- Taiwan

- /

- Real Estate

- /

- TPEX:5508

Unveiling 3 Undiscovered Gems In Asia With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by steady interest rates and mixed economic indicators, investors are increasingly turning their attention to Asia's dynamic market environment. In this context, identifying stocks with robust fundamentals and growth potential becomes crucial, particularly as small-cap companies in the region offer unique opportunities for those willing to explore beyond the mainstream.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 15.90% | 6.43% | -13.73% | ★★★★★★ |

| Hunan Hansen Pharmaceutical | 3.80% | 3.54% | 8.79% | ★★★★★★ |

| HeBei Jinniu Chemical IndustryLtd | NA | -4.19% | 11.42% | ★★★★★★ |

| YagiLtd | 38.98% | -8.93% | 16.36% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Pacific Construction | 21.89% | -4.29% | 35.64% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

| Sichuan Zigong Conveying Machine Group | 31.56% | 11.60% | 4.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

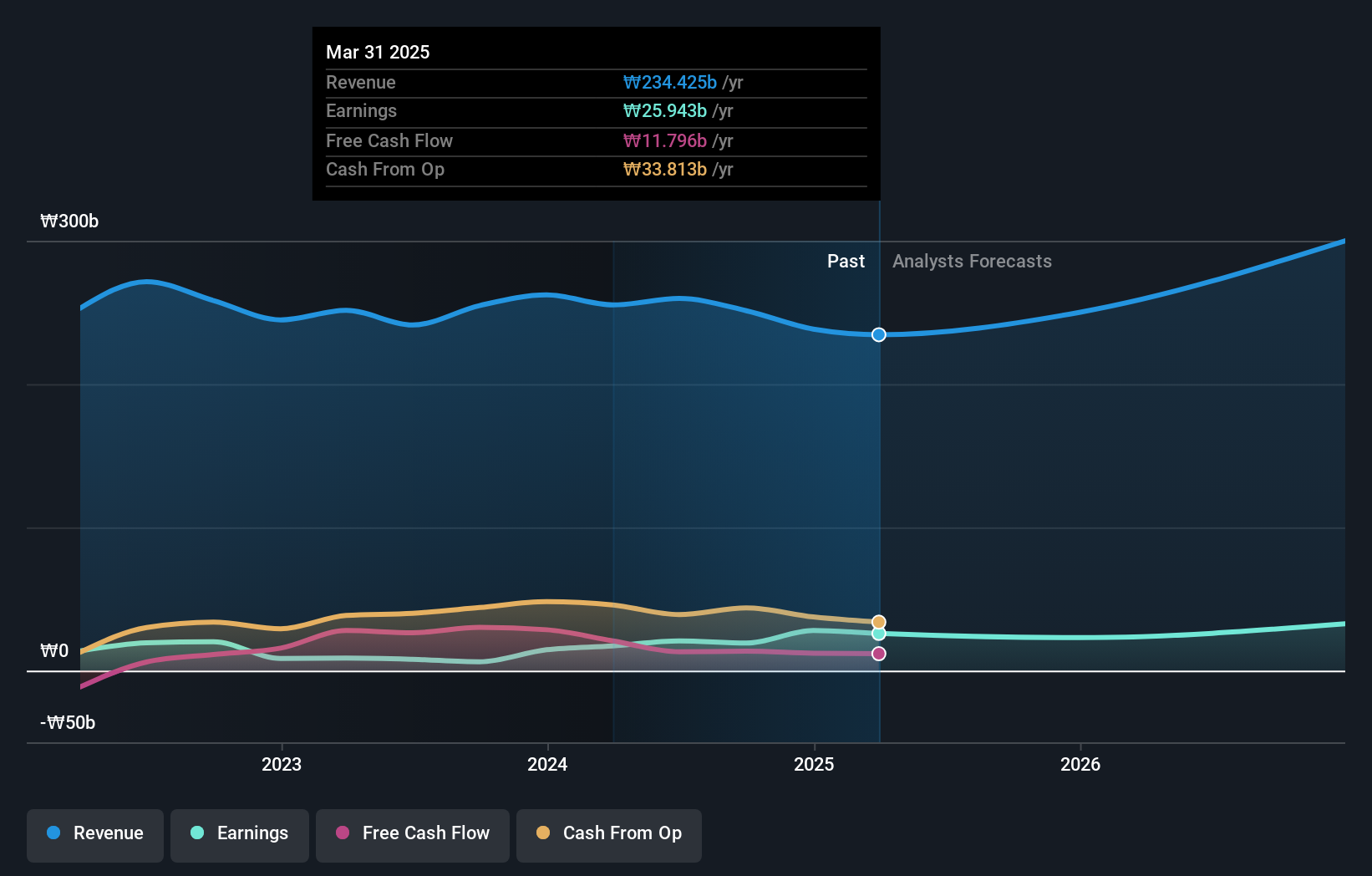

Synopex (KOSDAQ:A025320)

Simply Wall St Value Rating: ★★★★★★

Overview: Synopex Inc. is involved in the manufacturing and sale of FPCB products and electronic components both domestically in South Korea and internationally, with a market cap of ₩705.25 billion.

Operations: Synopex generates revenue primarily from its FPCB Business Division, contributing ₩316.16 billion, and the Filter Business Division, adding ₩38.32 billion. The company faces a consolidation adjustment of -₩103.31 billion in its financial reporting.

Synopex, a small cap player in the electronics sector, has shown impressive financial health with its debt to equity ratio dropping from 55% to 22.3% over five years. The company boasts high-quality earnings and free cash flow positivity, making it financially robust. With earnings growth of 212.9%, Synopex outpaced the industry's modest 6.2% rise last year, highlighting its competitive edge. Despite recent share price volatility, the firm remains profitable and well-covered on interest payments with an EBIT coverage of 43.9 times interest expenses, suggesting strong operational efficiency and potential for future growth in its field.

- Take a closer look at Synopex's potential here in our health report.

Examine Synopex's past performance report to understand how it has performed in the past.

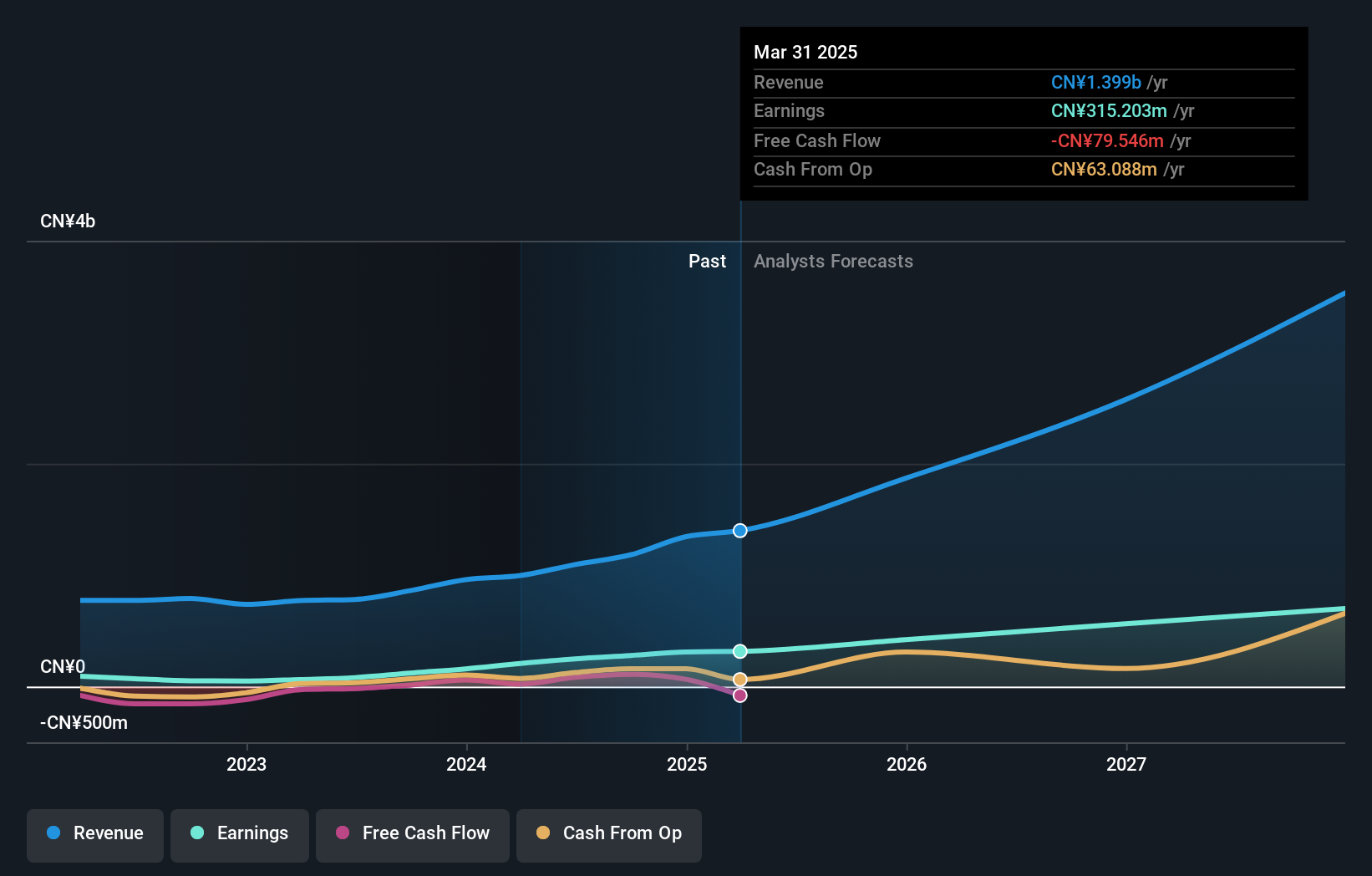

Jiangsu Shemar ElectricLtd (SHSE:603530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Shemar Electric Co., Ltd specializes in the research, development, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China with a market capitalization of approximately CN¥12.18 billion.

Operations: The company generates revenue primarily through the sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals. It has a market capitalization of approximately CN¥12.18 billion.

Jiangsu Shemar Electric, a notable player in the electrical sector, has demonstrated impressive growth with earnings surging 130.9% over the past year, significantly outpacing the industry average of 2.2%. The company is on solid financial ground, boasting more cash than total debt and maintaining positive free cash flow. Its debt-to-equity ratio rose from 0.04% to 1.8% over five years, indicating a strategic shift in capital structure while still ensuring interest payments are comfortably covered by profits. With high-quality earnings and robust profitability forecasts of 33% annual growth, it presents an intriguing opportunity for investors seeking potential in Asia's dynamic market landscape.

- Click to explore a detailed breakdown of our findings in Jiangsu Shemar ElectricLtd's health report.

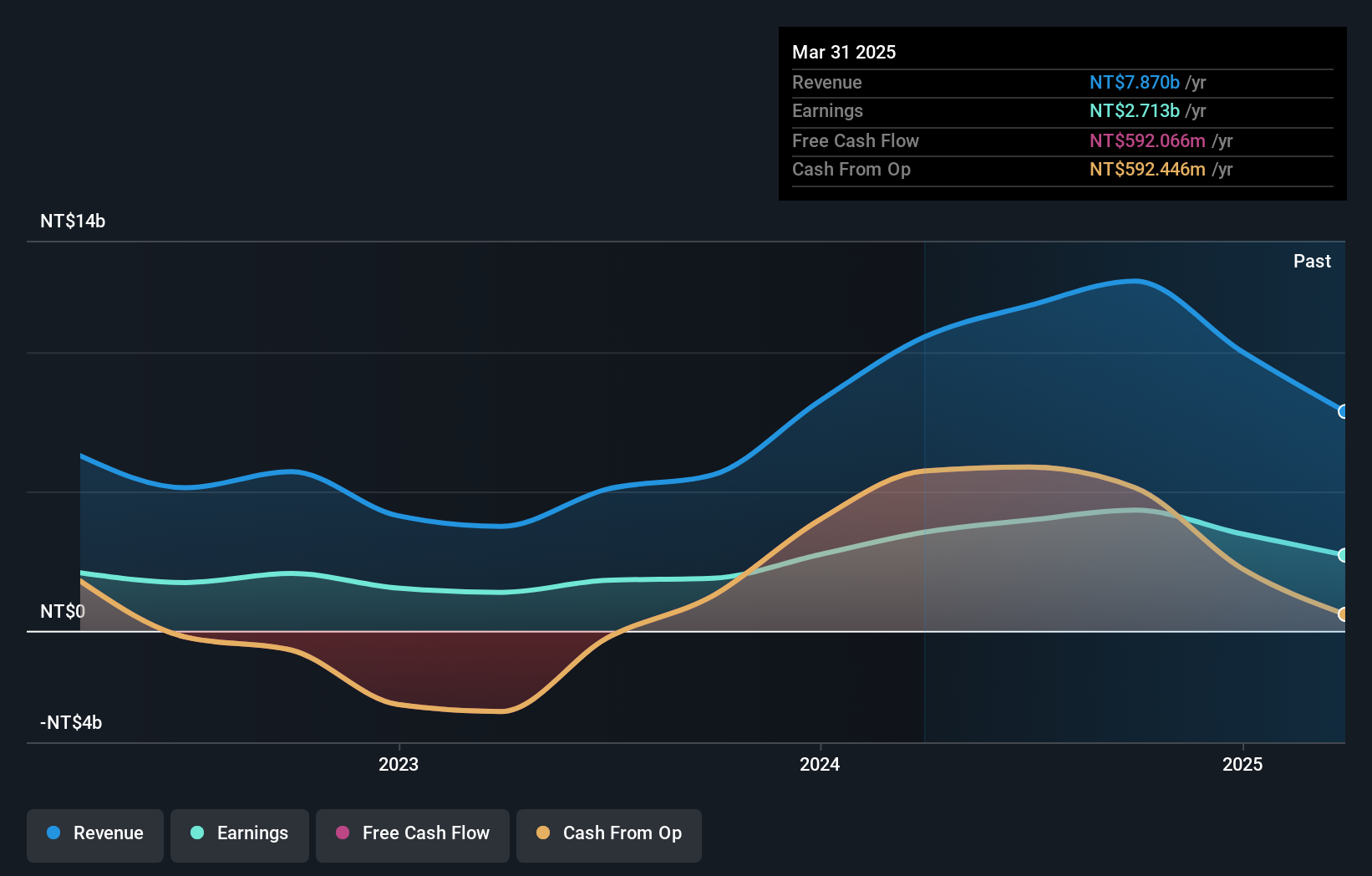

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yungshin Construction & Development Co., Ltd. operates in the construction industry, focusing on both residential and commercial projects, with a market capitalization of NT$32.40 billion.

Operations: Yungshin Construction & Development generates revenue primarily from its residential and commercial construction projects, amounting to NT$10.04 billion. The company's financial performance is reflected in its net profit margin, which stands at 7.5%.

Yungshin Construction & Development, a smaller player in the real estate sector, has shown notable financial strength despite its high debt levels. Over the past five years, its debt to equity ratio decreased from 106.6% to 96.8%, while earnings grew at an impressive annual rate of 36.5%. The company’s interest payments are well covered by EBIT with a coverage ratio of 4456.6x, indicating robust earnings quality and financial health. Despite a net debt to equity ratio of 93.3% being considered high, Yungshin remains attractive with a price-to-earnings ratio of 9.3x compared to the TW market average of 20.3x.

Taking Advantage

- Get an in-depth perspective on all 2646 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5508

Yungshin Construction & DevelopmentLtd

Yungshin Construction & Development Co.,Ltd.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026