- South Korea

- /

- Professional Services

- /

- KOSE:A094280

Hyosung ITX Co. Ltd. (KRX:094280) Will Pay A ₩200 Dividend In Three Days

It looks like Hyosung ITX Co. Ltd. (KRX:094280) is about to go ex-dividend in the next three days. This means that investors who purchase shares on or after the 29th of December will not receive the dividend, which will be paid on the 1st of January.

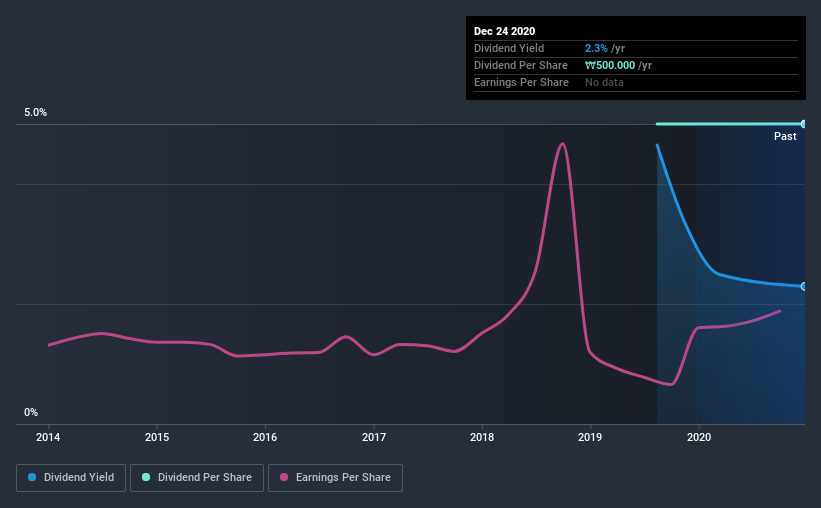

Hyosung ITX's next dividend payment will be ₩200 per share, and in the last 12 months, the company paid a total of ₩500 per share. Based on the last year's worth of payments, Hyosung ITX stock has a trailing yield of around 2.3% on the current share price of ₩21800. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Hyosung ITX

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Hyosung ITX paid out 51% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether Hyosung ITX generated enough free cash flow to afford its dividend. It distributed 46% of its free cash flow as dividends, a comfortable payout level for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Hyosung ITX paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at Hyosung ITX, with earnings per share up 6.6% on average over the last five years. Decent historical earnings per share growth suggests Hyosung ITX has been effectively growing value for shareholders. However, it's now paying out more than half its earnings as dividends. If management lifts the payout ratio further, we'd take this as a tacit signal that the company's growth prospects are slowing.

Unfortunately Hyosung ITX has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

To Sum It Up

Is Hyosung ITX worth buying for its dividend? While earnings per share growth has been modest, Hyosung ITX's dividend payouts are around an average level; without a sharp change in earnings we feel that the dividend is likely somewhat sustainable. Pleasingly the company paid out a conservatively low percentage of its free cash flow. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

In light of that, while Hyosung ITX has an appealing dividend, it's worth knowing the risks involved with this stock. To help with this, we've discovered 3 warning signs for Hyosung ITX that you should be aware of before investing in their shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Hyosung ITX, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyosung ITX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A094280

Hyosung ITX

Provides contact center services and IT solutions in South Korea.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.