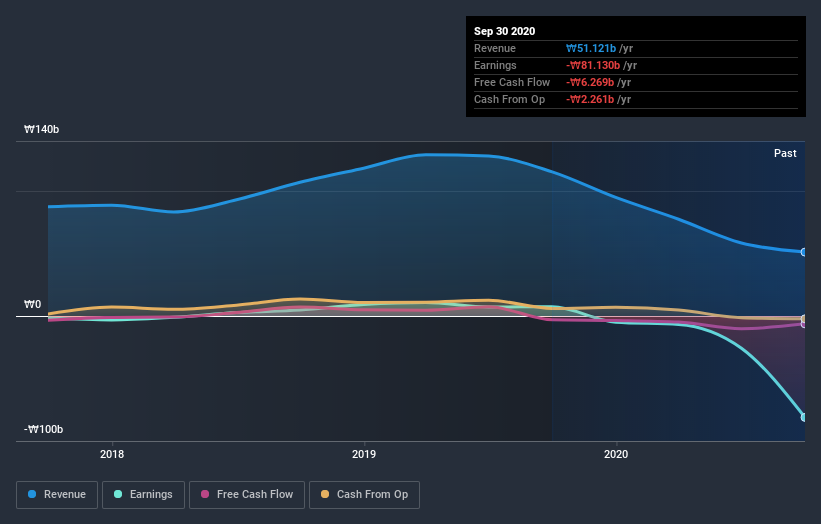

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on JangWonTech's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for JangWonTech shares, which cost holders 61%, while the market was up about 49%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 11% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with JangWonTech (including 2 which don't sit too well with us) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade JangWonTech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A174880

JangWonTech

JangWonTech Co., Ltd. manufactures and sells mobile phone, IT, and automotive components in South Korea, Vietnam, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion