- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A094840

Suprema HQ (KOSDAQ:094840) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

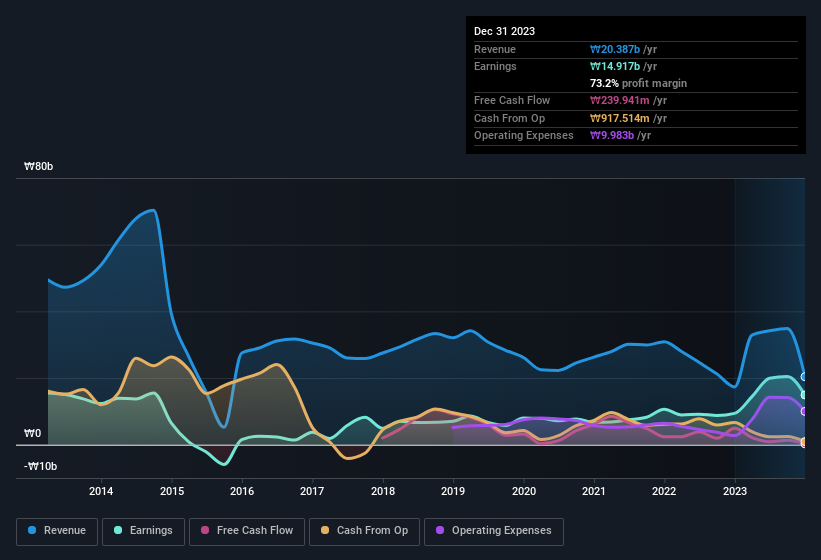

Suprema HQ Inc.'s (KOSDAQ:094840) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for Suprema HQ

How Do Unusual Items Influence Profit?

To properly understand Suprema HQ's profit results, we need to consider the ₩13b gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Suprema HQ had a rather significant contribution from unusual items relative to its profit to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Suprema HQ.

Our Take On Suprema HQ's Profit Performance

As we discussed above, we think the significant positive unusual item makes Suprema HQ's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Suprema HQ's underlying earnings power is lower than its statutory profit. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 3 warning signs with Suprema HQ, and understanding these should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Suprema HQ's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A094840

Suprema HQ

Manufactures and sells of access control, time and attendance, and biometrics solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion