- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

Daejoo Electronic Materials Co., Ltd.'s (KOSDAQ:078600) 25% Cheaper Price Remains In Tune With Revenues

Daejoo Electronic Materials Co., Ltd. (KOSDAQ:078600) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 11% share price drop.

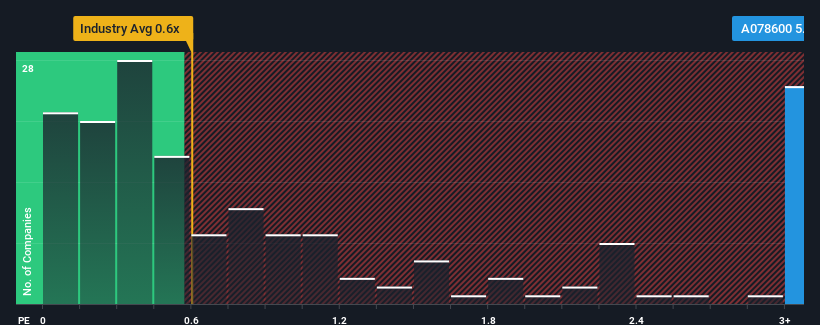

Although its price has dipped substantially, you could still be forgiven for thinking Daejoo Electronic Materials is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.3x, considering almost half the companies in Korea's Electronic industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Daejoo Electronic Materials

How Daejoo Electronic Materials Has Been Performing

Recent times have been advantageous for Daejoo Electronic Materials as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Daejoo Electronic Materials will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Daejoo Electronic Materials would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. As a result, it also grew revenue by 10% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 30% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we can see why Daejoo Electronic Materials is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Daejoo Electronic Materials' P/S Mean For Investors?

Daejoo Electronic Materials' shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Daejoo Electronic Materials' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Daejoo Electronic Materials is showing 3 warning signs in our investment analysis, and 2 of those make us uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Solid track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.