- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A089010

Is CHEMTRONICS.CO.Ltd (KOSDAQ:089010) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CHEMTRONICS.CO.,Ltd. (KOSDAQ:089010) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CHEMTRONICS.CO.Ltd

What Is CHEMTRONICS.CO.Ltd's Net Debt?

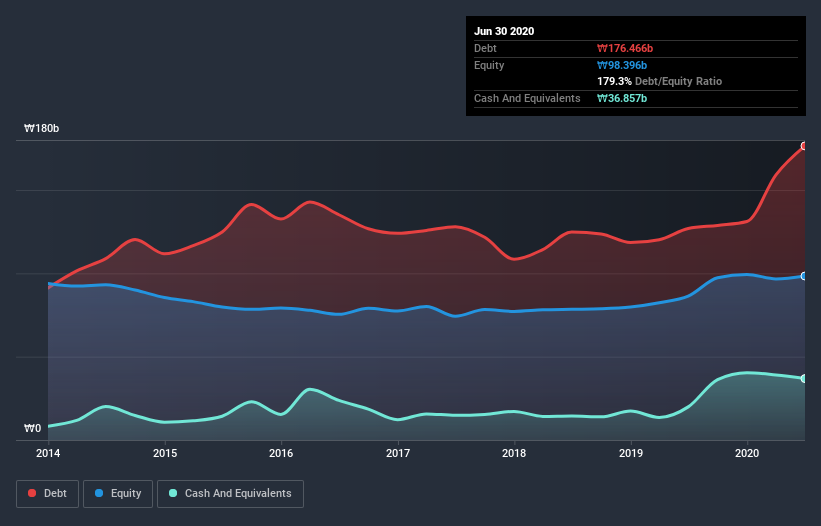

The image below, which you can click on for greater detail, shows that at June 2020 CHEMTRONICS.CO.Ltd had debt of ₩176.5b, up from ₩128.7b in one year. However, it does have ₩36.9b in cash offsetting this, leading to net debt of about ₩139.6b.

How Healthy Is CHEMTRONICS.CO.Ltd's Balance Sheet?

The latest balance sheet data shows that CHEMTRONICS.CO.Ltd had liabilities of ₩197.7b due within a year, and liabilities of ₩46.3b falling due after that. Offsetting these obligations, it had cash of ₩36.9b as well as receivables valued at ₩54.5b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩152.6b.

This deficit is considerable relative to its market capitalization of ₩253.9b, so it does suggest shareholders should keep an eye on CHEMTRONICS.CO.Ltd's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CHEMTRONICS.CO.Ltd's debt is 3.2 times its EBITDA, and its EBIT cover its interest expense 4.6 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, CHEMTRONICS.CO.Ltd's EBIT launched higher than Elon Musk, gaining a whopping 115% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CHEMTRONICS.CO.Ltd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last two years, CHEMTRONICS.CO.Ltd burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Neither CHEMTRONICS.CO.Ltd's ability to convert EBIT to free cash flow nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that CHEMTRONICS.CO.Ltd is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for CHEMTRONICS.CO.Ltd you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading CHEMTRONICS.CO.Ltd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A089010

CHEMTRONICS.Co.Ltd

Engages in the manufacture and sale of electronic parts and chemicals in South Korea and internationally.

High growth potential and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion