- South Korea

- /

- Professional Services

- /

- KOSE:A094280

What Type Of Shareholders Make Up Hyosung ITX Co. Ltd.'s (KRX:094280) Share Registry?

Every investor in Hyosung ITX Co. Ltd. (KRX:094280) should be aware of the most powerful shareholder groups. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

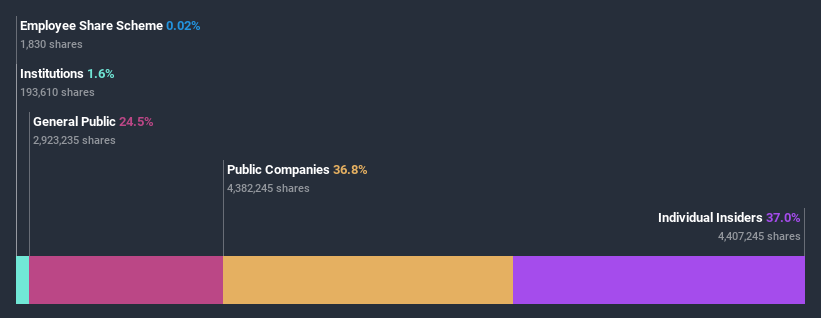

With a market capitalization of ₩224b, Hyosung ITX is a small cap stock, so it might not be well known by many institutional investors. In the chart below, we can see that institutional investors have not yet purchased much of the company. We can zoom in on the different ownership groups, to learn more about Hyosung ITX.

Check out our latest analysis for Hyosung ITX

What Does The Institutional Ownership Tell Us About Hyosung ITX?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

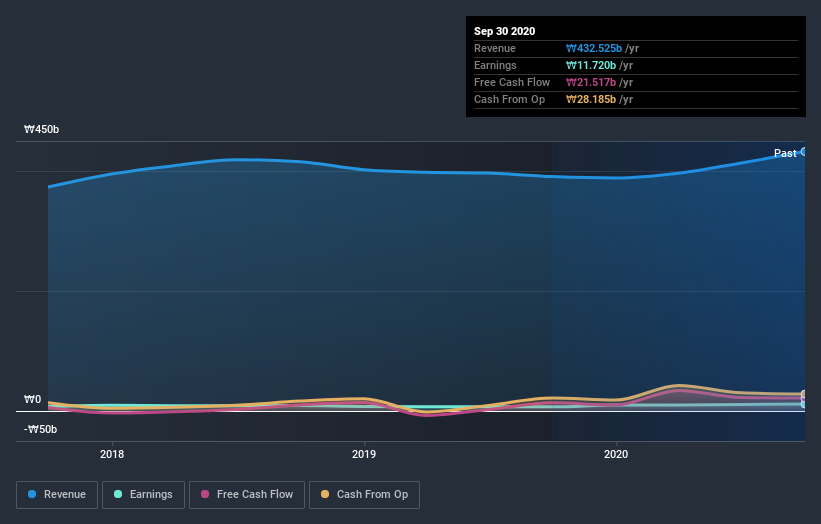

Since institutions own only a small portion of Hyosung ITX, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

Hyosung ITX is not owned by hedge funds. The company's largest shareholder is Hyun-Joon Cho, with ownership of 37%. In comparison, the second and third largest shareholders hold about 37% and 0.9% of the stock.

A more detailed study of the shareholder registry showed us that 2 of the top shareholders have a considerable amount of ownership in the company, via their 74% stake.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Hyosung ITX

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Hyosung ITX Co. Ltd.. It has a market capitalization of just ₩224b, and insiders have ₩83b worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public holds a 25% stake in Hyosung ITX. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

It appears to us that public companies own 37% of Hyosung ITX. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Hyosung ITX better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Hyosung ITX .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Hyosung ITX, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyosung ITX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A094280

Hyosung ITX

Provides contact center services and IT solutions in South Korea.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026