- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A065680

After Leaping 39% UJU Electronics Co. Ltd (KOSDAQ:065680) Shares Are Not Flying Under The Radar

UJU Electronics Co. Ltd (KOSDAQ:065680) shares have continued their recent momentum with a 39% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

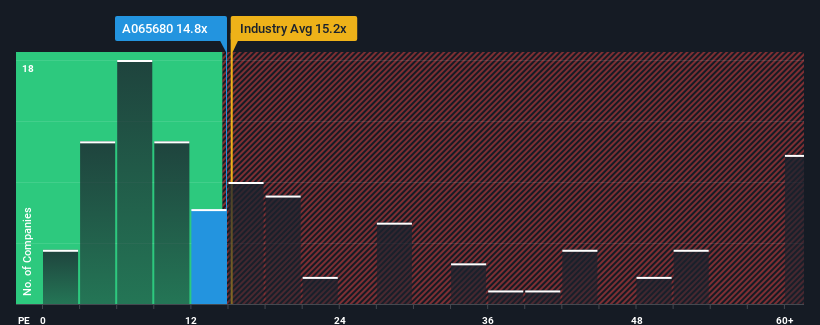

Since its price has surged higher, UJU Electronics may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.8x, since almost half of all companies in Korea have P/E ratios under 11x and even P/E's lower than 6x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

UJU Electronics certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for UJU Electronics

Is There Enough Growth For UJU Electronics?

There's an inherent assumption that a company should outperform the market for P/E ratios like UJU Electronics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 95%. However, this wasn't enough as the latest three year period has seen a very unpleasant 35% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 98% as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 29%, which is noticeably less attractive.

In light of this, it's understandable that UJU Electronics' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

UJU Electronics' P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of UJU Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for UJU Electronics with six simple checks.

If you're unsure about the strength of UJU Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A065680

UJU Electronics

Manufactures and sells precision connectors and electronic components in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion