- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A088130

Dong A Eltek Co., Ltd. (KOSDAQ:088130) Soars 26% But It's A Story Of Risk Vs Reward

Dong A Eltek Co., Ltd. (KOSDAQ:088130) shares have continued their recent momentum with a 26% gain in the last month alone. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

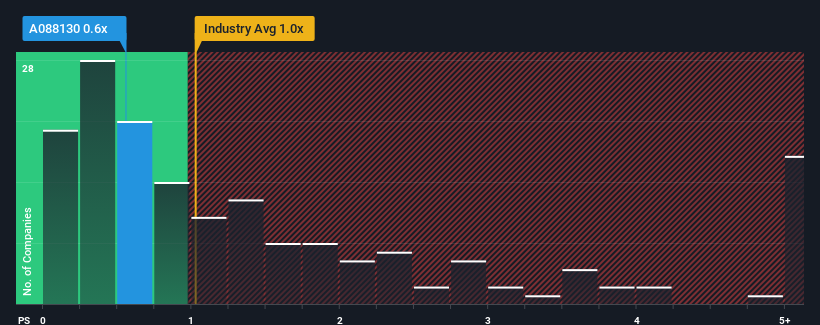

In spite of the firm bounce in price, it's still not a stretch to say that Dong A Eltek's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Electronic industry in Korea, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Dong A Eltek

What Does Dong A Eltek's Recent Performance Look Like?

Dong A Eltek hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dong A Eltek.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Dong A Eltek's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 20% per annum during the coming three years according to the lone analyst following the company. With the industry only predicted to deliver 15% per annum, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Dong A Eltek is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Dong A Eltek's P/S Mean For Investors?

Dong A Eltek's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Dong A Eltek currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Dong A Eltek (of which 1 is a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A088130

Dong A Eltek

Manufactures and sells display equipment in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026