- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A215200

Top KRX Dividend Stocks For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 2.3%, and over the past 12 months, it is up 5.0%. With earnings expected to grow by 29% per annum over the next few years, identifying strong dividend stocks can be a strategic move for investors looking to capitalize on this growth while securing steady income.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.61% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.48% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.78% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.78% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.38% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.12% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.98% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.41% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.64% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.03% | ★★★★★☆ |

Click here to see the full list of 78 stocks from our Top KRX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

MegaStudyEdu (KOSDAQ:A215200)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MegaStudyEdu Co. Ltd. provides online and offline educational services in South Korea, with a market cap of ₩485.89 billion.

Operations: MegaStudyEdu Co. Ltd.'s revenue segments are comprised of High School (₩591.27 billion), Elementary and Middle School (₩216.85 billion), University (₩76.42 billion), and Employment (₩57.27 billion).

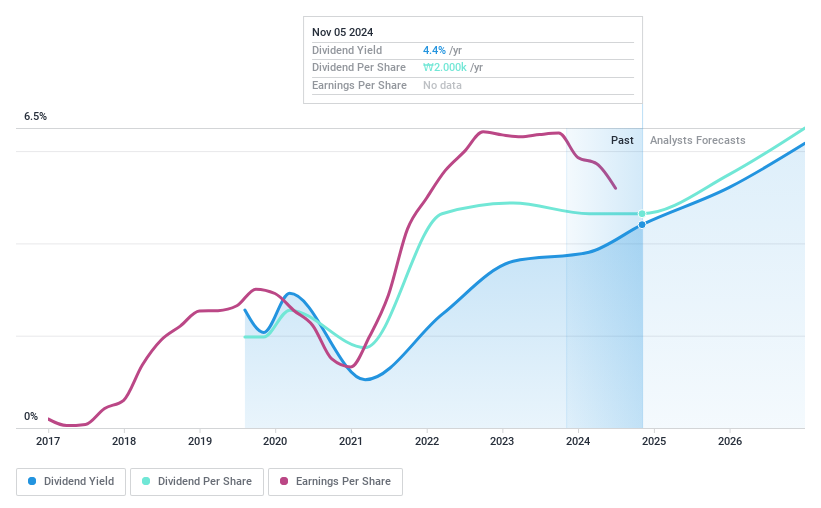

Dividend Yield: 4.5%

MegaStudyEdu's dividend payments have been volatile over the past five years, with a history of annual drops exceeding 20%. Despite this instability, the company's dividends are well covered by earnings (27.8% payout ratio) and cash flows (19.9% cash payout ratio). Trading at a significant discount to its estimated fair value and offering a top-tier dividend yield of 4.51%, MegaStudyEdu has also engaged in share buybacks worth KRW 10 billion to enhance shareholder value.

- Dive into the specifics of MegaStudyEdu here with our thorough dividend report.

- Upon reviewing our latest valuation report, MegaStudyEdu's share price might be too pessimistic.

HMMLtd (KOSE:A011200)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HMM Co., Ltd, with a market cap of ₩13.88 trillion, is an integrated logistics company offering shipping and logistics services globally.

Operations: HMM Co., Ltd generates revenue from three main segments: Container services (₩7.62 trillion), Tankers & Dry Bulkers (₩1.35 trillion), and Others (₩217.07 million).

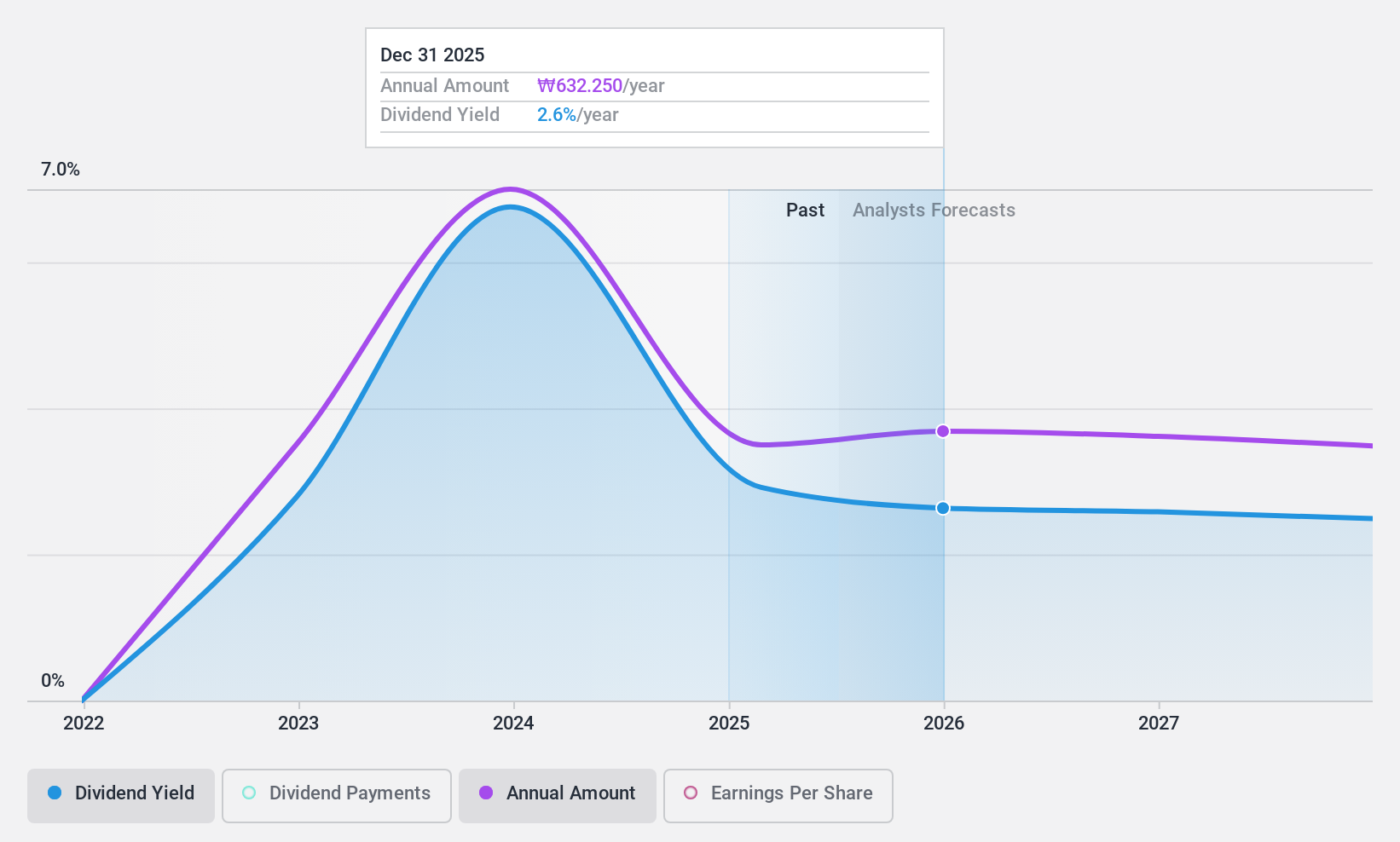

Dividend Yield: 3.8%

HMM Ltd's dividend payments have been unstable over the past two years, with significant volatility. Despite this, dividends are well covered by earnings (30.9% payout ratio) and cash flows (32.9% cash payout ratio). The company reported strong financial performance for Q2 2024, with net income reaching KRW 660.86 billion compared to KRW 312.63 billion a year ago. However, shareholders experienced substantial dilution in the past year and profit margins have declined significantly from last year’s figures.

- Click to explore a detailed breakdown of our findings in HMMLtd's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of HMMLtd shares in the market.

LX Hausys (KOSE:A108670)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX Hausys, Ltd., along with its subsidiaries, manufactures and sells building materials both in South Korea and internationally, with a market cap of ₩381.39 billion.

Operations: LX Hausys generates revenue primarily from its Building Materials segment (₩2.52 billion) and Automotive Materials / Industrial Films segment (₩982.66 million).

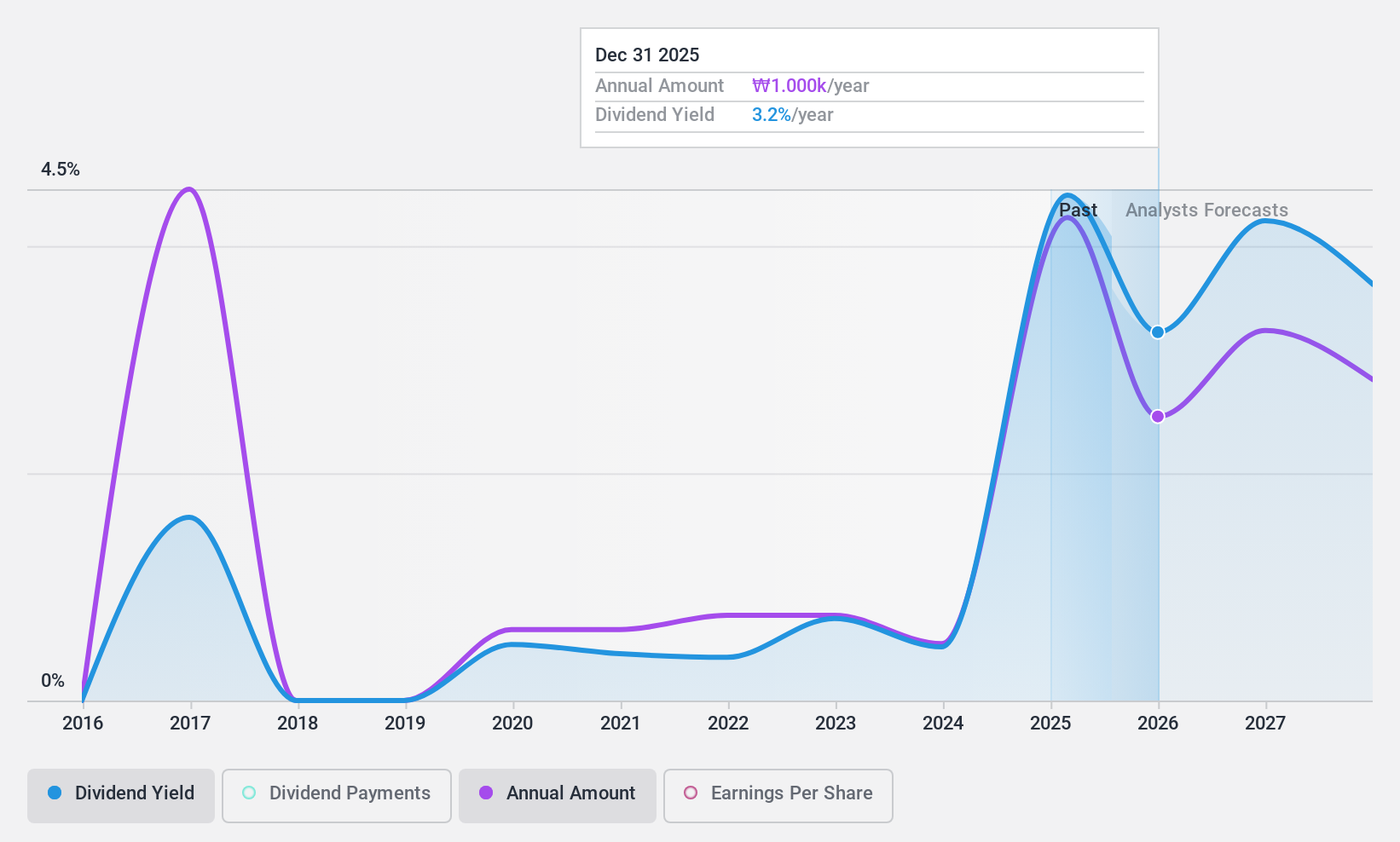

Dividend Yield: 4.3%

LX Hausys offers a dividend yield of 4.26%, placing it in the top 25% of South Korean dividend payers. The company's dividends are well-covered by earnings (24.6% payout ratio) and cash flows (11.5% cash payout ratio), indicating sustainability despite a high debt level. However, its dividend payments have been volatile over the past nine years, with periods of decline, making them unreliable for consistent income investors. Earnings are forecasted to grow by 8.32% annually.

- Delve into the full analysis dividend report here for a deeper understanding of LX Hausys.

- Our valuation report unveils the possibility LX Hausys' shares may be trading at a discount.

Make It Happen

- Embark on your investment journey to our 78 Top KRX Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A215200

MegaStudyEdu

Provides online and offline educational services in South Korea.

Very undervalued with adequate balance sheet and pays a dividend.