- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A020150

Exploring 3 High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

The South Korean market remained flat over the last week but has experienced a 9.5% rise over the past 12 months, with earnings forecasted to grow by 30% annually. In this context of anticipated growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability in a rapidly evolving industry landscape.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 27.44% | 69.62% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 22.96% | 33.25% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. is engaged in the development and sale of electronic materials across multiple regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.62 trillion.

Operations: The company focuses on the development, production, and sale of electrical and electronic components, generating revenue of ₩206.32 billion.

Daejoo Electronic Materials, amid a challenging market, has demonstrated remarkable resilience with its net income soaring to KRW 6,557.14 million from KRW 821.69 million year-over-year as of June 2024. This financial upturn is mirrored by an impressive projected annual revenue growth rate of 38.4% and earnings growth forecast at 37.5%. Despite a volatile share price in recent months, these figures underscore a robust recovery and potential for sustained growth, especially considering the company's strategic focus on enhancing non-cash earnings and maintaining a high Return on Equity forecasted at 23.3% in three years' time. Such performance highlights Daejoo's capability to not only navigate but also capitalize on the dynamics of South Korea's high-tech sector, positioning it as a noteworthy contender in the electronic materials industry despite some liquidity concerns marked by its operating cash flow coverage.

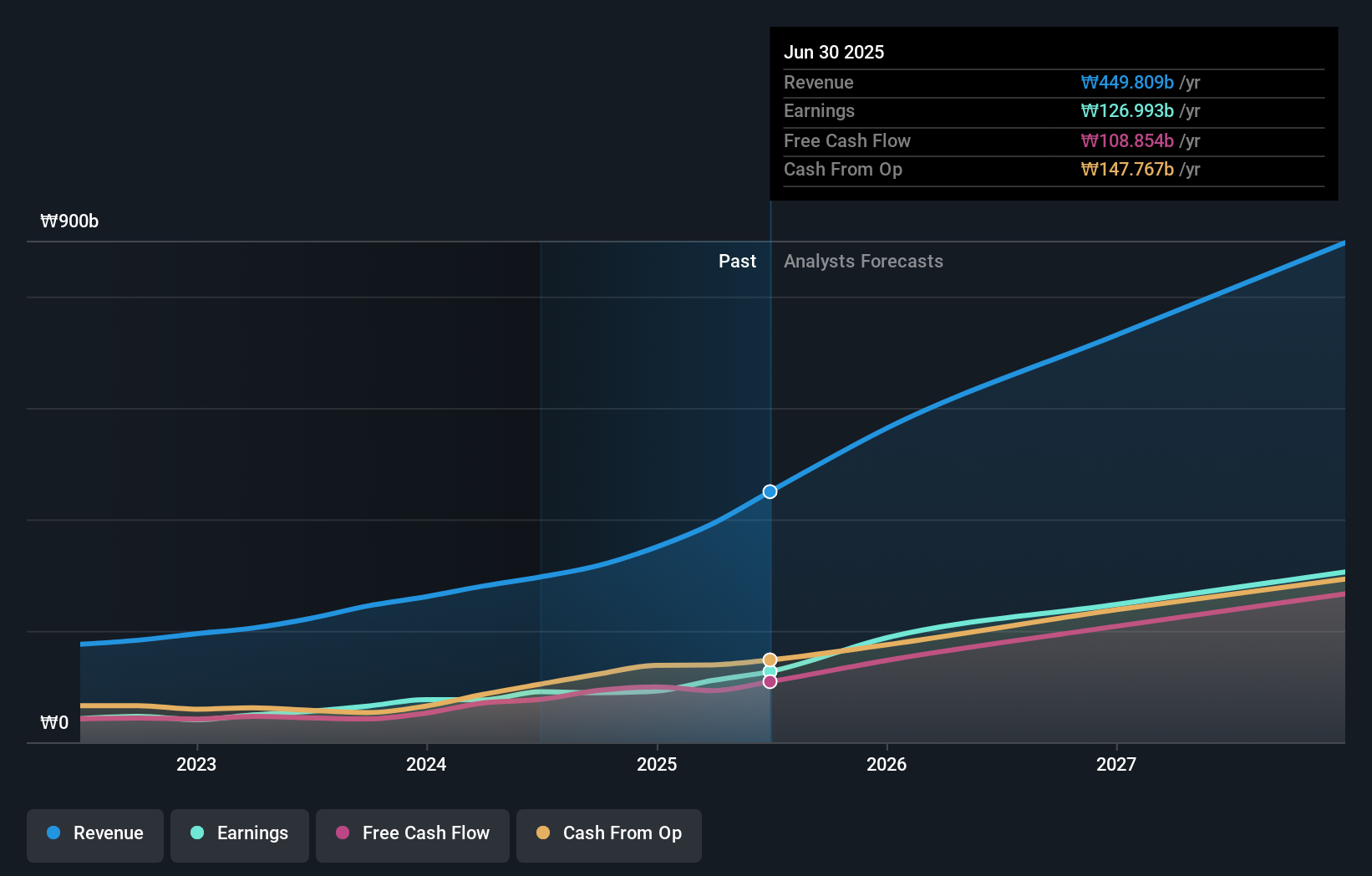

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market cap of ₩2.42 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to ₩296.59 billion.

PharmaResearch is distinguishing itself in South Korea's tech landscape, notably with a recent strategic move involving a private placement to issue shares, raising nearly KRW 200 billion. This influx of capital underscores its commitment to scaling operations and innovation, particularly as it projects an annual revenue growth of 22.3% and earnings growth at 22.2%. These figures not only reflect the company's robust financial health but also its ability to outpace average market growth rates significantly. Furthermore, PharmaResearch has prioritized R&D investments which have been pivotal in maintaining a competitive edge within the biotech sector—where it recently reported earnings growth surpassing industry averages by over tenfold (63.2% versus 6.1%). This focus on continuous improvement through research is likely to sustain its upward trajectory amidst evolving technological demands.

- Navigate through the intricacies of PharmaResearch with our comprehensive health report here.

Understand PharmaResearch's track record by examining our Past report.

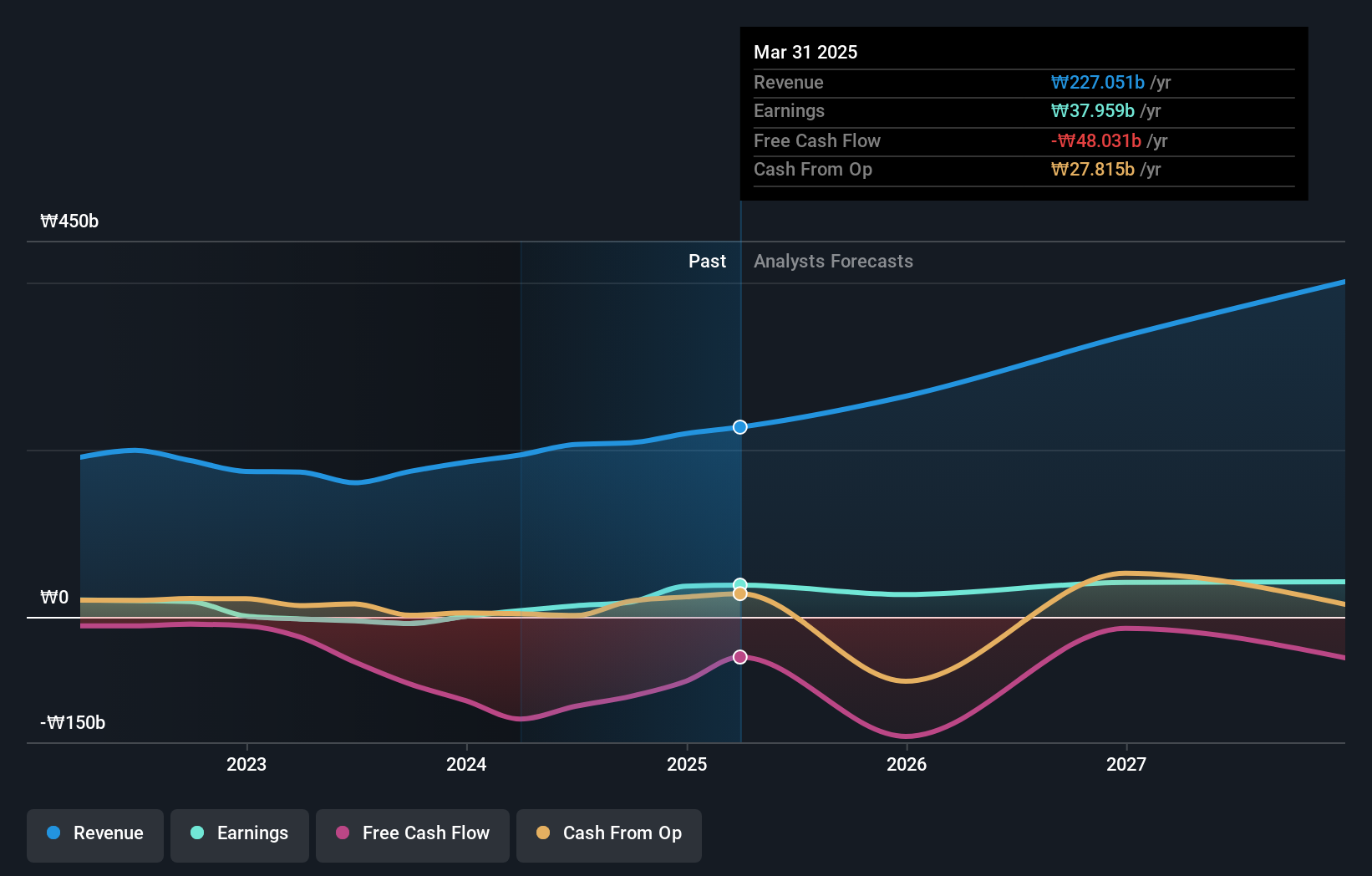

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation, with a market cap of ₩1.78 trillion, produces and sells elecfoils both in Korea and internationally.

Operations: The company generates revenue primarily from its manufacturing sector, which contributes ₩768.85 billion, while the service sector adds ₩218.48 billion.

Lotte Energy Materials is making strategic strides in South Korea's tech sector, particularly through its focus on R&D which has seen a significant investment increase to 14.7% of its revenue. This dedication is poised to enhance its competitive edge as it taps into advanced energy solutions. The company's earnings are expected to surge by 52.6% annually, outpacing the broader market growth of 29.6%. Moreover, with recent initiatives aimed at expanding its market reach and optimizing production capabilities, Lotte Energy Materials is well-positioned to capitalize on evolving industry demands and sustain its growth trajectory amidst intense competition.

Seize The Opportunity

- Get an in-depth perspective on all 48 KRX High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A020150

Lotte Energy Materials

Produces and sells elecfoils in Korea and internationally.

Reasonable growth potential with adequate balance sheet.