- South Korea

- /

- Packaging

- /

- KOSE:A014820

Undiscovered Gems In South Korea Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The South Korean market has climbed 2.3% in the last 7 days and is up 5.0% over the past 12 months, with earnings expected to grow by 29% per annum over the next few years. In this promising environment, identifying small-cap stocks with strong growth potential can offer significant opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

People & Technology (KOSDAQ:A137400)

Simply Wall St Value Rating: ★★★★★★

Overview: People & Technology Inc. specializes in providing coating, calendaring, slitting, automation, and other machinery services with a market cap of ₩1.30 billion.

Operations: People & Technology Inc. generates revenue primarily from machinery and industrial equipment, amounting to ₩792.60 million. The company's market cap stands at ₩1.30 billion.

People & Technology, a small cap in South Korea, has shown impressive earnings growth of 50.9% over the past year, outpacing the Machinery industry’s 5.4%. Trading at 56.5% below its estimated fair value, it seems undervalued. The company's net debt to equity ratio stands at a satisfactory 19.4%, and its interest payments are well covered by EBIT with a coverage of 30.3x. However, shareholders experienced dilution in the past year despite these positive indicators.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. develops, manufactures, and sells PCB automation equipment in South Korea and internationally, with a market cap of ₩699.74 billion.

Operations: Taesung Ltd. generates revenue primarily from manufacturing and selling PCB automation equipment, amounting to ₩45.68 billion.

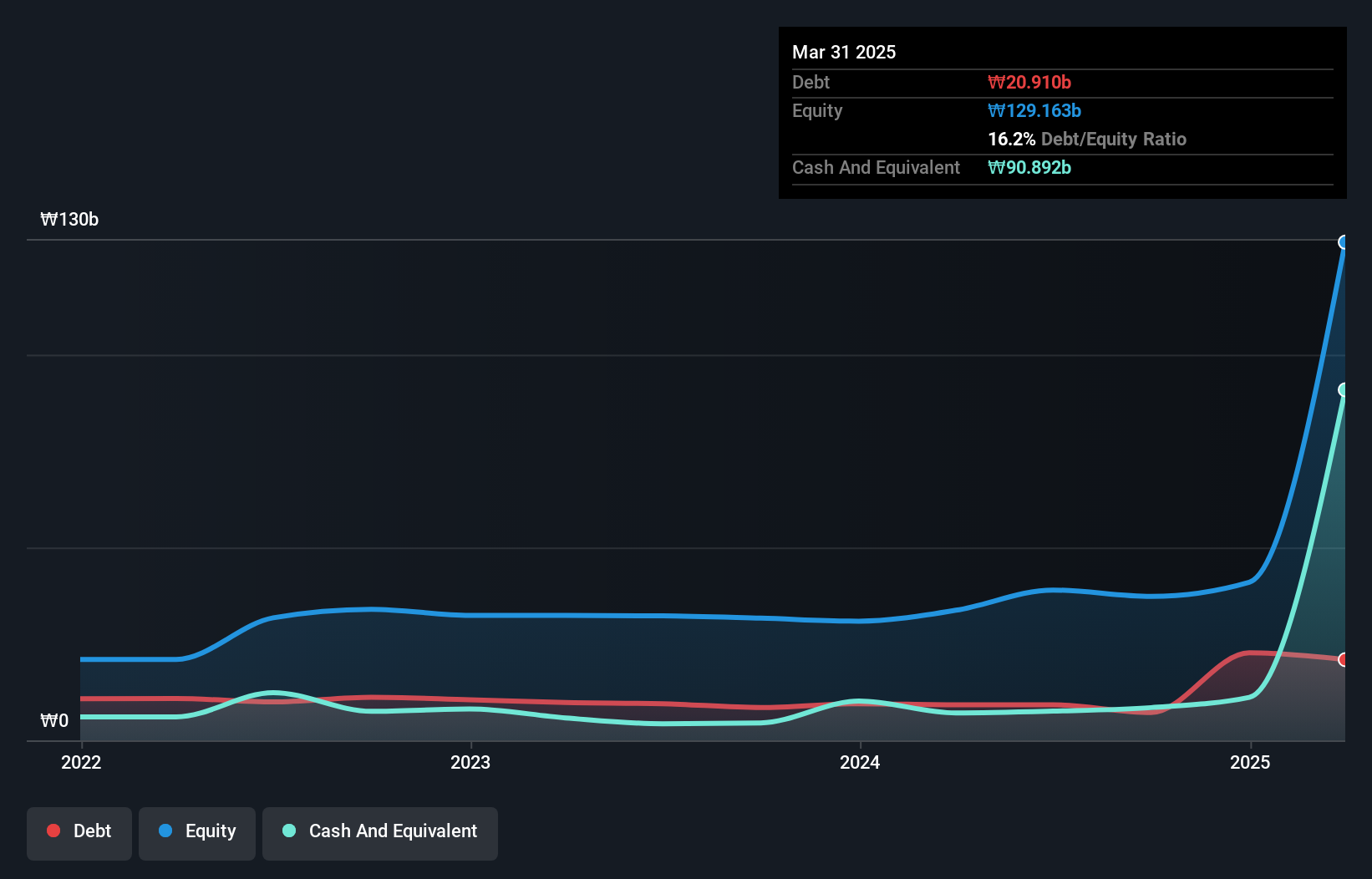

Taesung Ltd. has shown impressive performance, with earnings growth of 1482% over the past year, significantly outpacing the semiconductor industry’s -10%. The company’s net debt to equity ratio stands at a satisfactory 4.2%, and its interest payments are well covered by EBIT at 17.5 times. Recently added to the S&P Global BMI Index, Taesung's high-quality earnings and profitability make it an intriguing prospect despite its volatile share price in recent months.

- Take a closer look at TaesungLtd's potential here in our health report.

Explore historical data to track TaesungLtd's performance over time in our Past section.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongwon Systems Corporation is a South Korean company that manufactures and markets packaging materials, with a market cap of ₩1.28 billion.

Operations: The company's revenue from its packaging business is ₩1.27 billion.

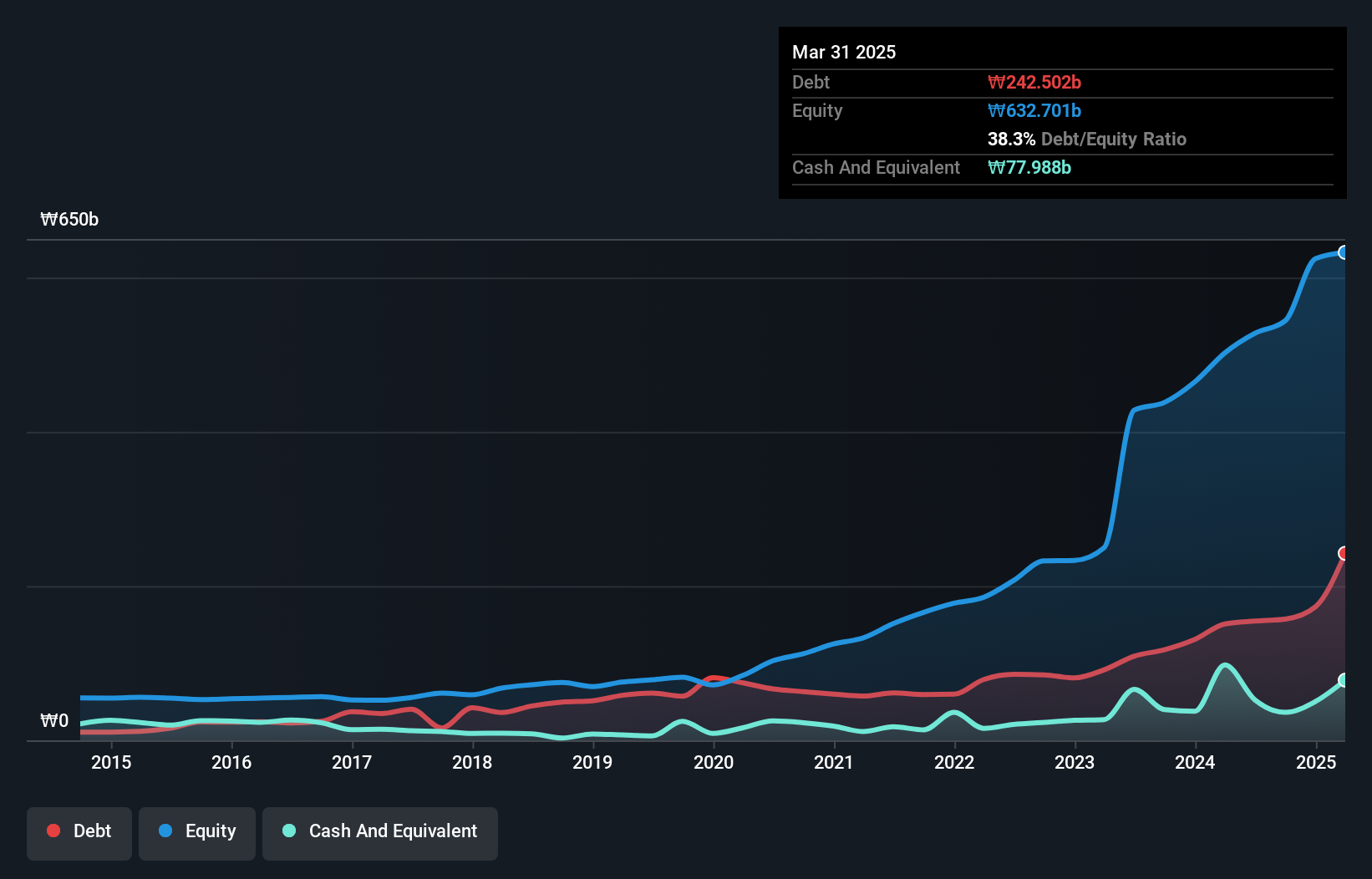

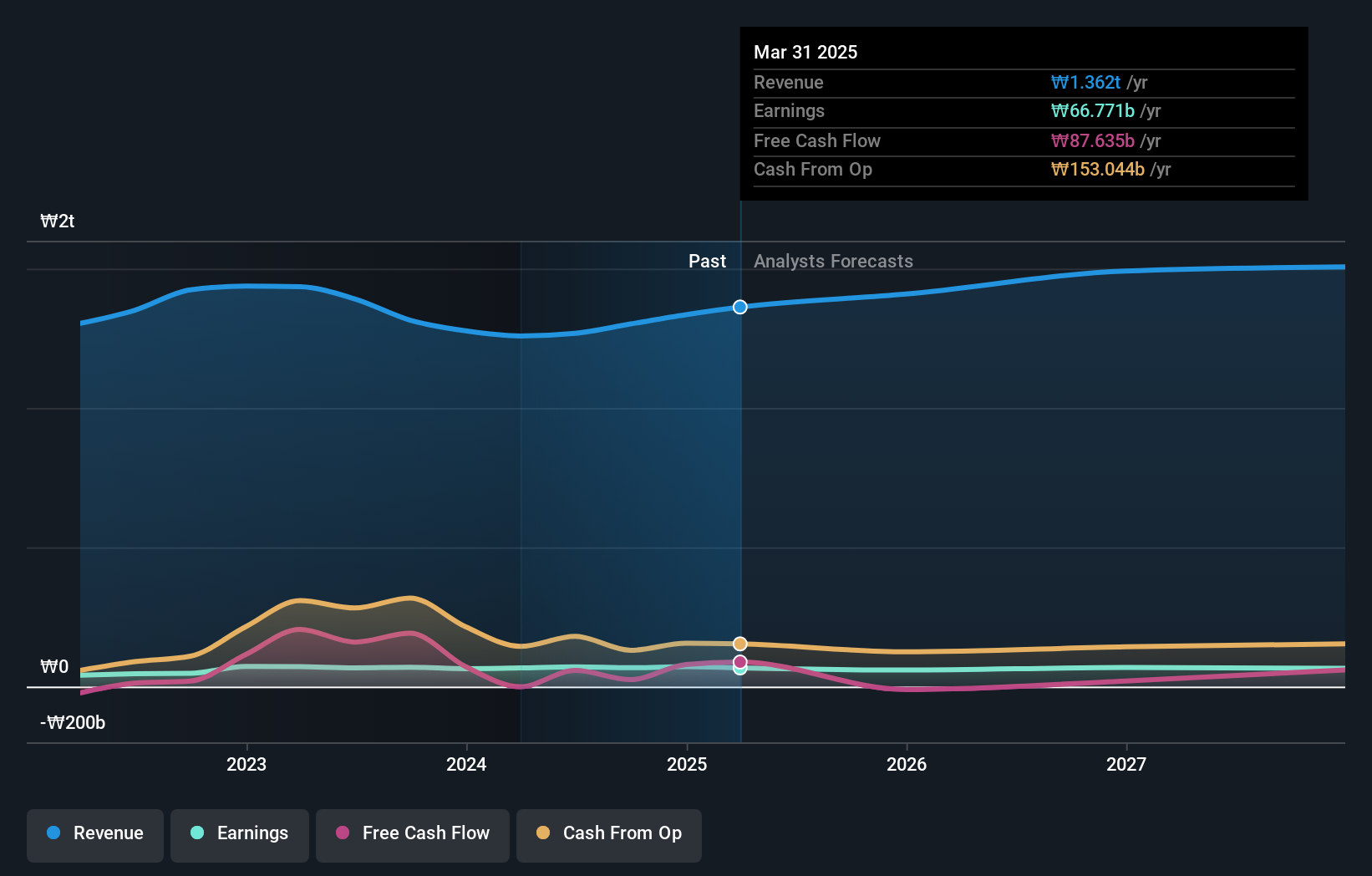

Dongwon Systems has shown solid performance, with earnings growing by 4.8% over the past year, outpacing the Packaging industry. The company reported KRW 22.26 million in net income for Q2 2024, up from KRW 17.90 million a year earlier, and basic earnings per share rose to KRW 761 from KRW 612. Over five years, its debt-to-equity ratio improved from 69.4% to 61.9%, indicating better financial health despite a high net debt to equity ratio of 48%.

- Click to explore a detailed breakdown of our findings in Dongwon Systems' health report.

Gain insights into Dongwon Systems' historical performance by reviewing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 190 KRX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A014820

Dongwon Systems

A packaging company, manufactures and markets packaging materials in South Korea.

Proven track record with adequate balance sheet.