- South Korea

- /

- Entertainment

- /

- KOSE:A352820

KRX Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 2.3%, contributing to a 5.0% increase over the past 12 months, with earnings forecasted to grow by 29% annually. In this favorable environment, identifying growth companies with high insider ownership can provide valuable insights into potential investment opportunities.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

We'll examine a selection from our screener results.

JYP Entertainment (KOSDAQ:A035900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JYP Entertainment Corporation operates as an entertainment company in South Korea and internationally, with a market cap of approximately ₩1.67 trillion.

Operations: The company's revenue segments include ₩456.35 billion from entertainment, ₩12.07 billion from music publishing, and ₩60.51 billion from distribution and sales.

Insider Ownership: 17%

Revenue Growth Forecast: 11.4% p.a.

JYP Entertainment is a growth company with high insider ownership, expected to see significant annual profit growth of 22.65% over the next three years. Despite this, its revenue growth forecast of 11.4% per year lags behind the broader South Korean market's earnings growth rate of 29.3%. Trading at 55.9% below its estimated fair value, JYP presents a potential investment opportunity but faces challenges with declining profit margins from 21.4% to 13.5%.

- Navigate through the intricacies of JYP Entertainment with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that JYP Entertainment is trading behind its estimated value.

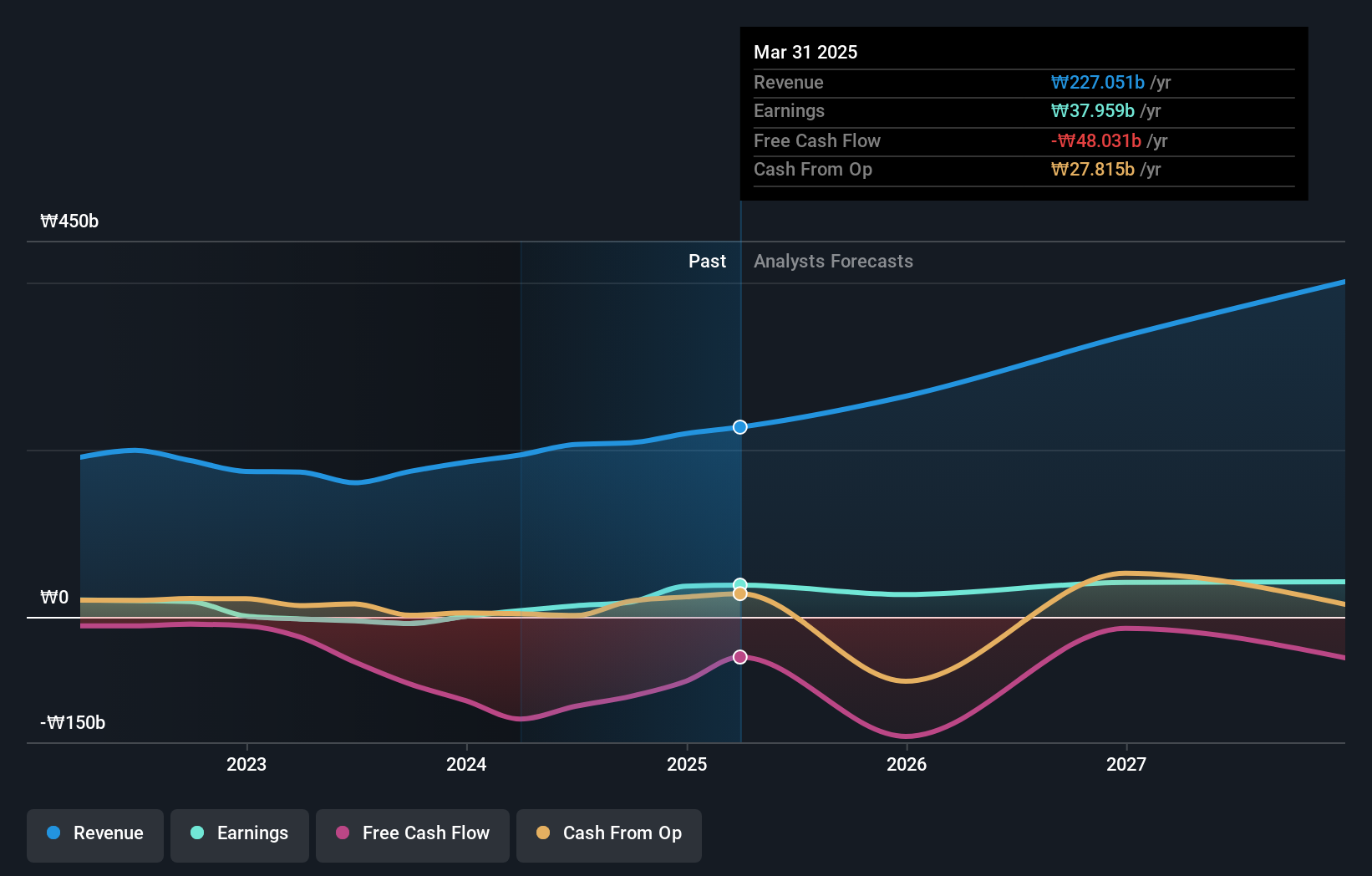

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across multiple regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.68 trillion.

Operations: The company's revenue from the development, production, and sale of electrical and electronic components is ₩206.32 billion.

Insider Ownership: 28.5%

Revenue Growth Forecast: 42.2% p.a.

Daejoo Electronic Materials has shown significant earnings growth, reporting a net income of KRW 12.21 billion for the first half of 2024, compared to a net loss last year. The company's revenue is forecast to grow at 42.2% per year, outpacing the South Korean market's average. However, it faces challenges with highly volatile share prices and debt not well covered by operating cash flow. Despite these issues, its return on equity is expected to reach 26% in three years.

- Click here to discover the nuances of Daejoo Electronic Materials with our detailed analytical future growth report.

- Our expertly prepared valuation report Daejoo Electronic Materials implies its share price may be too high.

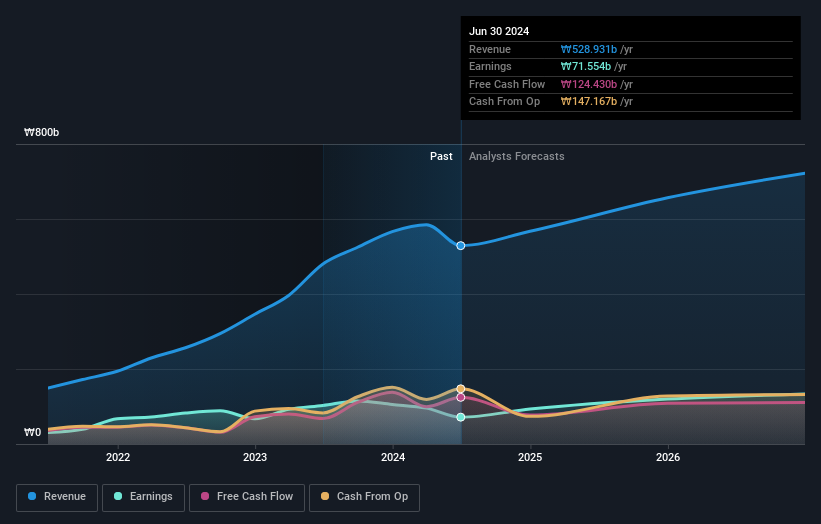

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩7.03 trillion.

Operations: HYBE Co., Ltd. generates revenue from three primary segments: Label (₩1.28 trillion), Platform (₩361.12 billion), and Solution (₩1.24 trillion).

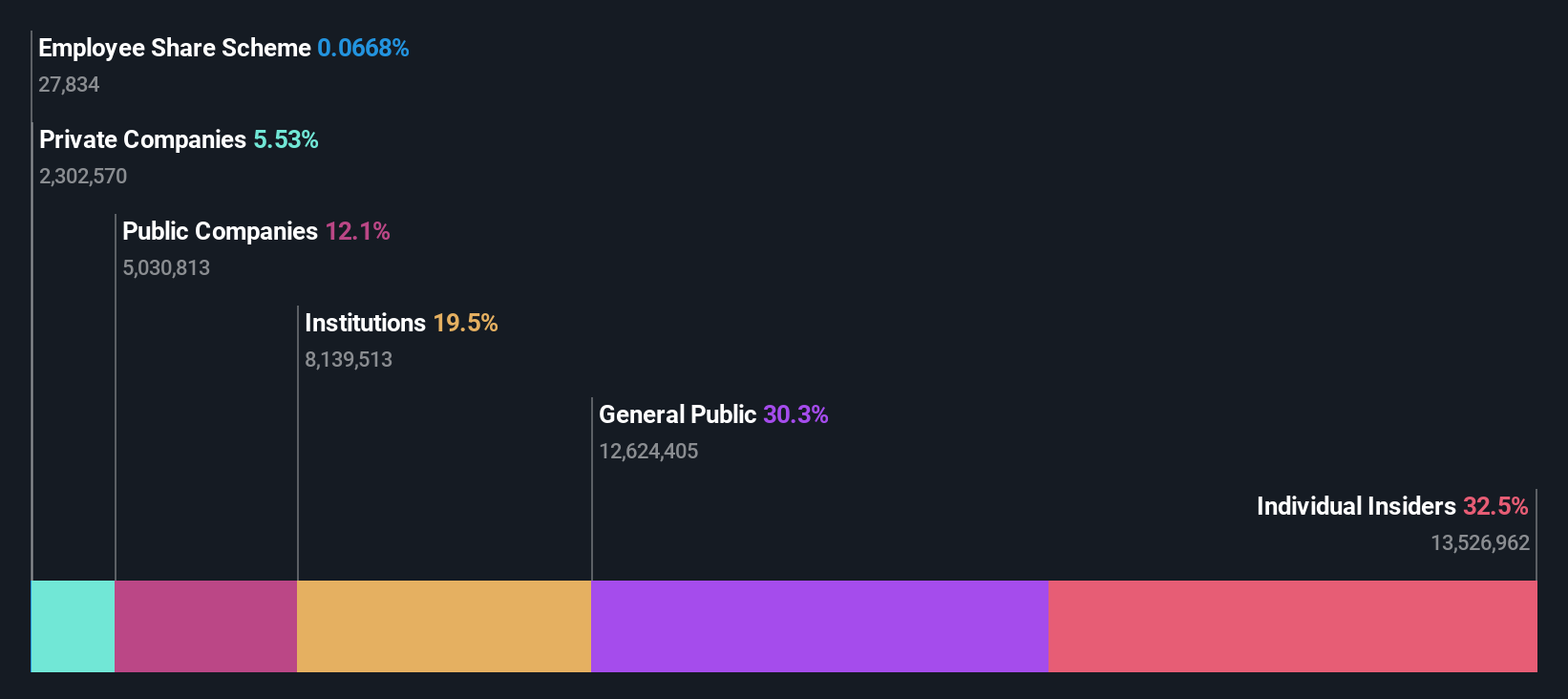

Insider Ownership: 32.5%

Revenue Growth Forecast: 14.0% p.a.

HYBE Co., Ltd. has demonstrated strong growth potential with forecasted revenue growth of 14% per year, exceeding the South Korean market average. Despite a recent decline in net income to KRW 14.59 million for Q2 2024, earnings are expected to grow significantly at 42.23% annually over the next three years. The company recently completed a share buyback program worth KRW 26,092.38 million, indicating confidence in its stock value and commitment to price stabilization.

- Click here and access our complete growth analysis report to understand the dynamics of HYBE.

- Insights from our recent valuation report point to the potential undervaluation of HYBE shares in the market.

Where To Now?

- Reveal the 88 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.