- South Korea

- /

- Communications

- /

- KOSDAQ:A138080

Does OE Solutions (KOSDAQ:138080) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies OE Solutions Co., Ltd. (KOSDAQ:138080) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for OE Solutions

What Is OE Solutions's Debt?

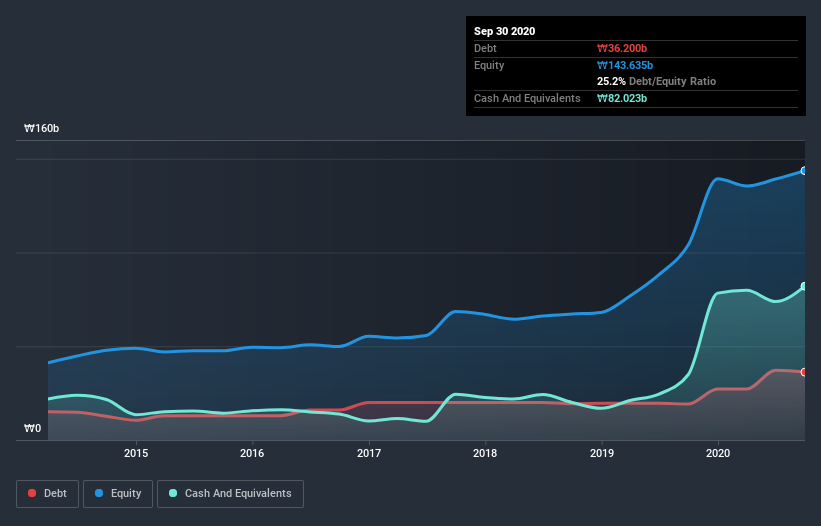

You can click the graphic below for the historical numbers, but it shows that as of September 2020 OE Solutions had ₩36.2b of debt, an increase on ₩19.2b, over one year. However, it does have ₩82.0b in cash offsetting this, leading to net cash of ₩45.8b.

A Look At OE Solutions' Liabilities

We can see from the most recent balance sheet that OE Solutions had liabilities of ₩46.9b falling due within a year, and liabilities of ₩2.33b due beyond that. Offsetting this, it had ₩82.0b in cash and ₩19.7b in receivables that were due within 12 months. So it actually has ₩52.5b more liquid assets than total liabilities.

This short term liquidity is a sign that OE Solutions could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that OE Solutions has more cash than debt is arguably a good indication that it can manage its debt safely.

The modesty of its debt load may become crucial for OE Solutions if management cannot prevent a repeat of the 59% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine OE Solutions's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While OE Solutions has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent two years, OE Solutions recorded free cash flow worth 68% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that OE Solutions has net cash of ₩45.8b, as well as more liquid assets than liabilities. The cherry on top was that in converted 68% of that EBIT to free cash flow, bringing in ₩21b. So we don't have any problem with OE Solutions's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with OE Solutions , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade OE Solutions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A138080

OE Solutions

Supplies optoelectronic transceiver solutions for broadband wireless and wireline markets.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026