- South Korea

- /

- Communications

- /

- KOSDAQ:A073540

Does FrtekLtd (KOSDAQ:073540) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Frtek Co.Ltd. (KOSDAQ:073540) does use debt in its business. But the real question is whether this debt is making the company risky.

We've discovered 1 warning sign about FrtekLtd. View them for free.When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is FrtekLtd's Net Debt?

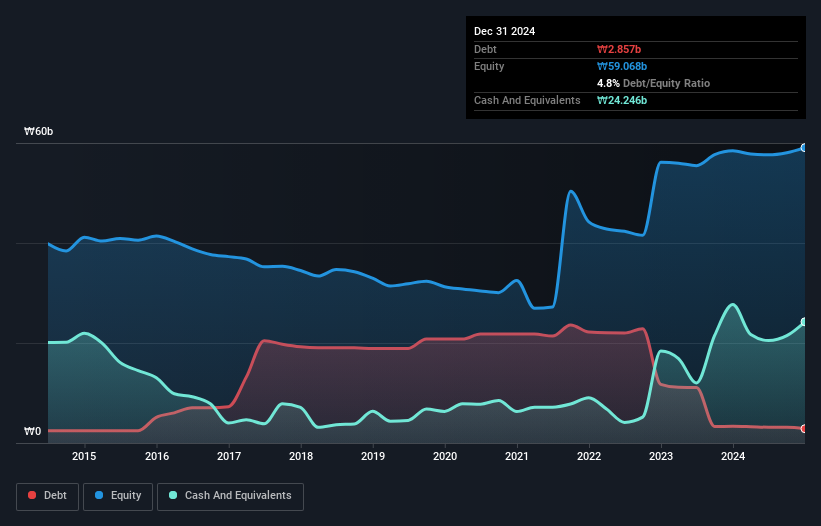

You can click the graphic below for the historical numbers, but it shows that FrtekLtd had ₩2.86b of debt in December 2024, down from ₩3.34b, one year before. However, it does have ₩24.2b in cash offsetting this, leading to net cash of ₩21.4b.

How Strong Is FrtekLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that FrtekLtd had liabilities of ₩7.13b due within 12 months and liabilities of ₩4.61b due beyond that. Offsetting this, it had ₩24.2b in cash and ₩584.0m in receivables that were due within 12 months. So it can boast ₩13.1b more liquid assets than total liabilities.

This surplus liquidity suggests that FrtekLtd's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, FrtekLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

Check out our latest analysis for FrtekLtd

Although FrtekLtd made a loss at the EBIT level, last year, it was also good to see that it generated ₩815m in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is FrtekLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. FrtekLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, FrtekLtd burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that FrtekLtd has net cash of ₩21.4b, as well as more liquid assets than liabilities. So we don't have any problem with FrtekLtd's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for FrtekLtd that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A073540

FrtekLtd

Provides mobile communication systems, LED lighting products, and information communication construction products in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026