- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

High Growth Tech Stocks in South Korea Daejoo Electronic Materials Plus Two More

Reviewed by Simply Wall St

The South Korean market has experienced a flat performance over the last week but has risen by 6.3% over the past year, with earnings projected to grow by 30% annually. In this context, identifying high growth tech stocks like Daejoo Electronic Materials involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. specializes in developing and selling electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.87 trillion.

Operations: The company focuses on the development, production, and sale of electrical and electronic components, generating revenue primarily from these activities. With a market capitalization of ₩1.87 trillion, its operations span multiple key regions globally.

Daejoo Electronic Materials, amid a challenging landscape, has shown remarkable resilience with its recent earnings report indicating a substantial increase in net income to KRW 6,557.14 million from KRW 821.69 million year-over-year for Q2 2024. This surge is underpinned by an impressive forecast of revenue growth at 42.2% annually, outpacing the South Korean market's average of 10.5%. Moreover, the company's commitment to innovation is evident from its R&D investments which are crucial for maintaining technological competitiveness in the high-stakes electronic materials sector. Despite a volatile share price and concerns over debt not being well covered by operating cash flow, Daejoo’s strategic focus on expanding its product lines and enhancing operational efficiencies suggests promising prospects for sustained growth.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩19.60 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. With a market cap of ₩19.60 billion, it focuses on innovative biotechnological developments in long-acting biobetters and antibody-related products.

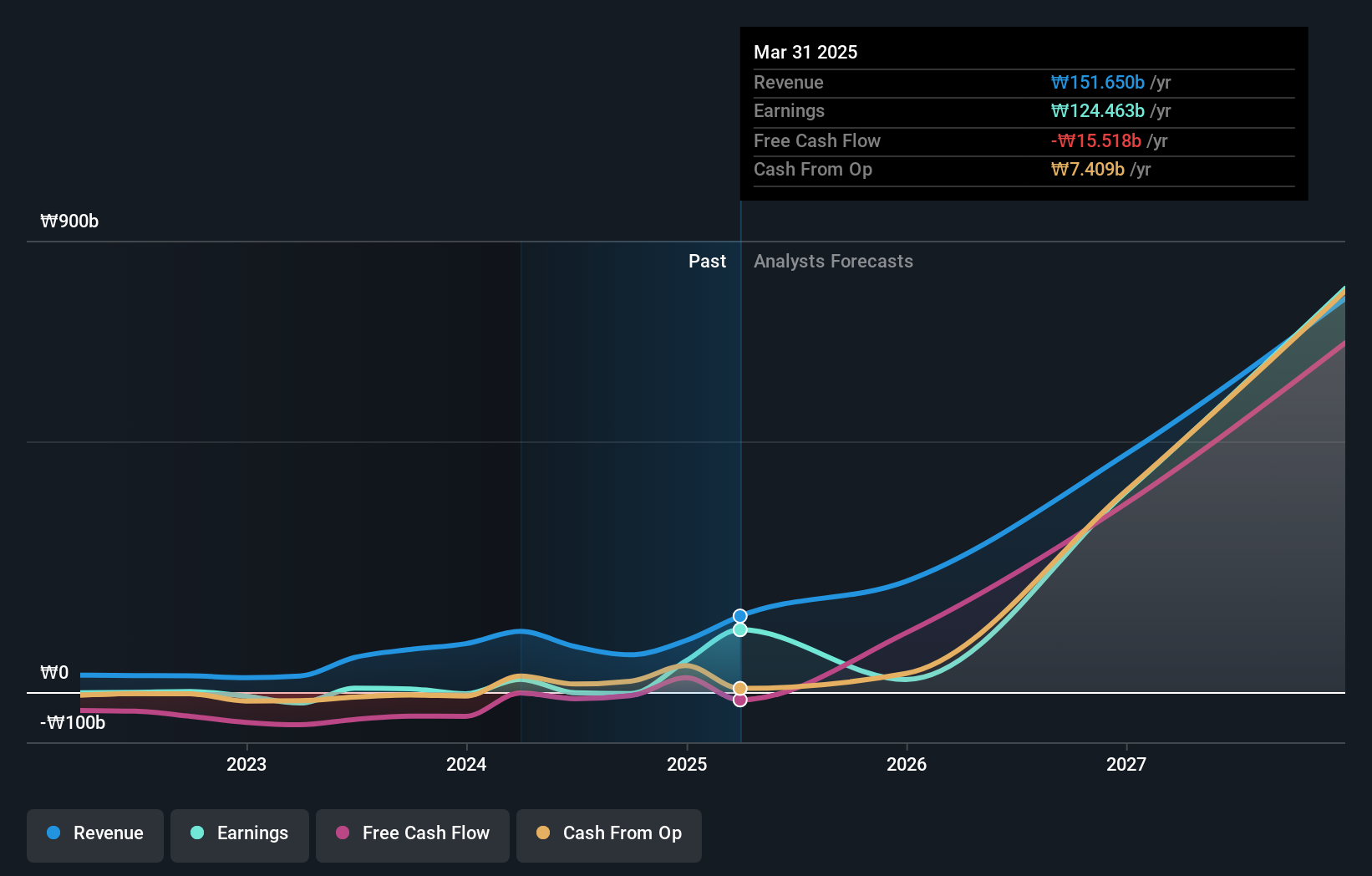

ALTEOGEN stands out in South Korea's biotech landscape, not only for its recent MFDS approval of Tergase®, a high-purity recombinant hyaluronidase, but also for its robust financial forecasts. With revenue expected to surge by 64.2% annually and earnings growth projected at an impressive 99.5%, the company is positioning itself strongly against competitors. This growth is underpinned by significant R&D investments, crucial for maintaining competitive edge in biotechnological innovations. Despite current unprofitability, these aggressive growth projections and strategic product advancements suggest promising future prospects as it transitions into a commercial-stage entity.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Review our historical performance report to gain insights into ALTEOGEN's's past performance.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩7.45 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily through its Label and Solution segments, with contributions of approximately ₩1.28 trillion and ₩1.24 trillion, respectively. The Platform segment adds an additional ₩361 billion to the company's revenue streams.

HYBE, a South Korean entertainment powerhouse, has demonstrated robust financial agility with its recent share repurchase initiative, signaling confidence in its operational stability and future growth prospects. In the past year alone, earnings surged by 21.6%, outpacing the industry's average of 7.3%, underpinned by strategic R&D investments which amounted to significant figures (exact numbers not provided). Looking ahead, HYBE is poised for continued expansion with revenue and earnings forecasted to grow annually at 14% and 42.2%, respectively—both metrics eclipsing broader market expectations. This trajectory is supported by a solid foundation in innovative content production that resonates globally, ensuring HYBE remains a critical player in shaping cultural trends and entertainment technology.

- Dive into the specifics of HYBE here with our thorough health report.

Evaluate HYBE's historical performance by accessing our past performance report.

Seize The Opportunity

- Delve into our full catalog of 48 KRX High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.