- South Korea

- /

- Communications

- /

- KOSDAQ:A138080

Further weakness as OE Solutions (KOSDAQ:138080) drops 10% this week, taking five-year losses to 68%

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. To wit, the OE Solutions Co., Ltd. (KOSDAQ:138080) share price managed to fall 69% over five long years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 24%. Unfortunately the share price momentum is still quite negative, with prices down 18% in thirty days.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for OE Solutions

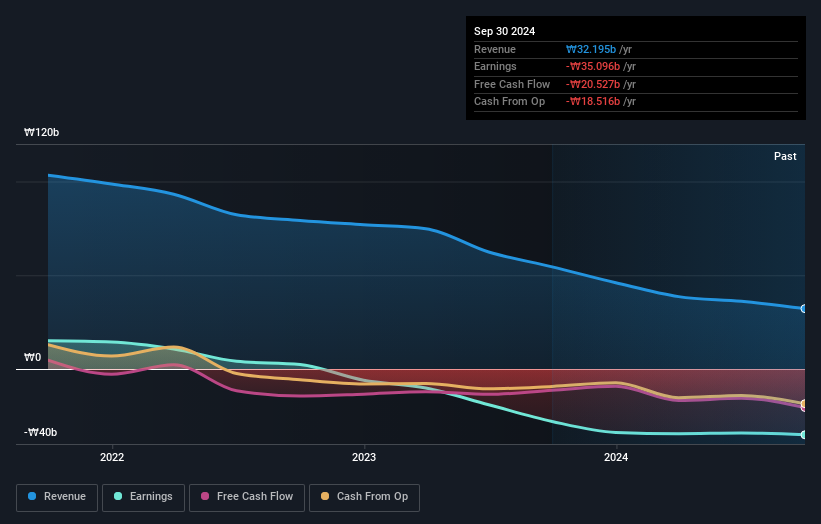

Given that OE Solutions didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last five years OE Solutions saw its revenue shrink by 32% per year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 11% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at OE Solutions' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 6.3% in the twelve months, OE Solutions shareholders did even worse, losing 24% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for OE Solutions you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A138080

OE Solutions

Supplies optoelectronic transceiver solutions for broadband wireless and wireline markets.

Mediocre balance sheet very low.

Market Insights

Community Narratives