- South Korea

- /

- Communications

- /

- KOSDAQ:A040160

Nuri Telecom's (KOSDAQ:040160) Earnings Are Growing But Is There More To The Story?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Nuri Telecom (KOSDAQ:040160).

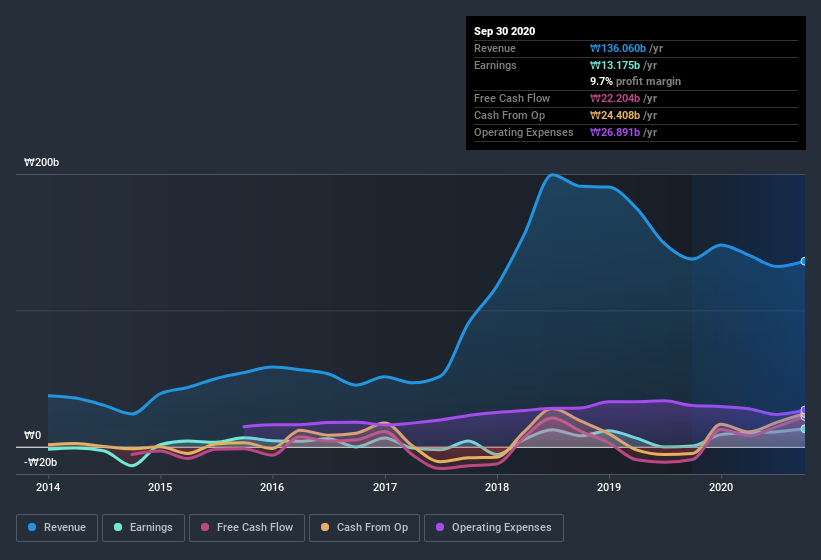

While Nuri Telecom was able to generate revenue of ₩136.1b in the last twelve months, we think its profit result of ₩13.2b was more important. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

View our latest analysis for Nuri Telecom

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. As a result, we think it's well worth considering what Nuri Telecom's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nuri Telecom.

Examining Cashflow Against Nuri Telecom's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2020, Nuri Telecom recorded an accrual ratio of -0.11. Therefore, its statutory earnings were quite a lot less than its free cashflow. To wit, it produced free cash flow of ₩22b during the period, dwarfing its reported profit of ₩13.2b. Given that Nuri Telecom had negative free cash flow in the prior corresponding period, the trailing twelve month resul of ₩22b would seem to be a step in the right direction.

Our Take On Nuri Telecom's Profit Performance

As we discussed above, Nuri Telecom has perfectly satisfactory free cash flow relative to profit. Based on this observation, we consider it likely that Nuri Telecom's statutory profit actually understates its earnings potential! Better yet, its EPS are growing strongly, which is nice to see. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Nuri Telecom as a business, it's important to be aware of any risks it's facing. Case in point: We've spotted 2 warning signs for Nuri Telecom you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Nuri Telecom's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Nuri Telecom, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NuriFlexLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A040160

NuriFlexLtd

Provides optimal IoT solutions for utilities, manufacturing, energy, and public sector in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026