- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A051370

Analysts Expect Interflex Co., Ltd. (KOSDAQ:051370) To Breakeven Soon

Interflex Co., Ltd. (KOSDAQ:051370) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Interflex Co., Ltd. manufactures and sells flexible printed circuit board (FPCB) in South Korea. The ₩278b market-cap company announced a latest loss of ₩44b on 31 December 2020 for its most recent financial year result. As path to profitability is the topic on Interflex's investors mind, we've decided to gauge market sentiment. We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

View our latest analysis for Interflex

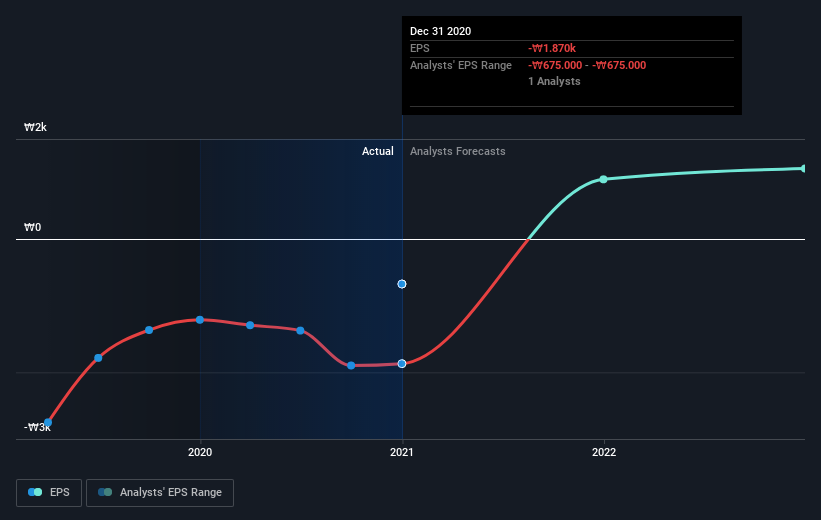

According to some industry analysts covering Interflex, breakeven is near. They expect the company to post a final loss in 2020, before turning a profit of ₩21b in 2021. So, the company is predicted to breakeven approximately a year from now or less! At what rate will the company have to grow in order to realise the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 115%, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving Interflex's growth isn’t the focus of this broad overview, though, bear in mind that typically a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

One thing we’d like to point out is that The company has managed its capital judiciously, with debt making up 29% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Interflex, so if you are interested in understanding the company at a deeper level, take a look at Interflex's company page on Simply Wall St. We've also put together a list of key factors you should look at:

- Valuation: What is Interflex worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Interflex is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Interflex’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A051370

Interflex

Manufactures and sells flexible printed circuit boards in South Korea.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion