- South Korea

- /

- Communications

- /

- KOSDAQ:A010170

Why Investors Shouldn't Be Surprised By Taihan Fiber Optics Co., Ltd's (KOSDAQ:010170) 28% Share Price Surge

Taihan Fiber Optics Co., Ltd (KOSDAQ:010170) shares have continued their recent momentum with a 28% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.5% in the last twelve months.

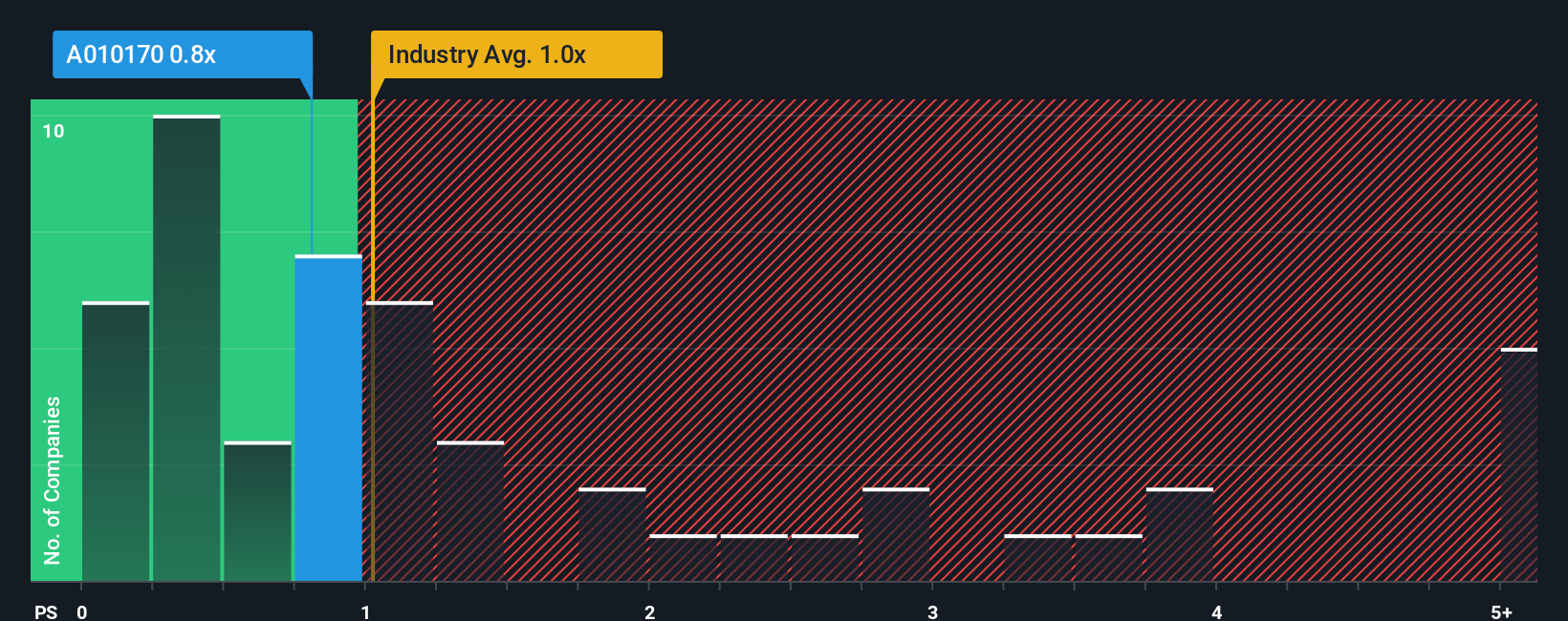

In spite of the firm bounce in price, there still wouldn't be many who think Taihan Fiber Optics' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Korea's Communications industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Taihan Fiber Optics

What Does Taihan Fiber Optics' Recent Performance Look Like?

Taihan Fiber Optics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Taihan Fiber Optics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Taihan Fiber Optics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 33% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 32%, which is not materially different.

With this information, we can see why Taihan Fiber Optics is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Its shares have lifted substantially and now Taihan Fiber Optics' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Taihan Fiber Optics' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Communications industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 5 warning signs for Taihan Fiber Optics you should be aware of, and 3 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Taihan Fiber Optics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A010170

Taihan Fiber Optics

Researches, develops, and produces optical materials in South Korea and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026