- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A092460

Hanla IMS Co., Ltd.'s (KOSDAQ:092460) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Hanla IMS' (KOSDAQ:092460) stock up by 2.1% over the past three months. Given that the stock prices usually follow long-term business performance, we wonder if the company's mixed financials could have any adverse effect on its current price price movement In this article, we decided to focus on Hanla IMS' ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Hanla IMS

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hanla IMS is:

4.7% = ₩3.8b ÷ ₩81b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.05 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Hanla IMS' Earnings Growth And 4.7% ROE

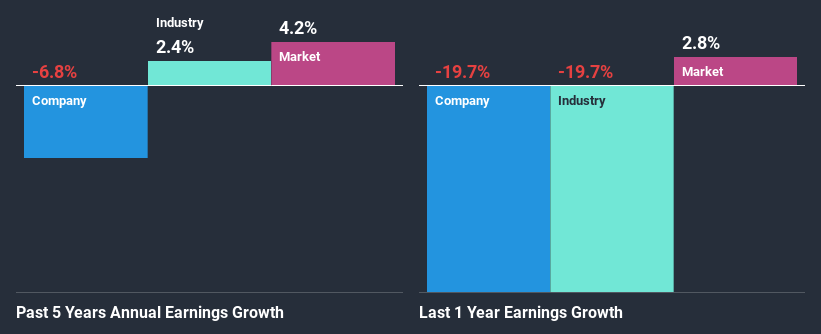

It is quite clear that Hanla IMS' ROE is rather low. A comparison with the industry shows that the company's ROE is pretty similar to the average industry ROE of 5.4%. Given the circumstances, the significant decline in net income by 6.8% seen by Hanla IMS over the last five years is not surprising.

However, when we compared Hanla IMS' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 2.4% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Hanla IMS fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hanla IMS Using Its Retained Earnings Effectively?

Despite having a normal three-year median payout ratio of 30% (where it is retaining 70% of its profits), Hanla IMS has seen a decline in earnings as we saw above. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Additionally, Hanla IMS has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

On the whole, we feel that the performance shown by Hanla IMS can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 4 risks we have identified for Hanla IMS visit our risks dashboard for free.

When trading Hanla IMS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanla IMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A092460

Hanla IMS

Provides integrated systems in South Korea, Singapore, China, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives