- South Korea

- /

- Communications

- /

- KOSDAQ:A060540

Here's Why System and Application Technologies (KOSDAQ:060540) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that System and Application Technologies Co., Ltd (KOSDAQ:060540) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for System and Application Technologies

What Is System and Application Technologies's Net Debt?

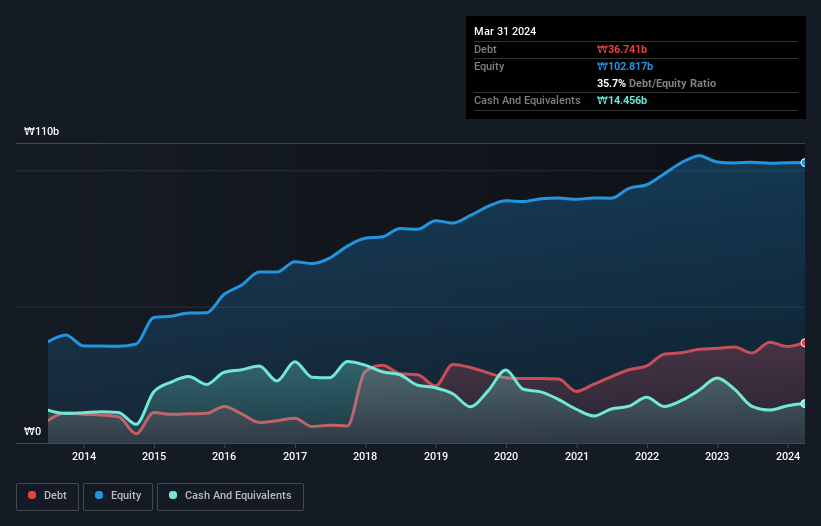

You can click the graphic below for the historical numbers, but it shows that as of March 2024 System and Application Technologies had ₩36.7b of debt, an increase on ₩35.2b, over one year. However, it does have ₩14.5b in cash offsetting this, leading to net debt of about ₩22.3b.

How Healthy Is System and Application Technologies' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that System and Application Technologies had liabilities of ₩53.3b due within 12 months and liabilities of ₩8.95b due beyond that. On the other hand, it had cash of ₩14.5b and ₩15.7b worth of receivables due within a year. So it has liabilities totalling ₩32.1b more than its cash and near-term receivables, combined.

This deficit isn't so bad because System and Application Technologies is worth ₩61.2b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

System and Application Technologies has net debt worth 2.0 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.4 times the interest expense. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Unfortunately, System and Application Technologies saw its EBIT slide 9.9% in the last twelve months. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. The balance sheet is clearly the area to focus on when you are analysing debt. But it is System and Application Technologies's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, System and Application Technologies saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We'd go so far as to say System and Application Technologies's conversion of EBIT to free cash flow was disappointing. But at least its net debt to EBITDA is not so bad. Overall, we think it's fair to say that System and Application Technologies has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with System and Application Technologies (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A060540

System and Application Technologies

Engages in the transportation management system, mobile system, and wireless communication system businesses in South Korea and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks