- South Korea

- /

- Communications

- /

- KOSDAQ:A138080

Did You Participate In Any Of OE Solutions' (KOSDAQ:138080) Incredible 718% Return?

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held OE Solutions Co., Ltd. (KOSDAQ:138080) shares for the last five years, while they gained 625%. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 19% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 31% in 90 days).

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for OE Solutions

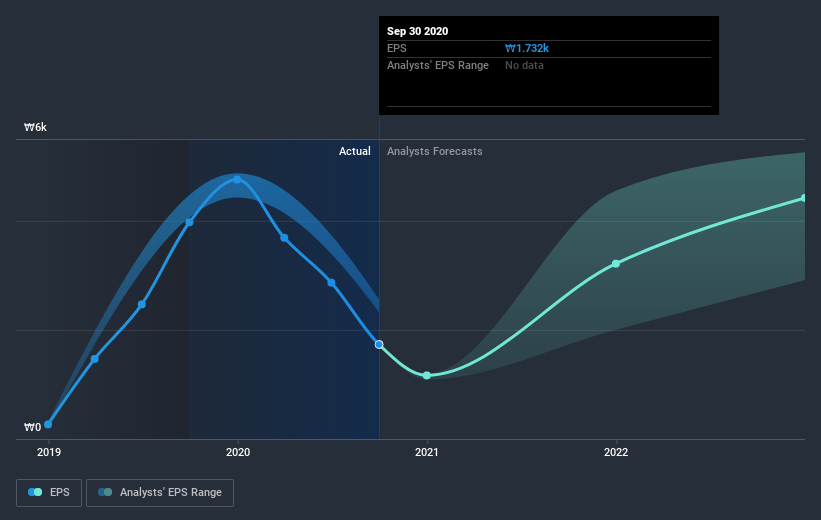

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, OE Solutions managed to grow its earnings per share at 79% a year. The EPS growth is more impressive than the yearly share price gain of 49% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how OE Solutions has grown profits over the years, but the future is more important for shareholders. This free interactive report on OE Solutions' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for OE Solutions the TSR over the last 5 years was 718%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

OE Solutions provided a TSR of 10% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 52% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for OE Solutions that you should be aware of before investing here.

But note: OE Solutions may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade OE Solutions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A138080

OE Solutions

Supplies optoelectronic transceiver solutions for broadband wireless and wireline markets.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026