- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A111870

Is Sambon ElectronicsLtd (KOSDAQ:111870) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Sambon Electronics Co.,Ltd (KOSDAQ:111870) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Sambon ElectronicsLtd

What Is Sambon ElectronicsLtd's Net Debt?

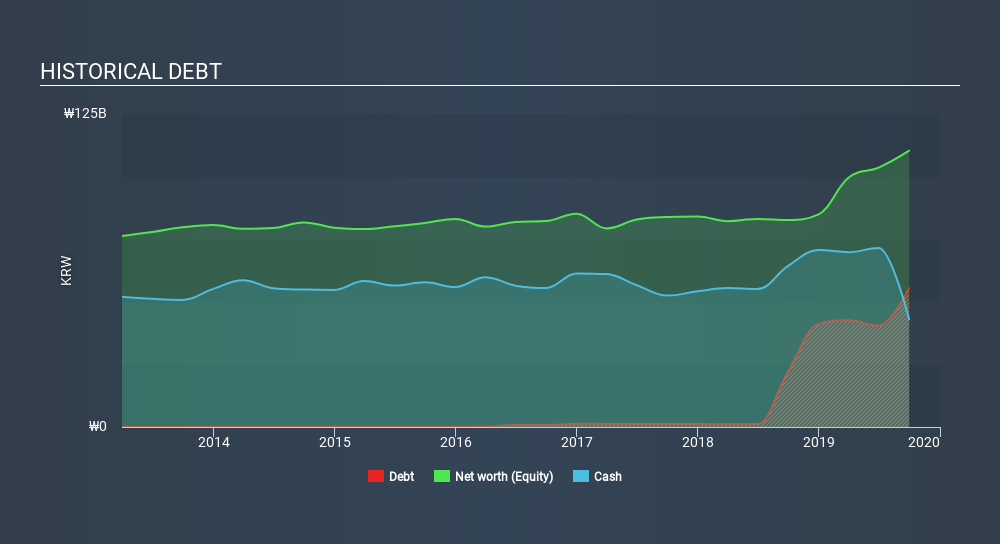

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Sambon ElectronicsLtd had ₩55.5b of debt, an increase on ₩22.1k, over one year. On the flip side, it has ₩43.0b in cash leading to net debt of about ₩12.5b.

How Strong Is Sambon ElectronicsLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Sambon ElectronicsLtd had liabilities of ₩61.3b due within 12 months and liabilities of ₩4.18b due beyond that. Offsetting these obligations, it had cash of ₩43.0b as well as receivables valued at ₩14.5b due within 12 months. So it has liabilities totalling ₩7.98b more than its cash and near-term receivables, combined.

Given Sambon ElectronicsLtd has a market capitalization of ₩172.5b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Sambon ElectronicsLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Sambon ElectronicsLtd saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months Sambon ElectronicsLtd produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at ₩385m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of ₩15b and the profit of ₩4.2b. So if we focus on those metrics there seems to be a chance the company will manage its debt without much trouble. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Sambon ElectronicsLtd is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KOSDAQ:A111870

KH ElectronLtd

KH Electron Co.,Ltd produces and sells devices for earphones and headphones in South Korea.

Imperfect balance sheet with weak fundamentals.

Market Insights

Community Narratives