- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A089010

Investors Appear Satisfied With CHEMTRONICS.Co.,Ltd.'s (KOSDAQ:089010) Prospects As Shares Rocket 31%

Despite an already strong run, CHEMTRONICS.Co.,Ltd. (KOSDAQ:089010) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

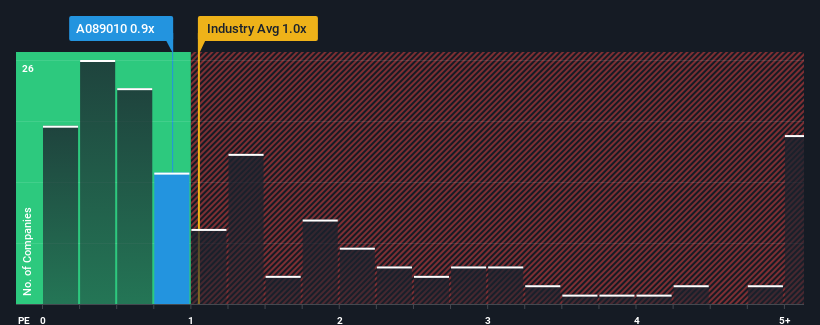

Although its price has surged higher, there still wouldn't be many who think CHEMTRONICS.Co.Ltd's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in Korea's Electronic industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for CHEMTRONICS.Co.Ltd

How Has CHEMTRONICS.Co.Ltd Performed Recently?

While the industry has experienced revenue growth lately, CHEMTRONICS.Co.Ltd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on CHEMTRONICS.Co.Ltd will help you uncover what's on the horizon.How Is CHEMTRONICS.Co.Ltd's Revenue Growth Trending?

CHEMTRONICS.Co.Ltd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 5.4% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 14% as estimated by the lone analyst watching the company. With the industry predicted to deliver 14% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that CHEMTRONICS.Co.Ltd's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now CHEMTRONICS.Co.Ltd's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A CHEMTRONICS.Co.Ltd's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electronic industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 4 warning signs for CHEMTRONICS.Co.Ltd (3 can't be ignored!) that we have uncovered.

If you're unsure about the strength of CHEMTRONICS.Co.Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A089010

CHEMTRONICS.Co.Ltd

Engages in the manufacture and sale of electronic parts and chemicals in South Korea and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives